TD Bank 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 Annual Report

Here

for you

Table of contents

-

Page 1

Here for you 2014 Annual Report -

Page 2

... CEO's Message Chairman of the Board's Message MANAGEMENT'S DISCUSSION AND ANALYSIS FINANCIAL RESULTS Consolidated Financial Statements Notes to Consolidated Financial Statements Principal Subsidiaries Ten-Year Statistical Review Glossary Shareholder and Investor Information 1 2 4 5 6 8 119 127 215... -

Page 3

....6% TD's 5-year CAGR (adjusted) 9.8% TD's 5-year CAGR (adjusted) 2.53% TD's 2014 return on Common Equity Tier 1 Capital risk-weighted assets (adjusted) $945 billion of total assets at October 31, 2014 DIVIDENDS PER SHARE (Canadian dollars) TOTAL SHAREHOLDER RETURN (5-year CAGR) TD'S PREMIUM... -

Page 4

...public offering (IPO) - largest Canadian IPO in 14 years; and World Bank - lead managed U.S. dollar global transactions for the first time. TD becomes Canada's largest Credit Card provider7 With the successful close of the Aeroplan portfolio purchase, this year TD moved to the #1 position in Canada... -

Page 5

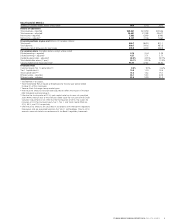

... of Canadian dollars) Total assets Total deposits Total loans net of allowance for loan losses Per common share (Canadian dollars, except where noted) Diluted earnings - reported Diluted earnings - adjusted 1 Dividend payout ratio - adjusted 1 Total shareholder return (1 year) 2 Closing market price... -

Page 6

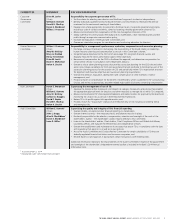

... these indicators. 2014 PERFORMANCE INDICATORS FINANCIAL • Deliver above-peer-average total shareholder return2 • Grow earnings per share (EPS) by 7 to 10% 3 • Deliver above-peer-average return on risk-weighted assets BUSINESS OPERATIONS • Grow revenue faster than expenses • Invest in core... -

Page 7

..., and our Canadian banking app was ranked first by subscribers accessing financial services on their mobile devices. BUILDING THE BETTER BANK TODAY AND TOMORROW In 2014, we continued to demonstrate that the fundamentals of our business model give TD a competitive advantage to: • Find ways to run... -

Page 8

... Communications Inc., Toronto, Ontario Wilbur J. Prezzano Corporate Director and Retired Vice Chairman, Eastman Kodak Company, Charleston, South Carolina Helen K. Sinclair Chief Executive Officer, BankWorks Trading Inc., Toronto, Ontario 6 TD BANK GROUP ANNUAL REPORT 2014 CHAIRMAN OF THE BOARD... -

Page 9

... business objectives and succession planning requirements; • Oversee the selection, evaluation, development and compensation of other members of senior management; and • Produce a report on compensation for the benefit of shareholders, which is published in TD's annual proxy circular, and review... -

Page 10

... Business Focus Canadian Retail U.S. Retail Wholesale Banking Corporate 2013 FINANCIAL RESULTS OVERVIEW Summary of 2013 Performance 2013 Financial Performance by Business Line 9 13 14 18 20 21 23 26 30 34 37 38 39 GROUP FINANCIAL CONDITION Balance Sheet Review Credit Portfolio Quality Capital... -

Page 11

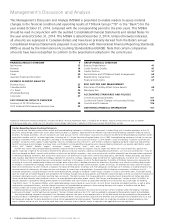

... world's leading online financial services firms, with approximately 9.4 million active online and mobile customers. TD had $945 billion in assets as at October 31, 2014. The Toronto-Dominion Bank trades under the symbol "TD" on the Toronto and New York Stock Exchanges. HOW THE BANK REPORTS The Bank... -

