U-Haul 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

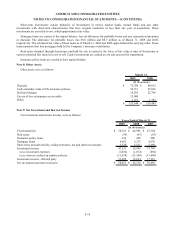

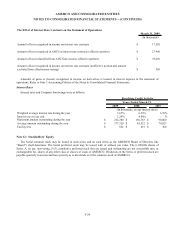

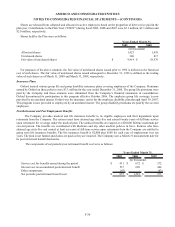

The Effect of Interest Rate Contracts on the Statement of Operations

March 31, 2009

(In thousands)

Amount of loss recognized in income on interest rate contracts $ 17,585

Amount of loss recognized in AOCI on interest rate contracts (effective portion) $ 27,496

Amount of loss reclassified from AOCI into income (effective portion) $ 18,266

Amount of loss recognized in income on interest rate contracts (ineffective portion and amount

excluded from effectiveness testing) $ 585

Amounts of gains or (losses) recognized in income on derivatives is located in interest expense in the statement of

operations. Refer to Note 3 Accounting Policies of the Notes to Consolidated Financial Statements.

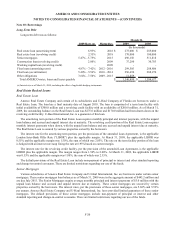

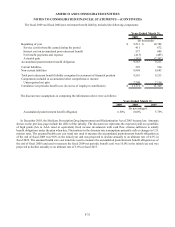

Interest Rates

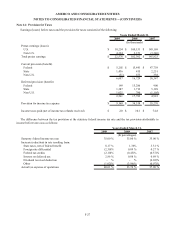

Interest rates and Company borrowings were as follows:

2009 2008 2007

Weighted average interest rate during the year 3.67% 6.25% 6.76%

Interest rate at year end 2.29% 4.80% - %

Maximum amount outstanding during the yea

r

$ 212,280 $ 150,783 $ 90,000

Average amount outstanding during the year $ 177,520 $ 85,522 $ 70,027

Facility fees $622 $ 419 $ 300

(In thousands, except interest rates)

Revolving Credit Activity

Years Ended March 31,

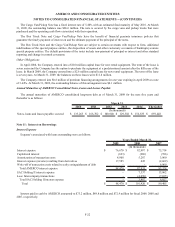

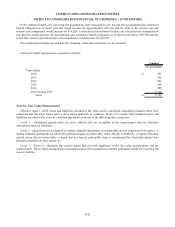

Note 12: Stockholders’ Equity

The Serial common stock may be issued in such series and on such terms as the AMERCO Board of Directors (the

“Board”) shall determine. The Serial preferred stock may be issued with or without par value. The 6,100,000 shares of

Series A, no par, non-voting, 8½% cumulative preferred stock that are issued and outstanding are not convertible into, or

exchangeable for, shares of any other class or classes of stock of AMERCO. Dividends on the Series A preferred stock are

payable quarterly in arrears and have priority as to dividends over the common stock of AMERCO.

F-24