Westjet 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

aiming

high

2008 Annual Report

Table of contents

-

Page 1

aiming high 2008 Annual Report -

Page 2

... results 2008 - 18 management's report to the shareholders - 54 auditors' report to the shareholders - 55 consolidated ï¬nancial statements - 56 notes to consolidated ï¬nancial statements - 61 executive team - 94 board of directors - inside back cover corporate information - inside back cover -

Page 3

... 11.0 1,379 378 1,050 260 149 2004 2005 2006 2007 2008 2004 2005 2006 2007 2008 2004 2005 2006 2007 2008 RASM vs. CASM (cents) Revenue (millions of dollars) Cash and cash equivalents (millions of dollars) RASM (revenue per available seat mile) CASM (cost per available seat mile) -

Page 4

...0.19 0.19 (0.14) (0.14) Consolidated operational highlights Available seat miles (ASM) Revenue passenger miles (RPM) Load factor Yield (cents) Revenue per ASM (cents) Operating cost per ASM (cents) Operating cost per ASM, excluding fuel and employee proï¬t share (cents) 17,138,883,465 13,730,960... -

Page 5

to be the best Our vision is to be one of the ï¬ve most successful airlines in the world by 2016. With the right strategy and the best and brightest people, it looks like clear skies ahead. -

Page 6

to put our people first Amazing things happen when you empower people to do the right thing for our business, our guests and each other. -

Page 7

Jennifer Fothergill Financial Accountant - External Reporting Finance WestJetter since 2001 -

Page 8

to deliver great guest value There are a million things that go into running an airline, but creating a superior guest experience is what makes ours truly successful. -

Page 9

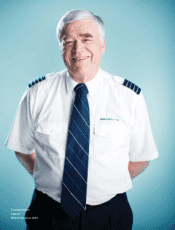

Timothy Hamm Captain WestJetter since 2001 -

Page 10

to grow strategically and proï¬tably We already ï¬,y to lots of places, and we will continue growing strategically and proï¬tably as we ï¬,y to many more. -

Page 11

Michelle DaSilva Manager Inï¬,ight Standards and Procedures WestJetter since 1996 -

Page 12

to strengthen our low-cost advantage Our ongoing commitment to being cost conscious supports our goal of maximizing value for our guests and our shareholders. -

Page 13

Keith Sampson Senior Technical Support Analyst, IT WestJetter since 1999 -

Page 14

our strategy -

Page 15

... our success. By keeping our commitment to low costs, we continue to offer value to our people, our shareholders and above all, our guests. It's on these fundamental beliefs that we built our four-pillar strategy: people and culture; guest experience and performance; revenue and growth; and cost and... -

Page 16

... our business. At WestJet, our owners care. In 2008 we: • Welcomed over 600 new WestJetters to our family • Accepted the award for one of Canada's most admired corporate cultures for the fourth year in a row • Celebrated being named Canada's top company for managing human resources • Shared... -

Page 17

... across Canada • Partnered with CanWest to create the successful Fly Free promotion • Provided hotel rooms, meal vouchers, taxis, chartered buses and third-party aircraft charters to care for guests caught in severe coast-to-coast winter weather during the busy holiday travel season because it... -

Page 18

.... We will continue to add new destinations and gain market share one great guest experience at a time. In 2008 we: • Reported one of the best pre-tax margins in the North American airline industry • Achieved revenue growth of 19.9 per cent • Added six new aircraft • Began service to eight... -

Page 19

... proï¬t margin that will be number one among North American airlines. We'll do it with a lot of hard work and smiles on our faces. It's the WestJet way. In 2008 we: • Continued focusing on the same low-cost philosophies we've always had, fostering a culture of owners who are focused on doing more... -

Page 20

... for our airline and a year for investing in our future. I truly believe that companies that invest wisely, even in tough times, will lead the way when the good times return. In store for 2009 In 2009, we believe we will increase our market share by focusing on adding new destinations and non-stop... -

Page 21

...airline. Sean Durfy President and Chief Executive Ofï¬cer March 10, 2009 Certain information in this president's message may contain forward-looking statements, including but not limited to, those regarding increasing market share, aircraft deliveries, code-sharing, expansion of WestJet Vacations... -

Page 22

... fuel consumption for our existing schedule and historical fuel burn and a Canadian-US dollar exchange rate similar to the current market rate; • our hedging expectations and intent to hedge anticipated jet fuel purchases was based on our current approved hedging strategy; 18 WestJet 2008 Annual... -