Page 12

... 2013 2012 (millions of Canadian dollars) Operating results - adjusted Net interest income1 Non-interest income2 Total revenue Provision for credit losses3 Insurance claims and related expenses Non-interest expenses4 Income before income taxes and equity in net income of an investment in associate... -

Page 13

...-average number of shares outstanding during the period. For explanation of items of note, see the "Non-GAAP Financial Measures - Reconciliation of Adjusted to Reported Net Income" table in the "Financial Results Overview" section of this document. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 14

..., may not be comparable to similar terms used by other issuers. TABLE 5 RETURN ON COMMON EQUITY 2014 2013 2012 (millions of Canadian dollars, except as noted) Average common equity Net income available to common shareholders - reported Items of note impacting income, net of income taxes1... -

Page 15

... last year, as shown in the following table. TABLE 6 IMPACT OF FOREIGN EXCHANGE RATE ON U.S. RETAIL TRANSLATED EARNINGS 2014 vs. 2013 2013 vs. 2012 (millions of Canadian dollars, except as noted) U.S. Retail (including TD Ameritrade) Increased total revenue - reported Increased total revenue... -

Page 16

...Wholesale Banking segments. U.S. Retail net interest income increased primarily due to strong loan and deposit volume growth, the full year inclusion of Target, and the impact of foreign currency translation. Canadian Retail net interest income increased primarily due to good loan and deposit volume... -

Page 17

... marketing fees incurred on the TD Ameritrade Insured Deposit Accounts (IDA) of $895 million (2013 - $821 million, 2012 - $834 million). Includes securitization liabilities designated at fair value through profit or loss of $11 billion (2013 - $22 billion, 2012 - $25 billion) and related amortized... -

Page 18

... includes asset-backed commercial paper and term notes with an amortized cost of $5 billion (2013 - $5 billion, 2012 - $5 billion). Certain comparative amounts have been reclassified to conform with the presentation adopted in the current year. 16 TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 19

...-RELATED INCOME 2014 2013 2012 (millions of Canadian dollars) Net interest income Trading income (loss) Financial instruments designated at fair value through profit or loss1 Total trading-related income (loss) By product Interest rate and credit portfolios Foreign exchange portfolios Equity... -

Page 20

... initiatives. NON-INTEREST EXPENSES (millions of Canadian dollars) EFFICIENCY RATIO (percent) $18,000 15,000 12,000 9,000 6,000 3,000 0 12 13 14 60% 50 40 30 20 10 0 12 13 14 Reported Adjusted Reported Adjusted 18 TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION AND ANALYSIS -

Page 21

... AND EFFICIENCY RATIO 1 (millions of Canadian dollars, except as noted) 2014 2013 2012 2014 vs. 2013 % change Salaries and employee benefits Salaries Incentive compensation Pension and other employee benefits Total salaries and employee benefits Occupancy Rent Depreciation Other Total occupancy... -

Page 22

... reports its investment in TD Ameritrade using the equity method of accounting. TD Ameritrade's tax expense of $198 million in the year, compared to $168 million last year, was not part of the Bank's tax rate. TA B L E 12 INCOME TAXES 2014 2013 2012 (millions of Canadian dollars, except as noted... -

Page 23

... increased over the past two years primarily due to higher base earnings in TD Ameritrade driven by higher client assets and trading volumes. The Bank's earnings also benefited from the impact of foreign currency translation over the past eight quarters. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 24

...% 2.17% 2.22% 2.22% 2.21% 2.15% For explanations of items of note, see the "Non-GAAP Financial Measures - Reconciliation of Adjusted to Reported Net Income" table in the "Financial Results Overview" section of this document. 22 TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION AND ANALYSIS -

Page 25

... and services to help business owners meet their financing, investment, cash management, international trade, and day-to-day banking needs. Auto Finance provides flexible financing options to customers at point-of-sale for automotive and recreational vehicle purchases through our auto dealer network... -

