U-Haul 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

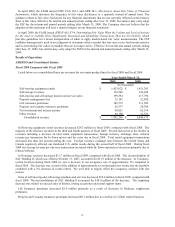

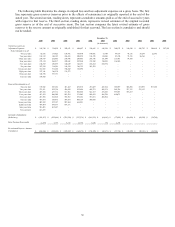

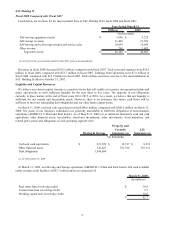

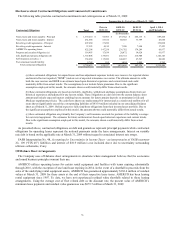

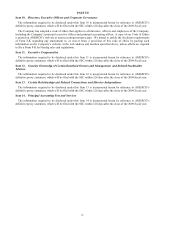

A summary of our consolidated cash flows for fiscal 2009, 2008 and 2007 is shown in the table below:

2009 2008 2007

Net cash provided by operating activities $ 274,960 $ 329,287 $ 350,721

Net cash used by investing activities (221,726) (357,962) (517,619)

Net cash provided (used) by financing activities (17,832) 159,929 87,685

Effects of exchange rate on cash (1,437) 96 (974)

Net cash flow 33,965 131,350 (80,187)

Cash at the beginning of the period 206,622 75,272 155,459

Cash at the end of the period $ 240,587 $ 206,622 $ 75,272

Years Ended March 31,

(In thousands)

Net cash provided by operating activities decreased $54.3 million in fiscal 2009, compared with fiscal 2008

primarily due to the decrease from the Moving and Storage segment. Fiscal 2008 included a $20.0 million payment

from SAC Holdings reducing their outstanding note payable with AMERCO. The decrease in self-moving

equipment rental revenues and product and service sales is a principal contributor to the decline in operating cash

flows.

Net cash used in investing activities decreased $136.2 million in fiscal 2009, compared with fiscal 2008 largely

due to a shift in using operating leases for the majority of new truck acquisitions instead of debt financing.

Additionally, cash flows from investing activities for Property and Casualty Insurance increased $9.0 million due to

investment maturities of which the proceeds have not yet been reinvested. Life Insurance’s cash flows from

investing activities decreased $10.2 million largely in tandem with its reduced contract deposit withdrawals.

Net cash used by financing activities increased $177.8 million in fiscal 2009, as compared with fiscal 2008. As

the allocation of new truck financing has shifted from primarily debt to largely operating leases, cash provided by

debt financing has declined compared with the same period last year. Net investment contract withdrawals from

annuity holders at Life Insurance decreased $11.6 million.

Liquidity and Capital Resources and Requirements of Our Operating Segments

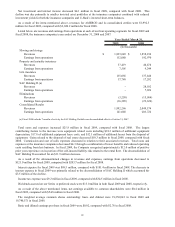

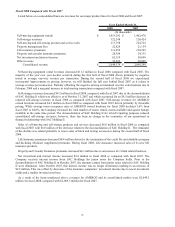

Moving and Storage

To meet the needs of our customers, U-Haul maintains a large fleet of rental equipment. Capital expenditures have

primarily reflected new rental equipment acquisitions and the buyouts of existing fleet from TRAC leases. The

capital to fund these expenditures has historically been obtained internally from operations and the sale of used

equipment, and externally from debt and lease financing. In the future, we anticipate that our internally generated

funds will be used to service the existing debt and support operations. U-Haul estimates that during fiscal 2010 the

Company will reinvest in its truck and trailer rental fleet approximately $125 million, net of equipment sales and

excluding any lease buyouts. For fiscal 2009, the Company invested, net of sales, approximately $400 million before

any lease-buyouts. Fleet investments in fiscal 2010 and beyond will be dependent upon several factors including

availability of capital, the truck rental environment and the used-truck sales market. We anticipate that the fiscal

2010 investment will be funded largely through external lease financing, debt financing and cash from operations.

Management considers several factors including cost and tax consequences when selecting a method to fund capital

expenditures. Our allocation between debt and lease financing can change from year to year based upon financial

market conditions which may alter the cost or availability of financing options.

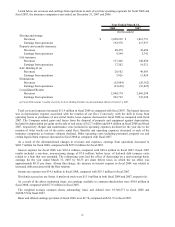

Real Estate has traditionally financed the acquisition of self-storage properties to support U-Haul's growth through

debt financing and funds from operations and sales. The Company’s plan for the expansion of owned storage

properties includes the acquisition of existing self-storage locations from third parties, the acquisition and

development of bare land, and the acquisition and redevelopment of existing buildings not currently used for self-

storage. The Company is funding these development projects through construction loans and internally generated

funds. For fiscal 2009, the Company invested nearly $82 million in real estate acquisitions, new construction and

renovation and repair. For fiscal 2010, the timing of new projects will be dependent upon several factors including

the entitlement process, availability of capital, weather, and the identification and successful acquisition of target

properties. U-Haul's growth plan in self-storage also includes eMove, which does not require significant capital.

33