TD Bank 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT’S DISCUSSION AND ANALYSIS 17

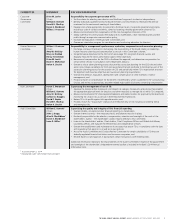

NON-INTEREST INCOME1

TABLE 9

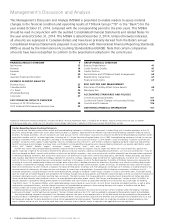

TRADING-RELATED INCOME

TABLE 10

(millions of Canadian dollars, except as noted) 2014 vs. 2013

2014 2013 2012 % change

Investment and securities services

TD Waterhouse fees and commissions $ 412 $ 406 $ 384 1%

Full-service brokerage and other securities services 684 596 562 15

Underwriting and advisory 482 365 437 32

Investment management fees 413 326 241 27

Mutual fund management 1,355 1,141 997 19

Total investment and securities services 3,346 2,834 2,621 18

Credit fees 845 785 745 8

Net securities gains (losses) 173 304 373 (43)

Trading income (losses) (349) (279) (41) (25)

Service charges 2,152 1,966 1,849 9

Card services 1,552 1,220 942 27

Insurance revenue 3,883 3,734 3,537 4

Trust fees 150 148 149 1

Other income (loss) 625 473 345 32

Total $ 12,377 $ 11,185 $ 10,520 11%

(millions of Canadian dollars) 2014 2013 2012

Net interest income $ 1,337 $ 1,231 $ 1,050

Trading income (loss) (349) (279) (41)

Financial instruments designated at fair value through profit or loss1 (9) (6) 10

Total trading-related income (loss) $ 979 $ 946 $ 1,019

By product

Interest rate and credit portfolios $ 601 $ 557 $ 534

Foreign exchange portfolios 385 368 374

Equity and other portfolios 2 27 101

Financial instruments designated at fair value through profit or loss1 (9) (6) 10

Total trading-related income (loss) $ 979 $ 946 $ 1,019

1 Excludes amounts related to securities designated at fair value through profit

or loss that are not managed within a trading portfolio, but which have been

combined with derivatives to form economic hedging relationships.

1 Certain comparative amounts have been reclassified to conform with the

presentation adopted in the current year.

NON-INTEREST INCOME

Non-interest income for the year on a reported basis was

$12,377 million, an increase of $1,192 million, or 11%, compared

with last year. Adjusted non-interest income for the year was

$12,097 million, an increase of $983 million, or 9%, compared

with last year. The increase in adjusted non-interest income was

primarily driven by increases in the Canadian Retail, U.S. Retail, and

Corporate segments. Canadian Retail non-interest income increased

primarily due to wealth asset growth, higher volume-related fee

growth, the inclusion of Aeroplan, and higher insurance revenue.

U.S. Retail non-interest income increased primarily due to the full year

inclusions of Target and Epoch, and the impact of foreign currency

translation, partially offset by lower gains on sales of securities and

debt securities classified as loans. Corporate segment non-interest

income increased primarily due to the gains on sales of TD Ameritrade

shares in the current year.

TRADING-RELATED INCOME

Trading-related income is the total of net interest income on trading

positions, trading income (loss), and income from financial instruments

designated at fair value through profit or loss that are managed within

a trading portfolio. Trading-related income increased by $33 million,

or 3%, compared with last year. The increase was primarily driven

by higher interest rate and credit trading on improved client activity

during the year.

The mix of trading-related income between net interest income

and trading income is largely dependent upon the level of interest

rates, which drives the funding costs of the Bank’s trading portfolios.

Generally, as interest rates rise, net interest income declines and trad-

ing income reported in non-interest income increases. Management

believes that the total trading-related income is the appropriate

measure of trading performance.