Page 26

... Financial Institutions (OSFI) prescribed scalar for inclusion of the Credit Valuation Adjustment (CVA). Effective the third quarter of 2014, the scalars for inclusion of CVA for CET1, Tier 1, and Total Capital RWA are 57%, 65%, and 77% respectively. 24 TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 27

...in the Canadian housing sector has also shown marked strength for the second consecutive calendar year quarter, both in terms of sales volumes and new construction activity. Interest-sensitive purchases have continued to benefit from low interest rates. That said, auto and home-related purchases are... -

Page 28

... banking Business banking Wealth Insurance Total 1 $ 9,600 2,284 3,226 4,051 $ 19,161 $ 8,808 2,232 2,917 3,825 $ 17,782 $ 8,482 2,170 2,668 3,673 $ 16,993 Certain comparative amounts have been restated to conform with current year presentation. 26 TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 29

... long-term fund sales and record assets under management. • TD has maintained its strong market share4 in key products: - TD is #1 in Canadian credit card market share. - Retained the #1 position in personal deposit market share and the #2 position in personal loan market share. - Business banking... -

Page 30

... the adjusted annualized return on common equity was 43.7%, compared with 42.3% and 43.3%, respectively, last year. Canadian Retail revenue is derived from the Canadian personal and commercial banking businesses, including credit cards, auto finance, wealth and insurance businesses. Revenue for the... -

Page 31

... of mutual funds and professionally managed portfolios. TDAM's institutional investment business has a leading market share in Canada and includes clients of some of the largest pension funds, endowments, and corporations in Canada. All asset management units work in close partnership with other TD... -

Page 32

..., TD Bank, America's Most Convenient Bank, U.S. Retail offers a full range of financial products and services to more than 8 million customers in the Bank's U.S. personal and commercial banking businesses, including U.S. credit cards and auto finance, as well as its wealth business. $2,110 Reported... -

Page 33

... pricing, optimizing fee-based businesses, disciplined risk management, and effective expense control. In the U.S., the wealth management industry is large and consists of banks, insurance companies, independent mutual fund companies, discount brokers, full service brokers, and independent asset... -

Page 34

... business and amounts due to Target Corporation under the credit card program agreement. Includes all Federal Deposit Insurance Corporation (FDIC) covered loans and other acquired credit-impaired loans. Results exclude the impact related to the equity in net income of the investment in TD Ameritrade... -

Page 35

... the customer experience, employee satisfaction, and shareholder value. TD AMERITRADE HOLDING CORPORATION Refer to Note 12 of the Consolidated Financial Statements for further information on TD Ameritrade. governments across a wide range of industries. In 2014, the business saw improved asset... -

Page 36

... name TD Securities, Wholesale Banking provides a wide range of capital markets, investment banking, and corporate banking products and services to corporate, government, and institutional clients in key global financial centres. $813 NET INCOME (millions of Canadian dollars) $2,680 TOTAL REVENUE... -

Page 37

... Total revenue Provision for (recovery of) credit losses Non-interest expenses Net income Selected volumes and ratios Trading-related revenue Common Equity Tier 1 Capital risk-weighted assets (billions of dollars)1,2 Return on common equity Efficiency ratio Average number of full-time equivalent... -

Page 38

... capital markets activity and strong advisory and underwriting fees. Corporate Banking • Corporate banking - includes corporate lending, trade finance and cash management services. Revenue increased over last year driven by higher fee revenue and solid loan volumes. Equity Investments • Equity... -

Page 39

... customers, shareholders, employees, governments, regulators, and the community at large. BUSINESS OUTLOOK AND FOCUS FOR 2015 We expect Corporate segment losses to increase next year as compared to 2014 due to higher expenses and a reduced level of favourable tax items. TD BANK GROUP ANNUAL REPORT... -

Page 40

... Summary of 2013 Performance TA B L E 23 REVIEW OF 2013 FINANCIAL PERFORMANCE Canadian Retail U.S. Retail Wholesale Banking Corporate Total (millions of Canadian dollars) Net interest income (loss) Non-interest income (loss) Total revenue Provision for (recovery of) credit losses Insurance... -

