Westjet 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 WestJet 2008 Annual Report

notes to consolidated

fi nancial statements

For the years ended December 31, 2008 and 2007

(Stated in thousands of Canadian dollars, except share and per share data)

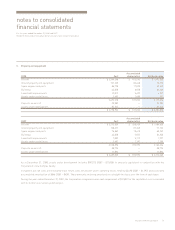

1. Summary of signifi cant accounting policies (continued)

(g) Cash fl ow hedges (continued)

Under cash fl ow hedge accounting, the effective portion of the change in the fair value of the hedging instrument is recognized in OCI while the

ineffective portion is recognized in non-operating income (expense). Upon maturity of the fi nancial derivative instrument, the effective gains

and losses previously recognized in accumulated other comprehensive loss (AOCL) are recorded in net earnings under the same caption as the

hedged item.

If the hedging relationship ceases to qualify for cash fl ow hedge accounting, any change in fair value of the instrument from the point it ceases

to qualify is recorded in non-operating income (expense). Amounts previously recorded in AOCL will remain in AOCL until the anticipated

transaction occurs, at which time, the amount is recorded in net earnings under the same caption as the hedged item. If the transaction is no

longer expected to occur, amounts previously recorded in AOCL will be reclassifi ed to non-operating income (expense).

(h) Foreign currency

Monetary assets and liabilities, denominated in foreign currencies, are translated into Canadian dollars at the rate of exchange in effect at

the balance sheet date with any resulting gain or loss being included in the consolidated statement of earnings. Non-monetary assets,

non-monetary liabilities and revenues and expenses arising from transactions denominated in foreign currencies are translated into Canadian

dollars at the rates prevailing at the time of the transaction.

(i) Cash and cash equivalents

Cash and cash equivalents consist of cash and short-term investments that are highly liquid in nature and have a maturity date of three months

or less.

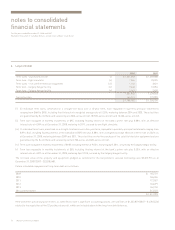

(j) Inventory

Effective January 1, 2008, the Corporation adopted CICA Section 3031, Inventories. This section provides more extensive guidance on the deter-

mination of cost, narrows permitted cost formulas, requires impairment testing and expands the disclosure requirements to increase transpar-

ency. There was no impact as a result of adoption on the fi nancial results of the Corporation.

Inventories are valued at the lower of cost and net realizable value, with cost being determined on a fi rst-in, fi rst-out basis. The Corporation’s

inventory balance consists of aircraft fuel, de-icing fl uid and retail merchandise. Aircraft expendables and consumables are expensed

as acquired.

(k) Deferred costs

Certain sales and distribution costs attributed to advance ticket sales are deferred in prepaid expenses, deposits and other on the consolidated

balance sheet and expensed to sales and distribution in the period the related revenue is recognized.