Page 23

...key operating indicators are airline industry metrics, which are useful in assessing the operating performance of an airline. Flight leg: Segment of a ï¬,ight involving a stopover, change of aircraft or change of airline from one landing site to another. Segment guest: Any person who has been booked... -

Page 24

... by one of the best earnings before tax (EBT) margins of any large North American airline, positive cash ï¬,ows from operations, a signiï¬cant cash position and a healthy balance sheet. Amid the turmoil in the economy, execution of our strategy was key as we added new destinations and routes, and... -

Page 25

...fuel prices resulted in capacity reductions, employee layoffs, grounding of aircraft, bankruptcy protection and aggressive ancillary revenue initiatives within the North American airline industry. Despite these trends, we remained committed to our strategic growth plan. We continued to take delivery... -

Page 26

...of our enhanced 2009 summer schedule: Yellowknife, Northwest Territories; Sydney, Nova Scotia; and San Francisco and San Diego, California. During 2008, we began service to the following destinations: Kamloops; Quebec City; Kona; New York City (via Newark); Bridgetown, Barbados; La Romana, Dominican... -

Page 27

...since 2001 SELECTED ANNUAL AND QUARTERLY FINANCIAL INFORMATION Annual audited ï¬nancial information ($ in thousands, except per share data) Total revenues Net earnings Basic earnings per share Diluted earnings per share Total assets Total long-term liabilities Shareholders' equity 2008 $ 2,549,506... -

Page 28

... saw signiï¬cant reductions in the quoted market price of US-dollar jet fuel, there is a lag between our realized cost of jet fuel and the market prices due to inventory levels we maintain and the pricing mechanisms embedded in some of our purchasing contracts. 24 WestJet 2008 Annual Report -

Page 29

... number of delayed ï¬,ights and cancellations impacted our ï¬nancial and operational results. As a result, we spent an additional $3.2 million on hotel RESULTS OF OPERATIONS Revenue rooms, meal vouchers, ground transportation, chartered aircraft and de-icing costs during the fourth quarter of 2008... -

Page 30

... hotel rooms into Las Vegas and has been successful in the popular Caribbean and Mexico markets. WVI has been instrumental in our growth and will be a key contributor to the future success of our airline. Ancillary revenues, which include service fees, onboard sales, and partner and program revenue... -

Page 31

... Our underlying low-cost business model was integral during this period of volatile fuel prices and unprecedented capital market conditions, as we were able to operate with costs below that of our competitors. Our CASM, excluding fuel, employee proï¬t share and the reservation system impairment of... -

Page 32

...a greater number of available seat miles contributed to the reduction of our CASM, excluding fuel and employee proï¬t share, during the year. Aircraft fuel Fuel prices continued to negatively impact our CASM during 2008, representing approximately 36 per cent of Average market price of jet fuel 180... -

Page 33

... dollars. ($ in thousands) Consolidated balance sheet: Fair value of fuel derivatives - current portion Fair value of fuel derivatives - long-term portion Net unrealized loss from fuel derivatives Statement presentation Accounts payable and accrued liabilities Other liabilities AOCL - before tax... -

Page 34

... consists primarily of airport landing and terminal fees, and ground handling costs for our scheduled service and charter operations. These expenditures typically ï¬,uctuate depending on the destinations serviced, aircraft weights, inclement weather conditions and number of guests. Transborder and... -

Page 35

...our capacity growth, as well as annual merit increases. Salaries and beneï¬ts expense for each department is included in the respective department's operating expense line item. Employee share purchase plan Our Employee Share Purchase Plan (ESPP) allows employees to become owners of WestJet shares... -

Page 36

... related to the 2008 Executive Share Unit Plan. Foreign exchange We are exposed to foreign currency exchange risks arising from ï¬,uctuations in exchange rates on our US-dollar denominated net monetary assets and our operating expenditures, mainly aircraft fuel, aircraft leasing expense, certain... -

Page 37

... by the federal government. In addition, we realized a beneï¬cial impact to our future effective tax rate for 2007 based on revised expectations of when certain temporary differences are anticipated to reverse. These changes resulted in a $33.7 million favourable WestJet 2008 Annual Report 33 -

Page 38

... for the North American airline industry. Our bag ratio represents the number of delayed or lost baggage claims made per 1,000 guests. Three months ended December 31 2008 On-time performance Completion rate Bag ratio 68.9% 98.1% 4.68 2007 77.8% 99.0% 4.32 Change (8.9 pts) (0.9 pts) (8.3%) Twelve... -

