TD Bank 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TD BANK GROUP ANNUAL REPORT 2014 CHAIRMAN OF THE BOARD’S MESSAGE 7

1

As at December 3, 2014

2

Designated Audit Committee Financial Expert

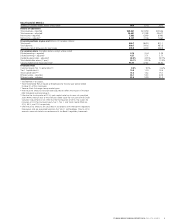

COMMITTEE

Corporate

Governance

Committee

Human Resources

Committee

Risk Committee

Audit Committee

MEMBERS1

Brian M. Levitt

(Chair)

William E. Bennett

Harold H. MacKay

Karen E. Maidment

Wilbur J. Prezzano

Wilbur J. Prezzano

(Chair)

Amy W. Brinkley

Mary Jo Haddad

Henry H. Ketcham

Brian M. Levitt

Nadir H. Mohamed

Helen K. Sinclair

Karen E. Maidment

(Chair)

William E. Bennett

Amy W. Brinkley

Colleen A. Goggins

David E. Kepler

Harold H. MacKay

Helen K. Sinclair

William E. Bennett2

(Chair)

John L. Bragg

Alan N. MacGibbon2

Karen E. Maidment2

Irene R. Miller2

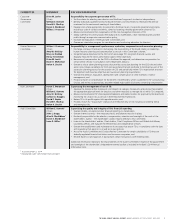

KEY RESPONSIBILITIES1

Responsibility for corporate governance of TD:

• Set the criteria for selecting new directors and the Board’s approach to director independence;

• Identify individuals qualified to become Board members and recommend to the Board the director

nominees for the next annual meeting of shareholders;

• Develop and, where appropriate, recommend to the Board a set of corporate governance principles,

including a code of conduct and ethics, aimed at fostering a healthy governance culture at TD;

• Review and recommend the compensation of the non-management directors of TD;

• Satisfy itself that TD communicates effectively with its shareholders, other interested parties and the

public through a responsive communication policy;

• Facilitate the evaluation of the Board and Committees; and

• Oversee an orientation program for new directors and continuing education for directors.

Responsibility for management’s performance evaluation, compensation and succession planning:

• Discharge, and assist the Board in discharging, the responsibility of the Board relating to leadership,

human resource planning and compensation as set out in this Committee’s charter;

• Set performance objectives for the CEO which encourage TD’s long-term financial success and

regularly measure the CEO’s performance against these objectives;

• Recommend compensation for the CEO to the Board for approval, and determine compensation for

certain senior officers in consultation with independent advisors;

• Oversee a robust talent planning process that provides succession planning for the CEO role and other

senior roles. Review candidates for CEO and recommend the best candidate to the Board as part of the

succession planning process for the position of CEO and periodically review TD’s organization structure

for alignment with business objectives and succession planning requirements;

• Oversee the selection, evaluation, development and compensation of other members of senior

management; and

• Produce a report on compensation for the benefit of shareholders, which is published in TD’s annual proxy

circular, and review, as appropriate, any other related major public disclosures concerning compensation.

Supervising the management of risk of TD:

• Approve the Enterprise Risk Framework and related risk category frameworks and policies that establish

the appropriate approval levels for decisions and other measures to manage risk to which TD is exposed;

• Review and recommend TD’s Risk Appetite Statement and related metrics for approval by the Board and

monitoring TD’s major risks as set out in the Enterprise Risk Framework;

• Review TD’s risk profile against risk appetite metrics; and

• Provide a forum for “big-picture” analysis of an enterprise view of risk including considering trends

and emerging risks.

Supervising the quality and integrity of TD’s financial reporting:

• Oversee reliable, accurate and clear financial reporting to shareholders;

• Oversee internal controls – the necessary checks and balances must be in place;

• Be directly responsible for the selection, compensation, retention and oversight of the work of the

shareholders’ auditor – the shareholders’ auditor reports directly to this Committee;

• Listen to the shareholders’ auditor, Chief Auditor, Chief Compliance Officer and Global Anti-Money

Laundering Officer, and evaluate the effectiveness and independence of each;

• Oversee the establishment and maintenance of processes that ensure TD is in compliance with the laws

and regulations that apply to it, as well as its own policies;

• Act as the Audit Committee and Conduct Review Committee for certain subsidiaries of TD that are

federally-regulated financial institutions and insurance companies; and

• Receive reports on and approve, if appropriate, certain transactions with related parties.

Additional information relating to the responsibilities of the Audit Committee in respect of the appointment

and oversight of the shareholder’s independent external auditor is included in the Bank’s 2014 Annual

Information Form.