TD Bank 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

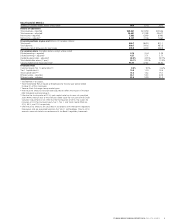

TD BANK GROUP ANNUAL REPORT 2014 YEAR AT A GLANCE2

1

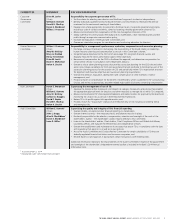

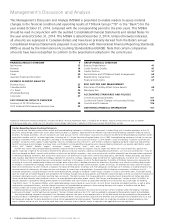

Effective November 1, 2011, The Toronto-Dominion Bank (the “Bank” or “TD”)

prepares its Consolidated Financial Statements in accordance with International

Financial Reporting Standards (IFRS), the current Generally Accepted Accounting

Principles (GAAP), and refers to results prepared in accordance with IFRS as the

”reported” results. The Bank also utilizes non-GAAP financial measures to arrive

at “adjusted” results to assess each of its businesses and to measure overall Bank

performance. To arrive at adjusted results, the Bank removes “items of note”,

net of income taxes, from reported results. See “How the Bank Reports” in the

accompanying 2014 Management’s Discussion and Analysis (MD&A) for further

explanation, a list of the items of note, and a reconciliation of non-GAAP financial

measures. The calculation of growth rates include balances in accordance with

Canadian Generally Accepted Accounting Principles for the 2010 financial year

and balances in accordance with IFRS for 2011 to 2014.

Certain comparative amounts have been restated as a result of the adoption

of new and amended standards under IFRS (New IFRS Standards and Amend-

ments) which required retrospective application and to retrospectively reflect the

impact of the January 31, 2014, stock dividend, as further discussed in Note 4 and

Note 21 of the 2014 Consolidated Financial Statements, respectively, and due to

reclassifications to conform with the presentation adopted in the current period.

In addition, the Bank’s comparative segment results have been restated to reflect

the segment realignment which occurred on November 1, 2013, which is further

discussed in Note 31 of the 2014 Consolidated Financial Statements.

“Five-year CAGR” is the compound annual growth rate calculated from 2009

to 2014 on an adjusted basis.

Canadian peers include Royal Bank of Canada, Scotiabank, Bank of Montreal,

and Canadian Imperial Bank of Commerce.

Total Shareholder Return based on Bloomberg for the five-year period ending

October 31, 2014.

“TD’s Premium Retail Earnings Mix” is based on adjusted results and excludes

Corporate segment.

2

Reference to retail earnings include the total adjusted earnings of the Canadian

Retail and U.S. Retail segments.

3

Total Shareholder Return based on Bloomberg for the one-year period ended

October 31, 2014.

4

Based on the Office of the Superintendent of Financial Institutions Canada (OSFI)

volumes as at September 30, 2014.

5

Client assets consists of TD Wealth $597 billion and TD Ameritrade $711 billion.

TD Ameritrade figures as of their year-end on September 30, 2014.

6

Based on SNL Financial rankings (as at October 31, 2014).

7

Canadian Market share of VISA and Mastercard outstanding balances based

on the Nilson report as at April 2014.

8

2014 Interbrand “Best Canadian Brands” ranking (September 2014).

TD Canada Trust received the highest numerical score among the big five

retail banks in the proprietary J.D. Power 2006-2014 Canadian Retail Banking

Customer Satisfaction StudiesSM. 2014 study based on 17,183 total responses and

measures opinions of consumers with their primary banking institution. Proprietary

study results are based on experiences and perceptions of consumers surveyed

May-June 2014. Your experiences may vary. Visit jdpower.com.

TD Canada Trust received the highest numerical score in the proprietary J.D.

Power 2014 Canadian Small Business Banking Satisfaction StudySM. Study based

on 1,348 total responses, measuring 5 financial institutions and measures opinions

of small business customers. Proprietary study results are based on experiences

and perceptions of customers surveyed in May-June 2014. Your experiences may

vary. Visit jdpower.com.

9

Comscore reporting current as of September 30, 2014, based on an audience of

approximately 24 million Canadian mobile subscribers above the age of 13.

Year at a Glance1

Record TD Adjusted Earnings

of $8.1 billion in 20142

TD announced record adjusted earnings for the

sixth consecutive year driven by record adjusted

earnings of $7.6 billion in our retail businesses

and a strong year in the Wholesale segment.

Strong TD Shareholder Returns3

TD shareholders benefited from a 20% Total

Shareholder Return (TSR) in fiscal 2014 and a

14% year-over-year increase in dividends paid.

TD Market Capitalization

reaches Milestone

TD’s market capitalization exceeded the

$100 billion milestone for the first time

in fiscal 2014.

TD Canada Trust remains

Canadians’ choice for Banking4

TD ranked #1 in market share for

Day to Day Banking.

Record Wealth Management

client assets5

As of October 31, 2014, clients of TD Wealth

and TD Ameritrade have entrusted us with

over $1.3 trillion in assets.

TD Bank, America’s Most

Convenient Bank® reaches Store

Network Milestone6

TD Bank, America’s Most Convenient Bank

is a top 10 U.S. bank (by stores), opening

15 new stores in Manhattan this year, and

now has 124 locations in New York City.

TD Securities showed strength in

its franchise origination business

Notable deals included: Nalcor Energy

Muskrat Falls Project – one of the largest bond

placements in Canadian history, at $5 billion;

PrairieSky Royalty’s $1.7 billion initial public

offering (IPO) – largest Canadian IPO in 14 years;

and World Bank – lead managed U.S. dollar

global transactions for the first time.

TD becomes Canada’s largest

Credit Card provider7

With the successful close of the Aeroplan

portfolio purchase, this year TD moved to the

#1 position in Canada from #6 in 5 years and

assumed the mass marketing rights to the

prestigious Aeroplan program.

TD continues to be a brand and

service leader in Canada8

TD named the Best Brand in Canada by

Interbrand. TD Canada Trust (TDCT) named

highest in Customer Satisfaction for the ninth

year in a row by J.D. Power in the Canadian

Retail Banking Study. TDCT also ranks highest

in the Canadian J.D. Power Small Business

Banking study for the first time and TD ranks

2nd in the J.D. Power Canadian Full Service

Investor study.

TD maintained mobile banking

leadership position in Canada9

TD ranked #1 for the number of mobile

subscribers accessing financial services via

their mobile devices.

TD issues Green Bond

In March 2014, TD became the first

commercial bank in Canada to issue a

green bond. The $500 million three-year

bond supports the low carbon economy

in three areas: renewable and low carbon

energy; energy efficiency and management,

with a focus on green buildings; and green

infrastructure and sustainable land use.

#TDTHANKSYOU Shows The

World That a Bank Can Care

TD turned ATMs into Automated Thanking

Machines to show its appreciation and create

very special experiences for customers. The

most powerful moments were captured on a

video that went on to garner worldwide media

attention and more than 18 million views.