Page 41

... due to loan and deposit volume growth, higher wealth assets, lower credit losses, and effective expense management, partially offset by lower earnings in the insurance business. The reported annualized return on common equity for the year was 42.3%, while the adjusted annualized return on common... -

Page 42

... in average business loans. In the current year, US$6 billion in credit cards outstanding were added due to Target. Average deposits increased US$17 billion, or 10%, compared with prior year, including a US$9 billion increase in average deposits of TD Ameritrade. Margin on average earning assets for... -

Page 43

... as a result of foreign currency translation, partially offset by redemption of preferred shares. TA B L E 24 SELECTED CONSOLIDATED BALANCE SHEET ITEMS As at October 31 October 31 2014 2013 (millions of Canadian dollars) Assets Interest-bearing deposits with banks Available-for-sale securities... -

Page 44

...consumer indirect auto, business and government loans. Exposures to debt securities classified as loans, acquired credit-impaired loans, and other geographic regions were limited. The largest U.S. exposures by state were in New England and New Jersey which represented 7% and 5% of total loans net of... -

Page 45

... over previous year - loans and acceptances, net of allowance 1 2 9.0% 9.0 8.5% 8.5 8.1% 8.1 Primarily based on the geographic location of the customer's address. Includes all FDIC covered loans and other acquired credit-impaired loans. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION... -

Page 46

... 2013 Percentage of total October 31 2014 October 31 2013 October 31 2012 October 31 2012 Gross loans Net loans Net loans Net loans Canada Atlantic provinces British Columbia2 Ontario2 Prairies2 Quebec Total Canada United States Carolinas (North and South) Florida New England3 New Jersey New... -

Page 47

...Excludes loans classified as trading as the Bank intends to sell the loans immediately or in the near term, and loans designated at fair value through profit or loss for which no allowance is recorded. Percentage based on outstanding balance. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION... -

Page 48

... loans classified as trading as the Bank intends to sell the loans immediately or in the near term, and loans designated at fair value through profit or loss for which no allowance is recorded. Based on house price at origination. 5 Home equity lines of credit loan-to-value includes first position... -

Page 49

...billion), and loans designated at fair value through profit or loss of $5 million as at October 31, 2014 (October 31, 2013 - $9 million). No allowance is recorded for trading loans or loans designated at fair value through profit or loss. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION AND... -

Page 50

... Statements. Excludes debt securities classified as loans. For additional information refer to the "Exposure to Non-Agency Collateralized Mortgage Obligations" section of this document and Note 8 to the 2014 Consolidated Financial Statements. 48 TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 51

... 2014 October 31 2013 October 31 2012 October 31 2012 Gross impaired loans Net impaired loans Net impaired loans Net impaired loans Canada Atlantic provinces British Columbia4 Ontario4 Prairies4 Quebec Total Canada5 United States Carolinas (North and South) Florida New England6 New Jersey New... -

Page 52

... total counterpartyspecific and individually insignificant provisions, up from 8% and 5% respectively in 2013. The following table provides a summary of provisions charged to the Consolidated Statement of Income. TA B L E 34 PROVISION FOR CREDIT LOSSES 2014 2013 2012 (millions of Canadian dollars... -

Page 53

... of $5 million as at October 31, 2014 (October 31, 2013 - $9 million). No allowance is recorded for trading loans or loans designated at fair value through profit or loss. Includes all FDIC covered loans and other ACI loans. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION AND ANALYSIS 51 -

Page 54

... 31 2014 For the years ended October 31 2013 October 31 2012 October 31 2014 Percentage of total October 31 2013 October 31 2012 Canada Atlantic provinces British Columbia2 Ontario2 Prairies2 Quebec Total Canada3 United States Carolinas (North and South) Florida New England4 New Jersey New York... -

Page 55

... there is an International Swaps and Derivatives Association (ISDA) master netting agreement. Trading Portfolio exposures are net of eligible short positions. Deposits of $1.3 billion (October 31, 2013 - $2 billion) are included in the Trading and Investment Portfolio. 5 6 The fair values of the... -

