TD Bank 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

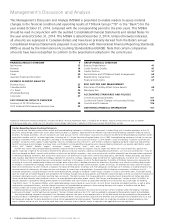

TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT’S DISCUSSION AND ANALYSIS 9

removes “items of note”, net of income taxes, from reported results.

The items of note relate to items which management does not believe

are indicative of underlying business performance. The Bank believes

that adjusted results provide the reader with a better understanding

of how management views the Bank’s performance. The items of note

are disclosed in Table 2. As explained, adjusted results are different

from reported results determined in accordance with IFRS. Adjusted

results, items of note, and related terms used in this document are not

defined terms under IFRS and, therefore, may not be comparable to

similar terms used by other issuers. The Bank implemented new and

amended standards under IFRS (New IFRS Standards and Amendments)

which required retrospective application, effective in fiscal 2014. As a

result, certain comparative amounts have been restated. For more

information refer to Note 4 of the 2014 Consolidated Financial

Statements.

The following table provides the operating results on a reported basis

for the Bank.

FINANCIAL RESULTS OVERVIEW

CORPORATE OVERVIEW

The Toronto-Dominion Bank and its subsidiaries are collectively known

as TD Bank Group. TD is the sixth largest bank in North America by

branches and serves more than 23 million customers in three key busi-

nesses operating in a number of locations in financial centres around

the globe: Canadian Retail, U.S. Retail and Wholesale Banking. TD also

ranks among the world’s leading online financial services firms, with

approximately 9.4 million active online and mobile customers. TD had

$945 billion in assets as at October 31, 2014. The Toronto-Dominion

Bank trades under the symbol “TD” on the Toronto and New York

Stock Exchanges.

HOW THE BANK REPORTS

The Bank prepares its Consolidated Financial Statements in accordance

with IFRS, the current generally accepted accounting principles (GAAP),

and refers to results prepared in accordance with IFRS as “reported”

results. The Bank also utilizes non-GAAP financial measures referred to

as “adjusted” results to assess each of its businesses and to measure

the overall Bank performance. To arrive at adjusted results, the Bank

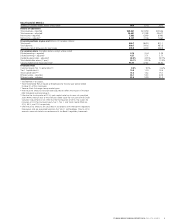

OPERATING RESULTS – Reported

TABLE 1

(millions of Canadian dollars) 2014 2013 2012

Net interest income $ 17,584 $ 16,074 $ 15,026

Non-interest income 12,377 11,185 10,520

Total revenue 29,961 27,259 25,546

Provision for credit losses 1,557 1,631 1,795

Insurance claims and related expenses 2,833 3,056 2,424

Non-interest expenses 16,496 15,069 14,016

Income before income taxes and equity in net income of an investment in associate 9,075 7,503 7,311

Provision for income taxes 1,512 1,135 1,085

Equity in net income of an investment in associate, net of income taxes 320 272 234

Net income – reported 7,883 6,640 6,460

Preferred dividends 143 185 196

Net income available to common shareholders and non-controlling interests in subsidiaries $ 7,740 $ 6,455 $ 6,264

Attributable to:

Non-controlling interests $ 107 $ 105 $ 104

Common shareholders 7,633 6,350 6,160