U-Haul 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

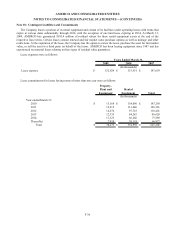

Note 18: Contingent Liabilities and Commitments

The Company leases a portion of its rental equipment and certain of its facilities under operating leases with terms that

expire at various dates substantially through 2016, with the exception of one land lease expiring in 2034. At March 31,

2009, AMERCO has guaranteed $183.4 million of residual values for these rental equipment assets at the end of the

respective lease terms. Certain leases contain renewal and fair market value purchase options as well as mileage and other

restrictions. At the expiration of the lease, the Company has the option to renew the lease, purchase the asset for fair market

value, or sell the asset to a third party on behalf of the lessor. AMERCO has been leasing equipment since 1987 and has

experienced no material losses relating to these types of residual value guarantees.

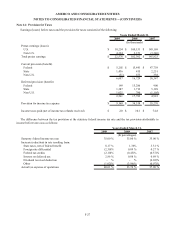

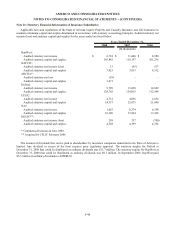

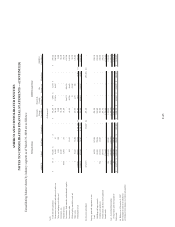

Lease expenses were as follows:

2009 2008 2007

Lease expense $ 152,424 $ 133,931 $ 147,659

Years Ended March 31,

(In thousands)

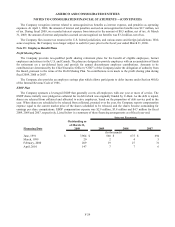

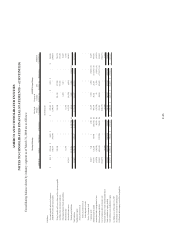

Lease commitments for leases having terms of more than one year were as follows:

Propert

y

,

Plant and

Equipment

Rental

Equipment Total

(In thousands)

Year-ended March 31:

2010 $ 13,168 $ 134,090 $ 147,258

2011 12,915 113,446 126,361

2012 12,676 97,725 110,401

2013 12,335 84,285 96,620

2014 11,323 66,266 77,589

Thereafter 7,859 59,118 66,977

Total $ 70,276 $ 554,930 $ 625,206

F-36