U-Haul 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

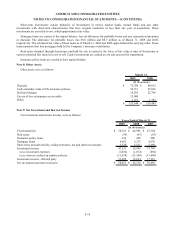

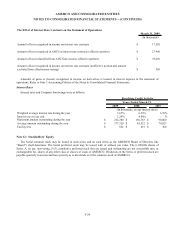

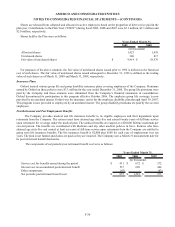

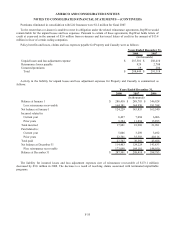

Significant components of the Company’s deferred tax assets and liabilities were as follows:

2009 2008

Deferred tax assets:

Net operating loss and credit carry forwards $ 50,460 $ 5,576

Accrued expenses 118,390 119,458

Policy benefit and losses, claims and loss expenses payable, net 11,935 13,744

Unrealized gains 31,006 13,828

Other 5,196 4,975

Total deferred tax assets 216,987 157,581

Deferred tax liabilities:

Property, plant and equipment 325,575 279,563

Deferred policy acquisition costs 3,925 4,051

Total deferred tax liabilities 329,500 283,614

N

et deferred tax liability $ 112,513 $ 126,033

March 31,

(In thousands)

Deferred tax assets and liabilities shown above are stated net of a valuation allowance of $2.9 million and $3.7 million

for March 31, 2009 and 2008, respectively.

Deferred tax assets and liabilities as of March 31, 2009 were reduced by $15.7 million as a result of the net-of-tax

presentation of FAS 115 items, and by $0.4 million for FAS 158 and other adjustments, which do not flow through the

provision for income tax expense.

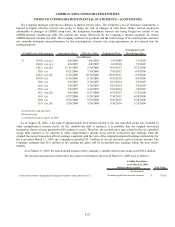

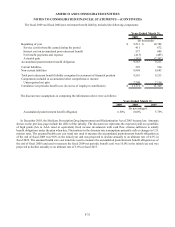

At March 31, 2009 and 2008, AMERCO has net operating loss carryforwards of $129.3 million and $0, respectively, to

be carried back and carried forward to offset taxable income in prior and future years. These carryforwards expire in 2029.

In the event of a change in control, under IRS Section 382, the utilization of our Federal net operating loss carryforwards

would be limited.

Effective April 1, 2007, the Company adopted FIN 48. FIN 48 prescribes a minimum recognition threshold and

measurement methodology that a tax position is required to meet before being recognized in the financial statements. As a

result of the adoption of FIN 48, the Company recognized a $6.8 million decrease to its previous reserves for uncertain tax

positions. This decrease is presented as an increase in the beginning balance of retained earnings for fiscal 2008.

The total amount of unrecognized tax benefits at April 1, 2008 was $7.1 million. This entire amount of unrecognized tax

benefits if resolved in our favor, would favorably impact our effective tax rate. During the current fiscal year we recorded

tax expense resulting from uncertain tax positions in the amount of $0.6 million. At March 31, 2009, the amount of

unrecognized tax benefits and the amount that would favorably affect our effective tax rate was $7.7 million.

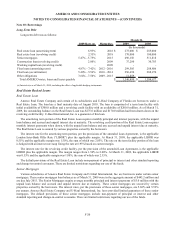

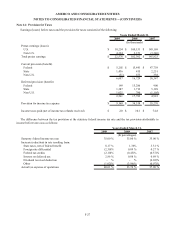

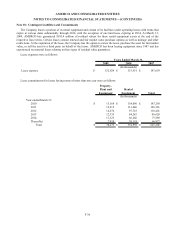

A reconciliation of beginning and ending amount of unrecognized tax benefits are as follows:

Amount

(In thousands)

Unrecognized tax benefits as of March 31, 2008 $ 7,142

Additions based on tax positions related to the current year 694

Reductions for tax positions of prior years (99)

Unrecognized tax benefits as of March 31, 2009 $ 7,737

F-28