U-Haul 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

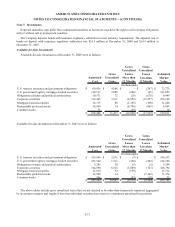

Note 10: Borrowings

Long-Term Debt

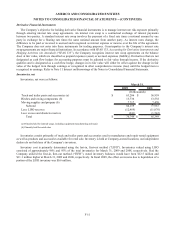

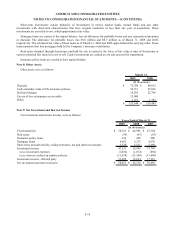

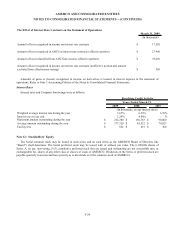

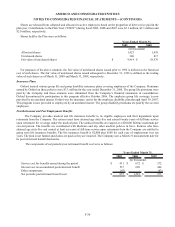

Long-term debt was as follows:

2009 Rate (a) Maturities 2009 2008

Real estate loan (amortizing term) 6.93% 2018 $ 275,000 $ 285,000

Real estate loan (revolving credit) 2.35% 2018 170,000 100,000

Senior mortgages 5.47% - 5.75% 2015 496,156 511,818

Construction loan (revolving credit) 2.00% 2009 37,280 30,783

Working capital loan (revolving credit) - 2009 - -

Fleet loans (amortizing term) 4.87% - 7.42% 2012 - 2016 299,505 288,806

Fleet loan (securitization) 5.40% - 5.56% 2010 - 2014 256,690 288,270

Other obligations 3.64% - 7.50% 2009 - 2015 11,859 -

Total AMERCO notes, loans and leases payable $ 1,546,490 $ 1,504,677

(a) Interest rate as of March 31, 2009, including the effect of applicable hedging instruments

(In thousands)

March 31,

Real Estate Backed Loans

Real Estate Loan

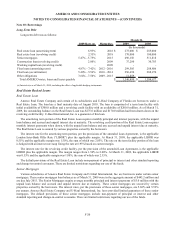

Amerco Real Estate Company and certain of its subsidiaries and U-Haul Company of Florida are borrowers under a

Real Estate Loan. The loan has a final maturity date of August 2018. The loan is comprised of a term loan facility with

initial availability of $300.0 million and a revolving credit facility with an availability of $200.0 million. As of March 31,

2009, the outstanding balance on the Real Estate Loan was $275.0 million and $170.0 million had been drawn down on the

revolving credit facility. U-Haul International, Inc. is a guarantor of this loan.

The amortizing term portion of the Real Estate Loan requires monthly principal and interest payments, with the unpaid

loan balance and accrued and unpaid interest due at maturity. The revolving credit portion of the Real Estate Loan requires

monthly interest payments when drawn, with the unpaid loan balance and any accrued and unpaid interest due at maturity.

The Real Estate Loan is secured by various properties owned by the borrowers.

The interest rate for the amortizing term portion, per the provisions of the amended Loan Agreement, is the applicable

London Inter-Bank Offer Rate (“LIBOR”) plus the applicable margin. At March 31, 2009, the applicable LIBOR was

0.55% and the applicable margin was 1.50%, the sum of which was 2.05%. The rate on the term facility portion of the loan

is hedged with an interest rate swap fixing the rate at 6.93% based on current margin.

The interest rate for the revolving credit facility, per the provision of the amended Loan Agreement, is the applicable

LIBOR plus the applicable margin. The margin ranges from 1.50% to 2.00%. At March 31, 2009, the applicable LIBOR

was 0.55% and the applicable margin was 1.80%, the sum of which was 2.35%.

The default provisions of the Real Estate Loan include non-payment of principal or interest and other standard reporting

and change-in-control covenants. There are limited restrictions regarding our use of the funds.

Senior Mortgages

Various subsidiaries of Amerco Real Estate Company and U-Haul International, Inc. are borrowers under certain senior

mortgages. These senior mortgages loan balances as of March 31, 2009 were in the aggregate amount of $443.2 million and

are due July 2015. The Senior Mortgages require average monthly principal and interest payments of $3.0 million with the

unpaid loan balance and accrued and unpaid interest due at maturity. These senior mortgages are secured by certain

properties owned by the borrowers. The interest rates, per the provisions of these senior mortgages, are 5.68% and 5.52%

per annum. Amerco Real Estate Company and U-Haul International, Inc. have provided limited guarantees of these senior

mortgages. The default provisions of these senior mortgages include non-payment of principal or interest and other

standard reporting and change-in-control covenants. There are limited restrictions regarding our use of the funds.

F-20