Page 56

... that are margined daily, and $11 million (October 31, 2013 - $7 million) invested in European diversified investment funds. As part of the Bank's usual credit risk and exposure monitoring processes, all exposures are reviewed on a regular basis. European exposures are reviewed monthly or more... -

Page 57

...Other includes the ACI loan portfolios of Chrysler Financial and the credit card portfolios of MBNA Canada, Target, and Aeroplan. During the year ended October 31, 2014, the Bank recorded a recovery of $2 million in provision for credit losses on ACI loans (2013 - provision for credit losses of $49... -

Page 58

..., new credit ratings were obtained for the re-securitized securities that better reflect the discount on acquisition and the Bank's risk inherent on the entire portfolio. As a result, 13% of the nonagency CMO portfolio is rated AAA for regulatory capital reporting (October 31, 2013 - 13... -

Page 59

...on fair valued liabilities Defined benefit pension fund net assets (net of related tax liability) Investment in own shares Significant investments in the common stock of banking, financial, and insurance entities that are outside the scope of regulatory consolidation, net of eligible short positions... -

Page 60

... loss as calculated within the IRB approach is less than the total allowance for credit losses, the difference is added to Tier 2 Capital. OSFI's target Tier 1 and Total Capital ratios for Canadian banks are 7% and 10%, respectively. 58 TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION AND... -

Page 61

... III rules apply to Canadian banks. Effective January 1, 2014, the CVA capital charge is phased in over a five year period, given the delays in the implementation of Basel III standards in the U.S. and European Union countries. The bilateral overthe-counter (OTC) derivative market is a global market... -

Page 62

... the common share issuance of $538 million under the dividend reinvestment plan and from stock option exercises. The growth in CET1 Capital is partially offset by share repurchases and the impact of acquisitions during the year. 60 TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION AND... -

Page 63

... with transition to Basel III and organic growth in the retail and commercial businesses in both Canada and the U.S. The new rules required a capital charge add-on for derivatives credit valuation adjustment effective January 1, 2014. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION... -

Page 64

...%). Non-counterparty credit risk includes loans and advances to retail customers (individuals and small business), corporate entities (wholesale and commercial customers), banks and governments, as well as holdings of debt, equity securities, and other assets (including prepaid expenses, current and... -

Page 65

... Management • Insurance Personal Deposits Consumer Lending Credit Cards Services Auto Finance Commercial Banking Small Business Banking Advice-based Wealth Business • Asset Management • TD Ameritrade • Investment Banking and Capital Markets • Corporate Banking • Equity Investments... -

Page 66

...the U.S. general risk-based capital rules (namely "Basel I"), until January 1, 2015, when the Bank's U.S. holding company and major U.S. retail bank subsidiaries will report both available regulatory capital and RWA on a U.S. Basel III basis. In February 2014, the U.S. Federal Reserve Board released... -

Page 67

... instalment and other personal loans was government insured (October 31, 2013 - $1 billion). Credit Card Loans The Bank securitizes credit card loans through a consolidated SPE as it serves as a financing vehicle for the Bank's assets; the Bank has power over the key economic decisions of the... -

Page 68

... enhancements, written options, and indemnification agreements. Certain guarantees remain offbalance sheet. See Note 29 to the Consolidated Financial Statements for further information regarding the accounting for guarantees. 66 TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION AND ANALYSIS -

Page 69

... 31 October 31 2014 2013 (millions of Canadian dollars) Personal loans, including mortgages Business loans Total 4 262 $ 266 $ 3 181 $ 184 $ In addition, the Bank offers deferred share and other plans to nonemployee directors, executives, and certain other key employees. See Note 25 to the... -

Page 70

... regions. These conditions include short-term and long-term interest rates, inflation, fluctuations in the debt and capital markets, real estate prices, employment levels, consumer spending and debt levels, business investment, government spending, exchange rates, sovereign debt risks, the strength... -

