U-Haul 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 29

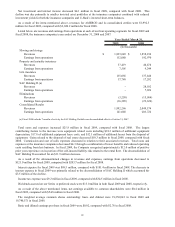

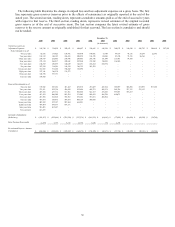

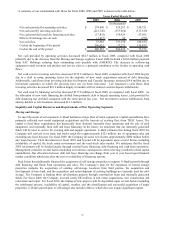

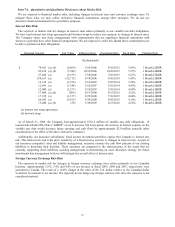

Total costs and expenses increased $31.2 million in fiscal 2008 as compared with fiscal 2007. The largest increase

was in depreciation expense associated with the rotation of our fleet. Conversely, with the shift in focus from

operating leases to purchases of new rental trucks lease expense decreased in fiscal 2008 as compared with fiscal

2007. The Company netted gains and losses from the disposal of property and equipment against depreciation.

Included in depreciation are gains on the sale of real estate of $12.7 million and $4.4 million in fiscal 2008 and fiscal

2007, respectively. Repair and maintenance costs included in operating expenses declined for the year due to the

rotation of older trucks out of the active rental fleet. These declines were offset by other operating costs including

personnel, property tax and certain legal-related expenses.

Equity in the earnings of AMERCO’s insurance subsidiaries increased $10.0 million in fiscal 2008 as compared

with fiscal 2007 primarily due to reduced operating expenses and benefits and losses.

As a result of the above mentioned changes in revenues and expenses, earnings from operations decreased to

$193.0 million in fiscal 2008, compared with $217.9 million for fiscal 2007.

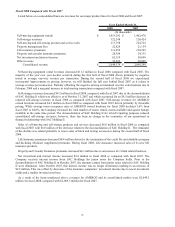

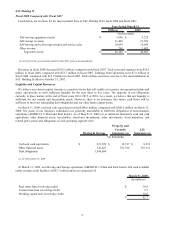

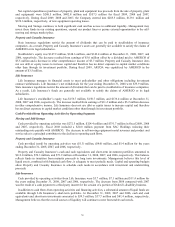

Property and Casualty Insurance

2008 Compared with 2007

Net premiums were $28.3 million and $28.4 million for the years ended December 31, 2008 and 2007,

respectively.

Net investment income was $9.1 million and $12.1 million for the years ended December 31, 2008 and 2007,

respectively. The decrease was a result of lower returns on bonds and short-term investments and a decrease in the

overall size of the investment portfolio.

Net operating expenses were $12.0 million for both of the years ended December 31, 2008 and 2007, respectively.

Benefits and losses incurred were $17.9 million and $19.0 million for the years ended December 31, 2008 and

2007, respectively.

As a result of the above mentioned changes in revenues and expenses, pretax earnings from operations were $7.5

million and $9.2 million for the years ended December 31, 2008 and 2007, respectively.

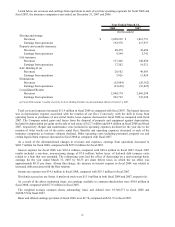

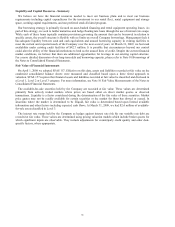

2007 Compared with 2006

Net premiums were $28.4 million and $24.3 million for the years ended December 31, 2007 and 2006,

respectively. The increased premiums were the result of U-Haul customer related programs.

Net investment income was $12.1 million and $14.2 million for the years ended December 31, 2007 and 2006,

respectively. The decrease was due to the sale of real estate in 2006, which resulted in gains before consolidation in

2006.

Net operating expenses were $12.0 million and $8.8 million for the years ended December 31, 2007 and 2006,

respectively. The increase was due to a $2.7 million increase in commissions on the additional liability program.

Benefits and losses incurred were $19.0 million and $21.9 million for the years ended December 31, 2007 and

2006, respectively.

Amortization of deferred acquisition costs were $0.2 million and $2.1 million for the years ended December 31,

2007 and 2006, respectively. The decrease was due to the termination of credit property business in March of 2006.

As a result of the above mentioned changes in revenues and expenses, pretax earnings from operations were $9.2

million and $5.7 million for the years ended December 31, 2007 and 2006, respectively.