TD Bank 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

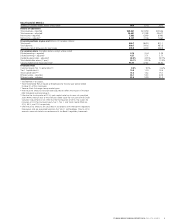

TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT’S DISCUSSION AND ANALYSIS10

NON-GAAP FINANCIAL MEASURES – Reconciliation of Adjusted to Reported Net Income

TABLE 2

(millions of Canadian dollars) 2014 2013 2012

Operating results – adjusted

Net interest income1 $ 17,584 $ 16,074 $ 15,062

Non-interest income2 12,097 11,114 10,615

Total revenue 29,681 27,188 25,677

Provision for credit losses3 1,582 1,606 1,903

Insurance claims and related expenses 2,833 3,056 2,424

Non-interest expenses4 15,863 14,390 13,180

Income before income taxes and equity in net income of an investment in associate 9,403 8,136 8,170

Provision for income taxes5 1,649 1,326 1,397

Equity in net income of an investment in associate, net of income taxes6 373 326 291

Net income – adjusted 8,127 7,136 7,064

Preferred dividends 143 185 196

Net income available to common shareholders and non-controlling interests in subsidiaries – adjusted 7,984 6,951 6,868

Attributable to:

Non-controlling interests in subsidiaries, net of income taxes 107 105 104

Net income available to common shareholders – adjusted 7,877 6,846 6,764

Adjustments for items of note, net of income taxes

Amortization of intangibles7 (246) (232) (238)

Integration charges and direct transaction costs relating to the acquisition of the credit card

portfolio of MBNA Canada8 (125) (92) (104)

Fair value of derivatives hedging the reclassified available-for-sale securities portfolio9 43 57 (89)

Set-up, conversion and other one-time costs related to affinity relationship with Aimia and acquisition

of Aeroplan Visa credit card accounts10 (131) (20) –

Impact of Alberta flood on the loan portfolio11 19 (19) –

Gain on sale of TD Waterhouse Institutional Services12 196 – –

Litigation and litigation-related charge/reserve13 – (100) (248)

Restructuring charges14 – (90) –

Impact of Superstorm Sandy15 – – (37)

Integration charges, direct transaction costs, and changes in fair value of contingent consideration

relating to the Chrysler Financial acquisition16 – – (17)

Reduction of allowance for incurred but not identified credit losses17 – – 120

Positive impact due to changes in statutory income tax rates18 – – 18

Fair value of credit default swaps hedging the corporate loan book, net of provision for credit losses19 – – –

Integration charges and direct transaction costs relating to U.S. Retail acquisitions20 – – (9)

Total adjustments for items of note (244) (496) (604)

Net income available to common shareholders – reported $ 7,633 $ 6,350 $ 6,160

1 Adjusted net interest income excludes the following item of note: 2012 –

$36 million ($27 million after tax) of certain charges against revenue related to

promotional-rate card origination activities, as explained in footnote 8.

2 Adjusted non-interest income excludes the following items of note: $49 million gain

due to change in fair value of derivatives hedging the reclassified available-for-sale

(AFS) securities portfolio, as explained in footnote 9; $231 million gain due to the

sale of TD Waterhouse Institutional Services, as explained in footnote 12; 2013 –

$71 million gain due to change in fair value of derivatives hedging the reclassified

AFS securities portfolio; 2012 – $2 million loss due to change in fair value of credit

default swaps (CDS) hedging the corporate loan book, as explained in footnote 19;

$89 million loss due to change in fair value of derivatives hedging the reclassified

AFS securities portfolio; $3 million loss due to change in fair value of contingent

consideration relating to Chrysler Financial, as explained in footnote 16, $1 million

loss due to the impact of Superstorm Sandy, as explained in footnote 15.

3 Adjusted provision for credit losses (PCL) excludes the following items of note:

$25 million release of the provision for the impact of the Alberta flood on the loan

portfolio, as explained in footnote 11; 2013 – $25 million due to the impact of the

Alberta flood on the loan portfolio; 2012 – $162 million in adjustments to allow-

ance for incurred but not identified credit losses in Canadian Retail, as explained

in footnote 17; $54 million due to the impact of Superstorm Sandy, as explained

in footnote 15.