Page 71

... supplier risk management, and policies and procedures governing third party relationships from the point of selection through the life cycle of both the relationship and the good or service. The Bank develops and tests robust business continuity management plans which contemplate customer, employee... -

Page 72

... reviewing and amending customer acquisition and management strategies as appropriate. The Bank has been investing in enhanced capabilities for our customers to transact across all of our channels seamlessly, with a particular emphasis on mobile technologies. 70 TD BANK GROUP ANNUAL REPORT 2014... -

Page 73

...the Bank's businesses and operations could be exposed. The Risk Inventory facilitates consistent risk identification and is the starting point in developing risk management strategies and processes. TD's major risk categories are: Strategic Risk, Credit Risk, Market Risk, Operational Risk, Insurance... -

Page 74

... of the key roles and responsibilities involved in risk management. The Bank's risk governance structure is illustrated in the following figure. RISK GOVERNANCE STRUCTURE Board of Directors Audit Committee Risk Committee Chief Executive Officer Senior Executive Team CRO Executive Committees... -

Page 75

..., Insurance, Credit Cards, and Enterprise Strategy, ALCO oversees directly and through its standing subcommittees (the Risk Capital Committee, Global Liquidity Forum and Enterprise Investment Committee) the management of TD's non-trading market risk and each of its consolidated liquidity, funding... -

Page 76

... manages, directs, and reports on the Bank's capital and investment positions, interest rate risk, liquidity and funding risk, and the market risks of TD's non-trading banking activities. The Risk Management function oversees TBSM's capital and investment activities. Three Lines of Defense In order... -

Page 77

... planning strategies. The scenario contemplates significantly stressful events that would result in TD reaching the point of non-viability in order to consider meaningful remedial actions for replenishing the Bank's capital and liquidity position. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 78

... process, management meetings, operating/financial reviews, and strategic business reviews. The Bank's annual planning process considers individual segment long-term and short-term strategies and associated key initiatives while also establishing enterprise asset concentration limits. The process... -

Page 79

... services, loans, dividends, and trade-related finance, as well as repatriation of the Bank's capital in that country. The Bank currently has credit exposure in a number of countries, with the majority of the exposure in North America. The Bank measures country risk using approved risk rating models... -

Page 80

... management, and are used to set exposure limits and loan pricing. Internal risk ratings are also used in the calculation of regulatory capital, economic capital, and incurred but not identified allowance for credit losses. Consistent with the AIRB approach to measure capital adequacy at a one-year... -

Page 81

... limits. As part of the credit risk monitoring process, management meets on a periodic basis to review all exposures, including exposures resulting from derivative financial instruments to higher risk counterparties. As at October 31, 2014, after taking into account risk mitigation strategies, TD... -

Page 82

... TD uses corresponds to the long-term ratings scales used by the rating agencies. The Bank's IAA process is subject to all of the key elements and principles of the Bank's risk governance structure, and is managed in the same way as outlined in this Credit Risk section. The Bank uses the results... -

Page 83

... Market Risk Non-Trading Market Risk - primary risk sensitivity (millions of Canadian dollars) Assets subject to market risk Interest-bearing deposits with banks Trading loans, securities, and other Derivatives Financial assets designated at fair value through profit or loss Available-for-sale... -

Page 84

... of time. At the end of each day, risk positions are compared with risk limits, and any excesses are reported in accordance with established market risk policies and procedures. Calculating VaR TD computes total VaR on a daily basis by combining the General Market Risk (GMR) and Idiosyncratic Debt... -

Page 85

... MARKET RISK MEASURES 2014 As at Average High Low As at Average High 2013 Low (millions of Canadian dollars) Interest rate risk Credit spread risk Equity risk Foreign exchange risk Commodity risk Idiosyncratic debt specific risk Diversification effect1 Total Value-at-Risk Stressed Value-at-Risk... -

