U-Haul 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

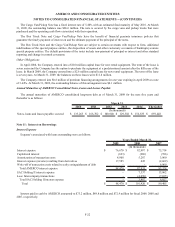

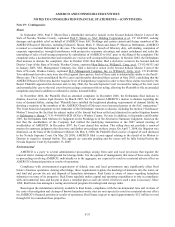

If the estimated health care cost trend rate assumptions were increased by one percent, the accumulated post retirement

benefit obligation as of fiscal year-end would increase by approximately $85,116 and the total of the service cost and

interest cost components would increase by $14,209. A decrease in the estimated health care cost trend rate assumption of

one percent would decrease the accumulated post retirement benefit obligation as of fiscal year-end by $93,740 and the

total of the service cost and interest cost components would decrease by $15,999.

Post employment benefits provided by the Company, other than retirement, are not material.

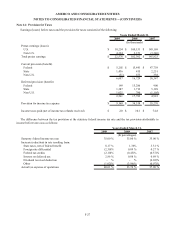

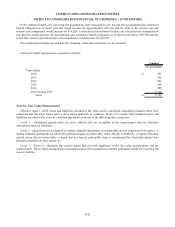

Future net benefit payments are expected as follows:

Amount

(In thousands)

Year-ended:

2010 $ 595

2011 692

2012 802

2013 899

2014 999

2015 through 2019 5,762

Total $ 9,749

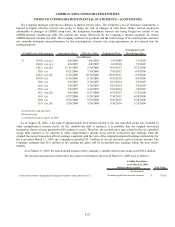

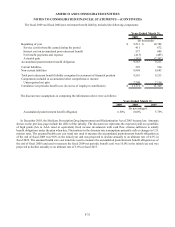

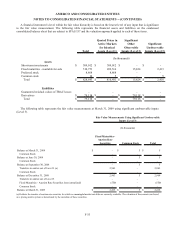

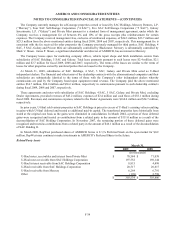

Note 16: Fair Value Measurements

Effective April 1, 2008, assets and liabilities recorded at fair value on the condensed consolidated balance sheet were

measured and classified based upon a three tiered approach to valuation. SFAS 157 requires that financial assets and

liabilities recorded at fair value be classified and disclosed in one of the following three categories:

Level 1 - Unadjusted quoted prices in active markets that are accessible at the measurement date for identical,

unrestricted assets or liabilities;

Level 2 – Quoted prices for identical or similar financial instruments in markets that are not considered to be active, or

similar financial instruments for which all significant inputs are observable, either directly or indirectly, or inputs other than

quoted prices that are observable, or inputs that are derived principally from or corroborated by observable market data

through correlation or other means; or

Level 3 – Prices or valuations that require inputs that are both significant to the fair value measurement and are

unobservable. These reflect management’s assumptions about the assumptions a market participant would use in pricing the

asset or liability.

F-32