Page 39

..., mainly resulting from deposits for aircraft fuel and other operating costs. Financing cash ï¬,ow For 2008, our total cash ï¬,ow used in ï¬nancing activities was $115.4 million, consisting primarily of $179.4 million in long-term debt repayments, $29.4 million to repurchase WestJet 2008 Annual... -

Page 40

...winglets. These purchase obligations in US dollars are: 2009 - $50,919; 2010 - $107,672; 2011 - $124,419; 2012 - $461,047; 2013 - $295,724. On December 19, 2008, we signed an agreement with Sabre ® Airline Solutions Inc. (Sabre) to provide us with a license to access and use its reservation system... -

Page 41

... per annum or a bankers acceptance rate at 2.0 per cent annual stamping fee, and will be available for general corporate expenses and working capital purposes. We are required to pay a standby fee of 15 basis points, based on the average unused portion of the line of credit for the previous quarter... -

Page 42

... risk factors listed below. Management performs a risk assessment on a continual basis to ensure that signiï¬cant risks related to our airline have been reviewed and assessed by management. Any major safety incident involving our aircraft or similar aircraft of other airlines could materially and... -

Page 43

... exchange rates and international political events. Notwithstanding our variable proï¬t share plan, a portion of an airline's costs, such as labour, aircraft ownership and facilities charges, cannot be easily adjusted in the short term to respond to market changes. WestJet 2008 Annual Report... -

Page 44

... processing of information critical to our business. Mitigating this risk is the fact that Sabre is a well-established airline solutions company, and the SabreSonic® reservation system is utilized by a number of major airlines. As a company that processes, transmits and stores credit card data, we... -

Page 45

... expenditures, mainly aircraft fuel, aircraft leasing expense, certain maintenance costs and a portion of airport operations costs. Since our revenues are received primarily in Canadian dollars, we are exposed to ï¬,uctuations in the US-dollar exchange rate with respect to these payment obligations... -

Page 46

... to increased costs and decreased aircraft utilization, which negatively affect proï¬tability. Our business is dependent on its ability to operate without interruption at a number of key airports, including Toronto Pearson International Airport and Calgary International Airport. An interruption... -

Page 47

..., and long-term debt. We are exposed to market, credit and liquidity risks associated with our ï¬nancial assets and liabilities. We will, from time to time, use various ï¬nancial derivatives to reduce market risk exposures from changes in foreign exchange rates, interest rates and jet fuel prices... -

Page 48

... fair value of foreign exchange derivative assets totalled $6.7 million. As at December 31, 2008, outstanding fuel derivatives are in a liability position. We are not exposed to counterparty credit risk on our US-dollar deposits that relate to purchased aircraft as the funds are held in a security... -

Page 49

... in accounting for our liability related to certain types of non-refundable guest credits. We issue future travel credits to guests for ï¬,ight changes and cancellations, as well as for gift certiï¬cates. Where appropriate, future travel credits are also issued for ï¬,ight delays, missing baggage... -

Page 50

... ticket sales to total bookings on an annualized basis. This amount is included on our consolidated balance sheet in prepaid expenses, deposits and other, and expensed to sales and distribution in the period the related revenue is recognized. Changes in accounting policies Effective January 1, 2008... -

Page 51

... of operations. As we are still in the Solution Development phase and have not yet selected our accounting policy choices and IFRS 1 exemptions, we are unable to quantify the impact of IFRS on our ï¬nancial statements. The areas of signiï¬cance identiï¬ed above are WestJet 2008 Annual Report 47 -

Page 52

... could result in changes to the transition plan being different from those communicated here. Key milestones Financial statement preparation Senior management and Steering Committee sign-off for all key IFRS accounting policy choices to occur during the third quarter of 2009. Development of draft... -

Page 53

... 31, 2008. Changes in internal control over ï¬nancial reporting During the year ended December 31, 2008, we began a more extensive fuel hedging program under a revised policy, as approved by our Board of Directors. Our current objective is to hedge a portion of our anticipated jet fuel purchases in... -

Page 54

...are presented in 2009. We are well-positioned to adapt our capacity during this period, with our seasonal deployment strategy, the number of new destinations that we can ï¬,y to, and our relatively low market share into a number of markets. Moreover, during these challenging times, our WestJet brand... -