Page 86

..., governance, and control over these market risks. The Risk Committee of the Board periodically reviews and approves key asset/liability management and non-trading market risk policies and receives reports on compliance with approved risk limits. HOW TD MANAGES ITS ASSET AND LIABILITY POSITIONS Non... -

Page 87

... investments, funding instruments, other capital market alternatives, and, less frequently, product pricing strategies to manage interest rate risk. As at October 31, 2014, an immediate and sustained 100 bps increase in interest rates would have decreased the economic value of shareholders' equity... -

Page 88

... value, successfully execute the Bank's business strategies, operate efficiently, and provide reliable, secure and convenient access to financial services. The Bank maintains a formal enterprise-wide operational risk management framework that emphasizes a strong risk management and internal control... -

Page 89

... the Bank's employees, customers, assets, and information, and in preventing and detecting errors and fraud. Annually, management undertakes comprehensive assessments of key risk exposures and the internal controls in place to reduce or offset these risks. Senior management reviews the results of... -

Page 90

... business assumed is managed through a policy that limits exposure to certain types of business and countries. The vast majority of reinsurance treaties are annually renewable, which minimizes long term risk. Pandemic exposure is reviewed and estimated annually. 88 TD BANK GROUP ANNUAL REPORT 2014... -

Page 91

... rates for all derivative contracts; and • coverage of maturities related to Bank-sponsored funding programs, such as the bankers' acceptances the Bank issues on behalf of clients and short-term revolving asset-backed commercial paper (ABCP) channels. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 92

...cover insurance liabilities and are not considered available to meet the Bank's general liquidity requirements. TA B L E 58 SUMMARY OF LIQUID ASSETS BY TYPE AND CURRENCY 1,2 (billions of Canadian dollars, except as noted) Securities received as collateral from securities financing and derivative... -

Page 93

... 60 SUMMARY OF AVERAGE LIQUID ASSETS BY TYPE AND CURRENCY 1 (billions of Canadian dollars, except as noted) Securities received as collateral from securities financing and derivative transactions2 Average for the year ended Bank-owned liquid assets Total liquid assets Encumbered liquid assets... -

Page 94

... table. TA B L E 61 SUMMARY OF AVERAGE UNENCUMBERED LIQUID ASSETS BY BANK, SUBSIDIARIES, AND BRANCHES 1 (billions of Canadian dollars) Average for the year ended October 31 2014 October 31 2013 The Toronto-Dominion Bank (Parent) Bank subsidiaries Foreign branches Total 1 71.1 149.5 34.9 $ 255... -

Page 95

...day-to-day operations including securities related to repurchase agreements, securities lending, clearing and payment systems, and assets pledged for derivative transactions. Also includes assets that have been pledged supporting Federal Home Loan Bank (FHLB) activity. Assets supporting TD's funding... -

Page 96

...issued by consolidated Bank-owned structured entities. 4 Subordinated notes and debentures are not considered wholesale funding as they may be raised primarily for capital management purposes. Includes fixed-term deposits from non-bank institutions. 94 TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 97

...closely as possible to the expected maturity profile of its balance sheet. The Bank also raises shorter-term unsecured wholesale deposits to fund trading assets based on its internal estimates of liquidity of these assets under stressed market conditions. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 98

...months to 1 year Over 1 to 2 years Over 2 to 5 years Over No Specific 5 years Maturity Total (millions of Canadian dollars) Assets Cash and due from banks Interest-bearing deposits with banks Trading loans, securities, and other1 Derivatives Financial assets designated at fair value through profit... -

Page 99

... Other assets Total assets Liabilities Trading deposits Derivatives Securitization liabilities at fair value Other financial liabilities designated at fair value through profit or loss Deposits4,5 Personal Banks Business and government Total deposits Acceptances Obligations related to securities... -

Page 100

..., associated with management's target debt rating. In addition, the Bank has a Capital Contingency Plan that is designed to prepare management to ensure capital adequacy through periods of Bank specific or systemic market stress. The Capital Contingency Plan determines the governance and procedures... -

