TD Bank 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

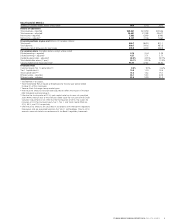

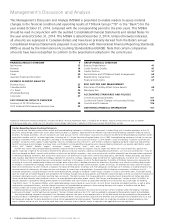

TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT’S DISCUSSION AND ANALYSIS12

RETURN ON COMMON EQUITY

TABLE 5

(millions of Canadian dollars, except as noted) 2014 2013 2012

Average common equity $ 49,495 $ 44,791 $ 41,102

Net income available to common shareholders – reported 7,633 6,350 6,160

Items of note impacting income, net of income taxes1 244 496 604

Net income available to common shareholders – adjusted 7,877 6,846 6,764

Return on common equity – adjusted 15.9% 15.3% 16.5%

1 For explanations of items of note, see the “Non-GAAP Financial Measures –

Reconciliation of Adjusted to Reported Net Income” table in the “Financial

Results Overview” section of this document.

RETURN ON COMMON EQUITY

The Bank’s methodology for allocating capital to its business segments

is aligned with the common equity capital requirements under Basel III.

Beginning November 1, 2013, capital allocated to the business segments

is based on 8% Common Equity Tier 1 (CET1) Capital which includes

an additional charge of 1% of risk-weighted assets (RWA) to account

for the Office of the Superintendent of Financial Institutions Canada

(OSFI) common equity capital surcharge for Domestic Systemically

Important Banks (D-SIBs), resulting in a CET1 Capital ratio minimum

requirement of 8% effective January 1, 2016. The return measures for

business segments reflect a return on common equity methodology.

Adjusted return on common equity (ROE) is adjusted net income

available to common shareholders as a percentage of average

common equity.

Adjusted ROE is a non-GAAP financial measure as it is not a defined

term under IFRS. Readers are cautioned that earnings and other

measures adjusted to a basis other than IFRS do not have standardized

meanings under IFRS and, therefore, may not be comparable to similar

terms used by other issuers.

SIGNIFICANT EVENTS IN 2014

Acquisition of certain CIBC Aeroplan Credit Card Accounts

On December 27, 2013, the Bank, Aimia Inc. (Aimia), and the Canadian

Imperial Bank of Commerce (CIBC) closed a transaction under which

the Bank acquired approximately 50% of CIBC’s existing Aeroplan

credit card portfolio, which primarily included accounts held by custom-

ers who did not have an existing retail banking relationship with CIBC.

The Bank accounted for the purchase as an asset acquisition. The results

of the acquisition have been recorded in the Canadian Retail segment.

The Bank acquired approximately 540,000 cardholder accounts with

an outstanding balance of $3.3 billion at a price of par plus $50 million

less certain adjustments for total cash consideration of $3.3 billion.

At the date of acquisition, the fair value of credit card receivables

acquired was $3.2 billion and the fair value of an intangible asset

for the purchased credit card relationships was $146 million.

In connection with the purchase agreement, the Bank agreed to pay

CIBC a further $127 million under a commercial subsidy agreement.

This payment was recognized as a non-interest expense in 2014.

Disposal of TD Waterhouse Institutional Services

On November 12, 2013, TD Waterhouse Canada Inc., a subsidiary of

the Bank, completed the sale of the Bank’s institutional services busi-

ness, known as TD Waterhouse Institutional Services, to a subsidiary

of National Bank of Canada. The transaction price was $250 million

in cash, subject to certain price adjustment mechanisms. A pre-tax

gain of $231 million was recorded in the Corporate segment in other

income in the first quarter of 2014. An additional pre-tax gain of

$13 million was recorded in the Corporate segment subsequently,

upon the settlement of price adjustment mechanisms.

AMORTIZATION OF INTANGIBLES, NET OF INCOME TAXES1

TABLE 4

(millions of Canadian dollars) 2014 2013 2012

TD Bank, N.A. $ 115 $ 117 $ 122

TD Ameritrade (included in equity in net income of an investment in associate) 53 54 57

MBNA Canada 37 36 33

Aeroplan 14 – –

Other 27 25 26

246 232 238

Software 236 176 141

Amortization of intangibles, net of income taxes $ 482 $ 408 $ 379

1 Amortization of intangibles, with the exception of software, are included as items

of note. For explanation of items of note, see the “Non-GAAP Financial Measures –

Reconciliation of Adjusted to Reported Net Income” table in the “Financial Results

Overview” section of this document.