Page 55

...-cost advantage lets us do lots of things outside the norm. Vincent Lamb, Sales Super Agent WestJetter since 2002 The following non-GAAP measures are used to monitor our ï¬nancial performance: Adjusted debt: The sum of long-term debt, obligations under capital lease and off-balance-sheet aircraft... -

Page 56

...,301) and interest expense of $76,078 (2007 - $75,749). For the year ended December 31, 2008, other includes the foreign exchange gain of $30,587 and loss on derivatives of $17,331 (2007 - reservation system impairment of $31,881 and foreign exchange loss of $12,750). 52 WestJet 2008 Annual Report -

Page 57

...employee proï¬t share Operating expenses - GAAP Adjusted for: Reservation system impairment Aircraft fuel expense Employee proï¬t share expense Operating expenses, excluding above items - Non-GAAP ASMs (in thousands) CASM, excluding above items - Non-GAAP (cents) 2008...WestJet 2008 Annual Report 53 -

Page 58

...its responsibilities, and to review the consolidated ï¬nancial statements and management's discussion and analysis. The Audit Committee reports its ï¬ndings to the Board of Directors 54 WestJet 2008 Annual Report prior to the approval of such statements for issuance to the shareholders. The Audit... -

Page 59

... position of the Corporation as at December 31, 2008 and 2007 and the results of its operations and its cash ï¬,ows for the years then ended in accordance with Canadian generally accepted accounting principles. Chartered Accountants Calgary, Canada February 10, 2009 WestJet 2008 Annual Report... -

Page 60

...) 2008 2007 Revenues: Guest revenues Charter and other revenues Expenses: Aircraft fuel Airport operations Flight operations and navigational charges Marketing, general and administration Sales and distribution Depreciation and amortization Inï¬,ight Aircraft leasing Maintenance Employee pro... -

Page 61

consolidated balance sheet As at December 31 (Stated in thousands of Canadian dollars) 2008 2007 Assets Current assets: Cash and cash equivalents (note 4) Accounts receivable Future income tax (note 7) Prepaid expenses, deposits and other (note 12(a)) Inventory $ 820,214 16,837 4,196 67,693 17,... -

Page 62

...dollars) 2008 2007 Share capital: Balance, beginning of year Issuance of shares pursuant to stock option plans (note 8(b)) Stock-based compensation on stock options exercised (note 8(b)) Shares repurchased... earnings: Balance, beginning of year Change in accounting policy Shares repurchased (note ... -

Page 63

... 31 (Stated in thousands of Canadian dollars) 2008 2007 Net earnings Other comprehensive income, net of taxes: Amortization of hedge settlements to aircraft leasing Net unrealized gain on foreign exchange derivatives under cash ï¬,ow hedge accounting (net of tax of ($3,097); 2007 - $nil) Reclassi... -

Page 64

... derivative instruments (note 11) Loss on disposal of property, equipment and aircraft parts (note 5) Stock-based compensation expense (note 8(e)(f)) Future income tax expense Unrealized foreign exchange loss (gain) Change in non-cash working capital (note 12(b)) $ 178,135 136,485 (937) 1,400 6,725... -

Page 65

... are provided to the guests. Included in ancillary revenues are fees associated with guest itinerary changes or cancellations, excess baggage fees, buy-on-board sales and pre-reserved seating fees. Included in other revenue is revenue from expired credit ï¬les recognized at the time of expiry. Also... -

Page 66

...ï¬cant accounting policies (continued) (e) Non-refundable guest credits The Corporation issues future travel credits to guests for ï¬,ight changes and cancellations, as well as for gift certiï¬cates. Where appropriate, future travel credits are also issued for ï¬,ight delays, missing baggage and... -

Page 67

...-for-trading. The Corporation will from time to time use various ï¬nancial derivatives to reduce market risk exposure from changes in foreign exchange rates and jet fuel prices. Derivatives, including embedded derivatives, are recorded at fair value on the balance sheet with changes in fair value... -

Page 68

... The Corporation's inventory balance consists of aircraft fuel, de-icing ï¬,uid and retail merchandise. Aircraft expendables and consumables are expensed as acquired. (k) Deferred costs Certain sales and distribution costs attributed to advance ticket sales are deferred in prepaid expenses, deposits... -

Page 69

...ï¬ed within the Corporation's lease agreements. The lease return costs are accounted for in accordance with the asset retirement obligations requirements and are initially measured at fair value and capitalized to property and equipment as an asset retirement cost. WestJet 2008 Annual Report 65 -

