TD Bank 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

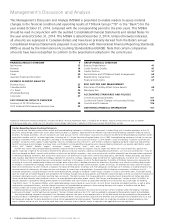

TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT’S DISCUSSION AND ANALYSIS 15

(millions of Canadian dollars, except as noted) 2014

2013

2012

Average Average Average Average Average Average

balance Interest3 rate balance Interest3 rate balance Interest3 rate

Interest-earning assets

Interest-bearing deposits with Banks

Canada $ 3,692 $ 17 0.46% $ 4,552 $ 23 0.51% $ 8,950 $ 41 0.46%

U.S. 27,179 30 0.11 17,748 32 0.18 13,580 42 0.31

Securities

Trading

Canada 55,383 1,367 2.47 54,390 1,398 2.57 48,342 1,332 2.76

U.S. 18,424 333 1.81 16,781 321 1.91 13,201 231 1.75

Non-trading

Canada 23,169 377 1.63 20,554 336 1.63 18,855 288 1.53

U.S. 76,245 1,370 1.80 66,675 1,384 2.08 66,089 1,671 2.53

Securities purchased under reverse

repurchase agreements

Canada 29,665 288 0.97 24,207 230 0.95 25,944 249 0.96

U.S. 35,232 62 0.18 31,422 94 0.30 27,025 90 0.33

Loans

Mortgages4

Canada 188,664 5,571 2.95 176,856 5,390 3.05 163,016 5,141 3.15

U.S. 45,787 1,713 3.74 41,744 1,710 4.10 36,910 1,671 4.53

Consumer instalment and other personal

Canada 90,512 4,499 4.97 91,729 4,718 5.14 93,622 5,270 5.63

U.S. 29,272 1,058 3.61 26,206 1,016 3.88 22,568 1,018 4.51

Credit card

Canada 17,984 2,245 12.48 14,582 1,828 12.54 14,128 1,699 12.03

U.S. 7,200 1,287 17.88 4,697 834 17.76 1,043 124 11.89

Business and government4

Canada 44,512 1,449 3.26 43,025 1,243 2.89 32,287 1,111 3.44

U.S. 41,233 1,495 3.63 33,452 1,340 4.01 29,451 1,362 4.62

International 68,898 767 1.11 62,180 718 1.15 59,101 898 1.52

Total interest-earning assets $ 803,051 $ 23,928 2.98% $ 730,800 $ 22,615 3.09% $ 674,112 $ 22,238 3.30%

Interest-bearing liabilities

Deposits

Personal

Canada $ 172,897 $ 1,394 0.81% $ 168,369 $ 1,660 0.99% $ 160,947 $ 1,819 1.13%

U.S. 147,025 197 0.13 130,378 211 0.16 119,605 264 0.22

Banks

Canada 5,898 18 0.31 6,134 11 0.18 4,984 28 0.56

U.S. 7,682 16 0.21 6,565 14 0.21 5,278 10 0.19

Business and government5,6

Canada 145,233 1,540 1.06 120,426 1,270 1.05 113,066 1,303 1.15

U.S. 125,375 1,065 0.85 111,787 1,248 1.12 88,962 1,226 1.38

Subordinated notes and debentures 7,964 412 5.17 8,523 447 5.24 11,509 612 5.32

Obligations related to securities sold

short and under repurchase agreements

Canada 43,334 535 1.23 40,874 472 1.15 37,875 432 1.14

U.S. 42,682 122 0.29 37,534 102 0.27 30,161 96 0.32

Securitization liabilities7 41,745 777 1.86 50,591 927 1.83 53,032 1,026 1.93

Other liabilities8,9

Canada 5,652 88 1.56 5,625 82 1.46 7,624 249 3.27

U.S. 29 1 3.45 72 3 4.17 152 3 1.97

International 32,077 179 0.56 19,766 94 0.48 17,964 144 0.80

Total interest-bearing liabilities $ 777,593 $ 6,344 0.82% $ 706,644 $ 6,541 0.93% $ 651,159 $ 7,212 1.11%

Total net interest income on

average earning assets $ 803,051 $ 17,584 2.19% $ 730,800 $ 16,074 2.20% $ 674,112 $ 15,026 2.23%

NET INTEREST INCOME ON AVERAGE EARNING BALANCES1,2

TABLE 7

1 Net interest income includes dividends on securities.

2 Geographic classification of assets and liabilities is based on the domicile of the

booking point of assets and liabilities.

3 Interest income includes loan fees earned by the Bank, which are recognized in net

interest income over the life of the loan through the effective interest rate method.

4 Includes trading loans that the Bank intends to sell immediately or in the near

term with a fair value of $37 million (2013 – $24 million, 2012 – $25 million) and

amortized cost of $36 million (2013 – $24 million, 2012 – $25 million), and loans

designated at fair value through profit or loss of $5 million (2013 – $9 million,

2012 – $13 million) and amortized cost of nil (2013 – nil, 2012 – nil).

5 Includes trading deposits with a fair value of $59 billion (2013 – $51 billion,

2012 – $39 billion).

6 Includes marketing fees incurred on the TD Ameritrade Insured Deposit Accounts

(IDA) of $895 million (2013 – $821 million, 2012 – $834 million).

7 Includes securitization liabilities designated at fair value through profit or loss

of $11 billion (2013 – $22 billion, 2012 – $25 billion) and related amortized cost

of $11 billion (2013 – $22 billion, 2012 – $25 billion). Also includes securitization

liabilities at amortized cost of $25 billion (2013 – $25 billion, 2012 – $25 billion).

8 Other liabilities includes asset-backed commercial paper and term notes with an

amortized cost of $5 billion (2013 – $5 billion, 2012 – $5 billion).

9 Certain comparative amounts have been reclassified to conform with the

presentation adopted in the current year.