U-Haul 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

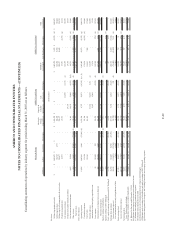

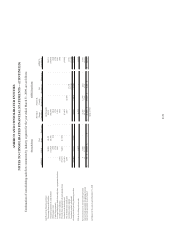

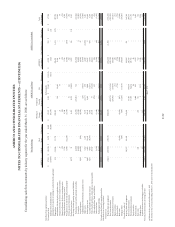

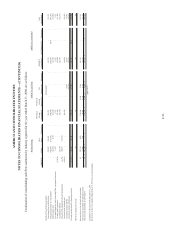

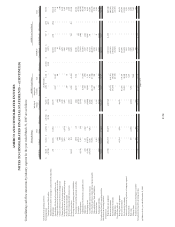

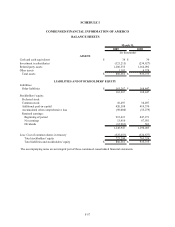

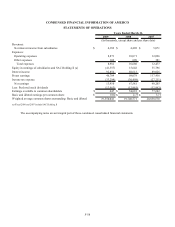

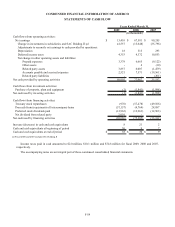

CONDENSED FINANCIAL INFORMATION OF AMERCO

STATEMENTS OF CASH FLOW

2009 2008 2007

Cash flows from operating activities:

Net earnings $ 13,410 $ 67,581 $ 90,205

Change in investments in subsidiaries and SAC Holding II (a) 41,557 (15,648) (35,796)

Adjustments to reconcile net earnings to cash provided by operations:

Depreciation 18 515 293

Deferred income taxes 4,353 4,372 10,853

Net change in other operating assets and liabilities:

Prepaid expenses 3,379 6,665 (9,122)

Other assets - 4 (10)

Related party assets 3,857 6,007 (1,479)

Accounts payable and accrued expenses 2,521 7,571 (19,561)

Related party liabilities - - (201)

Net cash provided by operating activities 69,095 77,067 35,182

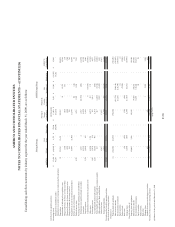

Cash flows from investment activities:

Purchase of property, plant and equipment (1) (1,841) (1,998)

Net cash used by investing activities (1) (1,841) (1,998)

Cash flows from financing activities:

Treasury stock repurchases (976) (57,478) (49,106)

Proceeds from (repayments of) intercompany loans (57,157) (4,764) 28,887

Preferred stock dividends paid (12,963) (12,963) (12,963)

Net dividend from related party 2,010 - -

Net cash used by financing activities (69,086) (75,205) (33,182)

Increase (decrease) in cash and cash equivalents 8 21 2

Cash and cash equivalents at beginning of period 30 9 7

Cash and cash equivalents at end of period $ 38 $ 30 $ 9

(a) Fiscal 2008 and 2007 include SAC Holding II

Years Ended March 31,

(In thousands)

Income taxes paid in cash amounted to $2.0 million, $10.1 million and $74.8 million for fiscal 2009, 2008 and 2007,

respectively.

The accompanying notes are an integral part of these condensed consolidated financial statements.

F-59