Page 70

... to funds used to ï¬nance property and equipment is capitalized to the related asset until the point of commercial use. Costs of new route development are expensed as incurred. (p) Future income tax The Corporation uses the asset and liability method of accounting for future income taxes. Under... -

Page 71

.... An external advisor has been engaged to work with the Corporation's dedicated project staff to complete the conversion. Regular reporting is provided by the project team to senior management, the Steering Committee and the Audit Committee of the Board of Directors. WestJet 2008 Annual Report 67 -

Page 72

... quantify the impact of IFRS on its ï¬nancial statements. The areas of signiï¬cance identiï¬ed above are based on available information and the Corporation's expectations as of the date of this report and thus, are subject to change for new facts and circumstances. 68 WestJet 2008 Annual Report -

Page 73

.... Key activity • Identify differences in Canadian GAAP/ IFRS accounting policies • Select ongoing IFRS policies • Select IFRS 1 choices • Develop ï¬nancial statement format • Quantify effects of change in initial IFRS disclosure and 2010 comparative ï¬nancial statements Training Deï¬ne... -

Page 74

.... The Corporation manages its capital structure and makes adjustments to it in light of changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain or adjust the capital structure, the Corporation may from time to time purchase shares for cancellation... -

Page 75

... ï¬nancial statements For the years ended December 31, 2008 and 2007 (Stated in thousands of Canadian dollars, except share and per share data) 3. Capital management (continued) 2008 Adjusted debt-to-equity: Long-term debt (i) Obligations under capital lease (ii) Off-balance-sheet aircraft leases... -

Page 76

... for future growth and is continuously reviewed by the Corporation. There were no changes in the Corporation's approach to capital management during the year ended December 31, 2008. 4. Cash and cash equivalents As at December 31, 2008, cash and cash equivalents includes bank balances of... -

Page 77

... amounts are being amortized on a straight-line basis over the term of each lease. During the year ended December 31, 2007, the Corporation recognized a non-cash impairment of $31,881 for the capitalized costs associated with its former reservation system project. WestJet 2008 Annual Report 73 -

Page 78

... Held within the special-purpose entities, as identiï¬ed in note 1, signiï¬cant accounting policies, are liabilities of $1,332,859 (2007 - $1,393,526) related to the acquisition of the 52 purchased aircraft, which are included above in the long-term debt balances. 74 WestJet 2008 Annual Report -

Page 79

...,483 $ (174,737) - (174,737) $ (174,737) The Corporation has recognized a beneï¬t of $314,384 (2007 - $352,298) for non-capital losses which are available for carry forward to reduce taxable income in future years. These losses will begin to expire in the year 2014. WestJet 2008 Annual Report 75 -

Page 80

... be issued, from time to time on one or more series, each series consisting of such number of non-voting shares and non-voting preferred shares as determined by the Corporation's Board of Directors who may also ï¬x the designations, rights, privileges, restrictions and conditions attaching to the... -

Page 81

... number of variable voting shares was 3,621,903 (2007 - 6,686,908). On March 12, 2008, the Corporation ï¬led a notice with the Toronto Stock Exchange (TSX) to make a normal course issuer bid to purchase outstanding shares on the open market. As approved by the TSX, WestJet is authorized to purchase... -

Page 82

... number of common voting shares issuable under the stock option plans, which may be issued within a one-year period, shall not exceed 10% of the issued and outstanding common and variable voting shares at any time. Stock options are granted at a price that equals the market value of the Corporation... -

Page 83

..., the Corporation accounts for actual forfeitures as they occur. (f) Executive share unit plan During the year ended December 31, 2008, the Board of Directors approved the 2008 executive share unit plan whereby up to a maximum of 200,000 restricted share units (RSU) and performance share units (PSU... -

Page 84

... price of the shares on the TSX for the ï¬ve days preceding the employee's notice to the Corporation. The Corporation's share of the contributions in 2008 amounted to $42,937 (2007 - $35,449) and is recorded as compensation expense within the related business unit. 80 WestJet 2008 Annual Report -

Page 85

... and live satellite television systems As at December 31, 2008, the Corporation is committed to purchase 24 737-700 aircraft for delivery between 2010 and 2013. The remaining estimated amounts to be paid in deposits and purchase prices for the 24 aircraft, as well as amounts to be paid for live... -

Page 86

..., or a bankers acceptance rate at 2.0% annual stamping fee or equivalent and will be available for general corporate expenses and working capital purposes. The Corporation is required to pay a standby fee of 15 basis points, based on the average unused portion of the line of credit for the previous... -

