U-Haul 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

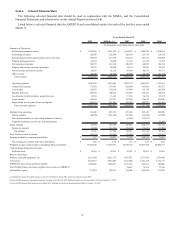

Fiscal 2008 Compared with Fiscal 2007

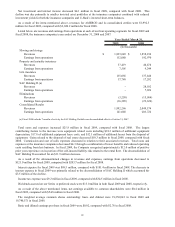

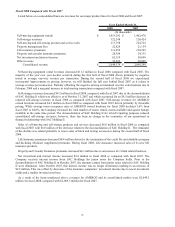

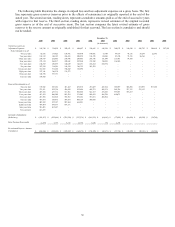

Listed below on a consolidated basis are revenues for our major product lines for fiscal 2008 and fiscal 2007:

2008 2007

Self-moving equipment rentals $ 1,451,292 $ 1,462,470

Self-storage revenues 122,248 126,424

Self-moving and self-storage product and service sales 217,798 224,722

Property management fees 22,820 21,154

Life insurance premiums 111,996 120,399

Property and casualty insurance premiums 28,388 24,335

Net investment and interest income 62,110 59,696

Other revenue 32,522 30,098

Consolidated revenue $ 2,049,174 $ 2,069,298

(In thousands)

Year Ended March 31,

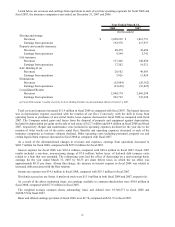

Self-moving equipment rental revenues decreased $11.2 million in fiscal 2008 compared with fiscal 2007. The

majority of the year over year decline occurred during the first half of fiscal 2008 driven primarily by negative

trends in average one-way revenue per transaction. During the second half of fiscal 2008 we experienced

incremental improvements in pricing; however, we still finished the full year behind fiscal 2007 as it relates to

average revenue per transaction. Partially offsetting the negative pricing environment was the extra business day in

February 2008 and a marginal increase in total moving transactions compared with fiscal 2007.

Self-storage revenues decreased $4.2 million in fiscal 2008, compared with fiscal 2007 due to the deconsolidation

of SAC Holding II which was effective as of October 31, 2007 and which accounted for an $8.5 million decrease in

reported self-storage revenues in fiscal 2008 as compared with fiscal 2007. Self-storage revenues for AMERCO

owned locations increased $4.3 million in fiscal 2008 as compared with fiscal 2007 driven primarily by favorable

pricing. While average room occupancy rates at AMERCO owned locations for fiscal 2008 declined 2.6% from

fiscal 2007 to 84.0%, the Company increased the total number of rooms rented, rooms available and square footage

available in the same time period. The deconsolidation of SAC Holding II for GAAP reporting purposes reduced

consolidated self-storage revenues; however, there has been no change in the economics of our operational or

financial relationship with SAC Holding II.

Sales of self-moving and self-storage products and services decreased $6.9 million in fiscal 2008 as compared

with fiscal 2007 with $6.0 million of the decrease related to the deconsolidation of SAC Holding II. The remainder

of the decline was related primarily to lower sales of hitch and towing accessories during the second half of fiscal

2008.

Life Insurance premiums decreased $8.4 million driven by the termination of the credit life and disability program

and declining Medicare supplement premiums. During fiscal 2008, Life Insurance increased sales of its new life

insurance products.

Property and Casualty Insurance premiums increased $4.1 million due to an increase in U-Haul related business.

Net investment and interest income increased $2.4 million in fiscal 2008 as compared with fiscal 2007. The

Company receives interest income from SAC Holdings for junior notes the Company holds. Prior to the

deconsolidation of SAC Holding II in October 2007, the amounts earned from junior notes related to SAC Holding

II were eliminated. After October 2007, this interest income was no longer eliminated resulting in an increase of

$2.9 million. This was offset by decreases of the insurance companies’ investment income due to lower investment

yields and a smaller invested asset base.

As a result of the items mentioned above, revenues for AMERCO and its consolidated entities were $2,049.2

million for fiscal 2008, compared with $2,069.3 million for fiscal 2007.

25