TD Bank 2014 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2014 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

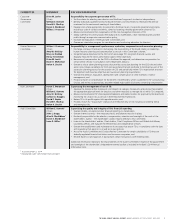

TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT’S DISCUSSION AND ANALYSIS16

(millions of Canadian dollars) 2014 vs. 2013

2013 vs. 2012

Favourable (unfavourable) due to change in

Favourable (unfavourable) due to change in

Average volume Average rate Net change Average volume Average rate Net change

Interest-earning assets

Interest-bearing deposits with banks

Canada $ (5) $ (1) $ (6) $ (20) $ 2 $ (18)

U.S. 17 (19) (2) 13 (23) (10)

Securities

Trading

Canada 26 (57) (31) 166 (100) 66

U.S. 32 (20) 12 62 28 90

Non-trading

Canada 43 (2) 41 26 22 48

U.S. 199 (213) (14) 14 (301) (287)

Securities purchased under reverse

repurchase agreements

Canada 52 6 58 (16) (3) (19)

U.S. 11 (43) (32) 14 (10) 4

Loans

Mortgages3

Canada 360 (179) 181 436 (187) 249

U.S. 165 (162) 3 219 (180) 39

Consumer instalment and other personal

Canada (62) (157) (219) (106) (446) (552)

U.S. 119 (77) 42 164 (166) (2)

Credit card

Canada 426 (9) 417 55 74 129

U.S. 444 9 453 435 275 710

Business and government3

Canada 43 163 206 370 (238) 132

U.S. 312 (157) 155 185 (207) (22)

International 95 (46) 49 65 (245) (180)

Total interest-earning assets $ 2,277 $ (964) $ 1,313 $ 2,082 $ (1,705) $ 377

Interest-bearing liabilities

Deposits

Personal

Canada $ (44) $ 310 $ 266 $ (85) $ 244 $ 159

U.S. (27) 41 14 (24) 77 53

Banks

Canada – (7) (7) (6) 23 17

U.S. (3) 1 (2) (2) (2) (4)

Business and government4,5

Canada (262) (8) (270) (85) 118 33

U.S. (152) 335 183 (315) 293 (22)

Subordinated notes and debentures 29 6 35 159 6 165

Obligations related to securities sold short and

under repurchase agreements

Canada (29) (34) (63) (34) (6) (40)

U.S. (14) (6) (20) (24) 18 (6)

Securitization liabilities6 159 (9) 150 32 67 99

Other liabilities7,8

Canada (1) (5) (6) 65 102 167

U.S. 2 – 2 2 (2) –

International (68) (17) (85) (23) 73 50

Total interest-bearing liabilities $ (410) $ 607 $ 197 $ (340) $ 1,011 $ 671

Total net interest income on average earning assets $ 1,867 $ (357) $ 1,510 $ 1,742 $ (694) $ 1,048

ANALYSIS OF CHANGE IN NET INTEREST INCOME1,2

TABLE 8

1 Geographic classification of assets and liabilities is based on the domicile of the

booking point of assets and liabilities.

2 Interest income includes loan fees earned by the Bank, which are recognized in net

interest income over the life of the loan through the effective interest rate method.

3 Includes trading loans that the Bank intends to sell immediately or in the near

term with a fair value of $37 million (2013 – $24 million, 2012 – $25 million) and

amortized cost of $36 million (2013 – $24 million, 2012 – $25 million), and loans

designated at fair value through profit or loss of $5 million (2013 – $9 million,

2012 – $13 million) and amortized cost of nil (2013 – nil, 2012 – nil).

4 Includes trading deposits with a fair value of $59 billion (2013 – $51 billion,

2012 – $39 billion).

5 Includes marketing fees incurred on the TD Ameritrade IDA of $895 million

(2013 – $821 million, 2012 – $834 million).

6 Includes securitization liabilities designated at fair value through profit or loss

of $11 billion (2013 – $22 billion, 2012 – $25 billion) and related amortized cost

of $11 billion (2013 – $22 billion, 2012 – $25 billion). Also includes securitization

liabilities at amortized cost of $25 billion (2013 – $25 billion, 2012 – $25 billion).

7 Other liabilities includes asset-backed commercial paper and term notes with an

amortized cost of $5 billion (2013 – $5 billion, 2012 – $5 billion).

8 Certain comparative amounts have been reclassified to conform with the

presentation adopted in the current year.

The following table presents an analysis of the change in net interest

income of volume and interest rate changes. In this analysis, changes

due to volume/interest rate variance have been allocated to average

interest rate.