Page 87

... liabilities Total carrying amount 2008 Asset (liability) Cash and cash equivalents Accounts receivable Foreign exchange options (i) Cash ï¬,ow hedges: (ii) Foreign exchange forward contracts (iii) Fuel derivatives (iv) US-dollar deposits (v) Accounts payable and accrued liabilities (vi) Long-term... -

Page 88

... in the balance sheet as at December 31, 2008 and 2007, are as follows: 2008 Carrying amount Asset (liability) Cash and cash equivalents Accounts receivable Foreign exchange options Cash ï¬,ow hedges: Foreign exchange forward contracts Fuel derivatives US-dollar deposits Accounts payable and accrued... -

Page 89

... to market, credit and liquidity risks associated with its ï¬nancial assets and liabilities. The Corporation will, from time to time, use various ï¬nancial derivatives to reduce market risk exposures from changes in foreign exchange rates, interest rates and jet fuel prices. The Corporation does... -

Page 90

... of aircraft fuel expense. The Corporation's policy for its fuel derivatives is to measure effectiveness based on the change in the intrinsic value of the fuel derivatives versus the change in the intrinsic value of the anticipated jet fuel purchase. The Corporation has elected to exclude time value... -

Page 91

... of changes in foreign exchange rates. The Corporation is exposed to foreign currency exchange risks arising from ï¬,uctuations in exchange rates on its US-dollar denominated net monetary assets and its operating expenditures, mainly aircraft fuel, aircraft leasing expense, certain maintenance costs... -

Page 92

... aircraft, which, as at December 31, 2008 totalled $24,309 (2007 - $22,748). A reasonable change in market interest rates for the year ended December 31, 2008 would not have signiï¬cantly impacted the Corporation's net earnings as a result of the US-dollar deposits. 88 WestJet 2008 Annual Report -

Page 93

..., the Corporation's accounts receivable are the result of tickets sold to individual guests through the use of travel agents and other airlines. Purchase limits are established for each agent and, in some cases, when deemed necessary, a letter of credit is obtained. As at December 31, 2008, $7,403... -

Page 94

... dollars, except share and per share data) 11. Financial instruments and risk management (continued) (b) Risk management (continued) Credit risk (continued) (iv) US-dollar deposits The Corporation is not exposed to counterparty credit risk on its US-dollar deposits that relate to purchased aircraft... -

Page 95

... included in aircraft leasing. During the year ended December 31, 2008 the Corporation recognized amortization of $869 (2007 - $868). (v) Unearned revenue relates to the BMO Mosaik® AIR MILES® MasterCard® credit card for future net retail sales and for fees on newly activated credit cards. During... -

Page 96

...information 2008 Net change in non-cash working capital from operations: Increase in accounts receivable Decrease in income taxes recoverable Increase in prepaid expenses and deposits (i) Increase in inventory Increase in accounts payable and accrued liabilities (ii) Increase in advance ticket sales... -

Page 97

... ï¬nancial statements For the years ended December 31, 2008 and 2007 (Stated in thousands of Canadian dollars, except share and per share data) 12. Additional ï¬nancial information (continued) (c) Accumulated other comprehensive loss Cash ï¬,ow hedges Amortization of - foreign exchange hedge... -

Page 98

... Vice-President, Finance and CFO Sean Durfy, President and CEO Fred Ring, Executive Vice-President, Corporate Projects Dr. Hugh Dunleavy, Executive Vice-President, Commercial Distribution Bob Cummings, Executive Vice-President, Guest Experience and Marketing Ferio Pugliese, Executive Vice-President... -

Page 99

-

Page 100

..., St. John's, Sydney, Thunder Bay, Toronto, Vancouver, Victoria, Winnipeg, Yellowknife United States: Fort Lauderdale, Fort Myers, Honolulu, Kona, Las Vegas, Los Angeles, Maui (Kahului), New York (via Newark), Orlando, Palm Springs, Phoenix, San Diego, San Francisco, Tampa International: Bridgetown... -

Page 101

... corporate information Stock exchange listing Shares in WestJet stock are publicly traded on the Toronto Stock Exchange under the symbols WJA and WJA.A. Investor relations contact information Phone: 1-877-493-7853 E-mail: [email protected] WestJet Campus 22 Aerial Place NE Calgary... -

Page 102

WestJet 22 Aerial Place NE Calgary, Alberta, T2E 3J1 Phone: (403) 444-2600 westjet.com