4 Adjusted non-interest expenses exclude the following items of note: $286 million

amortization of intangibles, as explained in footnote 7; $169 million of integration

charges relating to the acquisition of the credit card portfolio of MBNA Canada, as

explained in footnote 8; $178 million of costs in relation to the affinity relationship

with Aimia and acquisition of Aeroplan credit card accounts, as explained in foot-

note 10; 2013 – $272 million amortization of intangibles; $125 million of integra-

tion charges and direct transaction costs relating to the acquisition of the MBNA

Canada credit card portfolio; $127 million of litigation and litigation-related

charges, as explained in footnote 13; $129 million due to the initiatives to reduce

costs, as explained in footnote 14; $27 million of set-up costs in preparation for

the affinity relationship with Aimia Inc. with respect to Aeroplan credit cards;

2012 – $277 million amortization of intangibles; $11 million of integration

charges related to U.S. Retail acquisitions, as explained in footnote 20; $24 million

of integration charges and direct transaction costs relating to the Chrysler Financial

acquisition, as explained in footnote 16; $104 million of integration charges and

direct transaction costs relating to the acquisition of the MBNA Canada credit card

portfolio; $413 million of litigation and litigation related charges; $7 million due

to the impact of Superstorm Sandy, as explained in footnote 15.

5 For a reconciliation between reported and adjusted provision for income taxes, see

the ‘Non-GAAP Financial Measures – Reconciliation of Reported to Adjusted Provi-

sion for Income Taxes’ table in the “Income Taxes” section of this document.

6 Adjusted equity in net income of an investment in associate excludes the following

items of note: $53 million amortization of intangibles, as explained in footnote 7;

2013 – $54 million amortization of intangibles; 2012 – $57 million amortization

of intangibles.

7 Amortization of intangibles relate primarily to the TD Banknorth acquisition in 2005

and its privatization in 2007, the acquisitions by TD Banknorth of Hudson United

Bancorp in 2006 and Interchange Financial Services in 2007, the Commerce acqui-

sition in 2008, the amortization of intangibles included in equity in net income of

TD Ameritrade, the acquisition of the credit card portfolio of MBNA Canada in

2012, the acquisition of Target Corporation’s U.S. credit card portfolio in 2013, the

Epoch Investment Partners, Inc. acquisition in 2013, and to the acquired Aeroplan

credit card portfolio in 2014. Amortization of software is recorded in amortization

of intangibles; however, amortization of software is not included for purposes of

items of note, which only includes amortization of intangibles acquired as a result

of asset acquisitions and business combinations.

8 As a result of the acquisition of the credit card portfolio of MBNA Canada, as well

as certain other assets and liabilities, the Bank incurred integration charges. Inte-

gration charges consist of costs related to information technology, employee reten-

tion, external professional consulting charges, marketing (including customer

communication and rebranding), integration related travel, employee severance

costs, consulting, and training. The Bank’s integration charges related to the MBNA

acquisition were higher than what were anticipated when the transaction was first

announced. The elevated spending was primarily due to additional costs incurred

(other than the amounts capitalized) to build out technology platforms for the busi-

ness. Integration charges related to this acquisition were incurred by the Canadian

Retail segment. The fourth quarter of 2014 is the last quarter Canadian Retail

included any further MBNA-related integration charges as an item of note.

9

During 2008, as a result of deterioration in markets and severe dislocation in the

credit market, the Bank changed its trading strategy with respect to certain trading

debt securities. Since the Bank no longer intended to actively trade in these debt

securities, the Bank reclassified these debt securities from trading to the AFS cate-

gory effective August 1, 2008. As part of the Bank’s trading strategy, these debt

securities are economically hedged, primarily with CDS and interest rate swap

contracts. This includes foreign exchange translation exposure related to the debt

securities portfolio and the derivatives hedging it. These derivatives are not eligible

for reclassification and are recorded on a fair value basis with changes in fair value

recorded in the period’s earnings. Management believes that this asymmetry in the

accounting treatment between derivatives and the reclassified debt securities results

in volatility in earnings from period to period that is not indicative of the economics

of the underlying business performance in Wholesale Banking. The Bank may from

time to time replace securities within the portfolio to best utilize the initial, matched

fixed term funding. As a result, the derivatives are accounted for on an accrual basis

in Wholesale Banking and the gains and losses related to the derivatives in excess of

the accrued amounts are reported in the Corporate segment. Adjusted results of the

Bank exclude the gains and losses of the derivatives in excess of the accrued amount.