Westjet 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2008 Annual Report 51

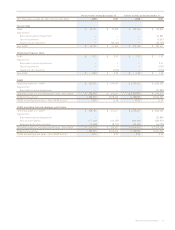

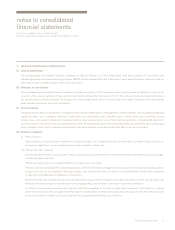

The following non-GAAP measures are used to monitor our

fi nancial performance:

Adjusted debt: The sum of long-term debt, obligations under

capital lease and off-balance-sheet aircraft operating leases.

Our practice, consistent with common industry practice,

is to multiply the trailing twelve months of aircraft leasing

expense by 7.5 to derive a present value debt equivalent.

This measure is used in the calculation of adjusted

debt-to-equity and adjusted net debt to Earnings Before

Interest, Taxes, Depreciation, Aircraft Rent and other items,

as defi ned below.

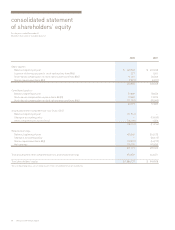

Adjusted equity: The sum of share capital, contributed

surplus and retained earnings, excluding accumulated

other comprehensive loss (AOCL). This measure is used in

the calculation of adjusted debt-to-equity.

Adjusted net debt: Adjusted debt less cash and cash

equivalents. This measure is used in the calculation of

adjusted net debt to Earnings Before Interest, Taxes,

Depreciation, Aircraft Rent and other items, as defi ned below.

EBITDAR: Earnings Before Interest, Taxes, Depreciation,

Aircraft Rent and other items, such as asset impairments,

gains and losses on derivatives, and foreign exchange gains

or losses. EBITDAR is a non-GAAP measure commonly

used in the airline industry to evaluate results by excluding

differences in the method in which an airline fi nances

its aircraft.

Net earnings, diluted earnings per share and CASM,

adjusted for one-time items: We have excluded one-time

items, such as the reservation system impairment and

favourable income tax rate reduction in 2007, in assessing

the operating performance of our ongoing operations.

These items are excluded from our results, as they could

skew the trend analysis of our fi nancial performance and

were one-time items unique to 2007 that we do not expect

to see in the future.

CASM, excluding fuel and employee profi t share: We

exclude the effects of aircraft fuel expense and employee

profi t share expense to assess the operating performance of

our business. Fuel expense is excluded from our operating

results due to the fact that fuel prices are impacted by a

host of factors outside our control, such as signifi cant

weather events, geopolitical tensions, refi nery capacity and

global demand and supply. Excluding this expense allows

us to analyze our operating results on a comparable basis.

Employee profi t share expense is excluded from our

operating results due to its variable nature, and excluding

this expense allows greater comparability.

Economic cost of fuel: As presented in the non-GAAP

measures to GAAP reconciliation on page 29 of this MD&A

in Results of Operations – Aircraft Fuel, we believe it is

useful to refl ect aircraft fuel expense on an economic

basis, which includes realized losses on fuel derivatives not

designated under cash fl ow hedge accounting, and excludes

ineffectiveness, as defi ned, for future period derivative

instruments. Since fuel expense is highly volatile, we

believe presenting the economic cost of fuel is useful to a

reader. This table has not been repeated in this section.

We just don’t believe guests should have to pay extra

to speak to a real person; our low-cost advantage lets

us do lots of things outside the norm.

Vincent Lamb, Sales Super Agent

WestJetter since 2002