Page 101

... TD invests; (3) identification and management of emerging environmental regulatory issues; and (4) failure to understand and appropriately leverage environment-related trends to meet customer and consumer demands for products and services. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION... -

Page 102

... metrics, targets, and performance are publicly reported within its annual Corporate Responsibility Report. Performance is reported according to the Global Reporting Initiative (GRI) and is independently assured. TD applies its Environmental and Social Credit Risk Management Procedures to credit and... -

Page 103

..., foreign exchange rates, and option volatilities. Valuation techniques include comparisons with similar instruments where observable market prices exist, discounted cash flow analysis, option pricing models, and other valuation techniques commonly used by market participants. TD BANK GROUP ANNUAL... -

Page 104

.... EMPLOYEE BENEFITS The projected benefit obligation and expense related to the Bank's pension and non-pension post-retirement benefit plans are determined using multiple assumptions that may significantly influence the value of these amounts. Actuarial assumptions including discount rates... -

Page 105

... variable returns, unless an analysis of the factors above indicates otherwise. The decisions above are made with reference to the specific facts and circumstances relevant for the structured entity and related transaction(s) under consideration. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 106

... fair value using the assumptions that market participants would use when pricing the asset or liability under current market conditions. IFRS 13 is effective for annual periods beginning on or after January 1, 2013, which was November 1, 2013 for the Bank, and is applied prospectively. This new... -

Page 107

... with customers. The standard is effective for annual periods beginning on or after January 1, 2017, which will be November 1, 2017, for the Bank, and is to be applied retrospectively. The Bank is currently assessing the impact of adopting this standard. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 108

... public accounting firm that has also audited the Consolidated Financial Statements of the Bank as of and for the year ended October 31, 2014. Their Report on Internal Controls under Standards of the Public Company Accounting Oversight Board (United States), included in the Consolidated Financial... -

Page 109

... dividend rate and is adjusted for the amortization of premiums and discounts; the effect of related hedging activities is excluded. Represents contractual maturities. Actual maturities may differ due to prepayment privileges in the applicable contract. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 110

... stated dividend rate and is adjusted for the amortization of premiums and discounts; the effect of related hedging activities is excluded. Represents contractual maturities. Actual maturities may differ due to prepayment privileges in the applicable contract. 108 TD BANK GROUP ANNUAL REPORT 2014... -

Page 111

... dividend rate and is adjusted for the amortization of premiums and discounts; the effect of related hedging activities is excluded. Represents contractual maturities. Actual maturities may differ due to prepayment privileges in the applicable contract. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 112

... stated dividend rate and is adjusted for the amortization of premiums and discounts; the effect of related hedging activities is excluded. Represents contractual maturities. Actual maturities may differ due to prepayment privileges in the applicable contract. 110 TD BANK GROUP ANNUAL REPORT 2014... -

Page 113

... dividend rate and is adjusted for the amortization of premiums and discounts; the effect of related hedging activities is excluded. Represents contractual maturities. Actual maturities may differ due to prepayment privileges in the applicable contract. TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT... -

Page 114

... stated dividend rate and is adjusted for the amortization of premiums and discounts; the effect of related hedging activities is excluded. Represents contractual maturities. Actual maturities may differ due to prepayment privileges in the applicable contract. 112 TD BANK GROUP ANNUAL REPORT 2014... -

Page 115

..., 2014 (millions of Canadian dollars) Canada Residential mortgages Consumer instalment and other personal HELOC Indirect Auto Other Credit card Total personal Real estate Residential Non-residential Total real estate Total business and government (including real estate) Total loans - Canada United... -

Page 116

..., 2013 (millions of Canadian dollars) Canada Residential mortgages Consumer instalment and other personal HELOC Indirect Auto Other Credit card Total personal Real estate Residential Non-residential Total real estate Total business and government (including real estate) Total loans - Canada United... -

Page 117

..., 2012 (millions of Canadian dollars) Canada Residential mortgages Consumer instalment and other personal HELOC Indirect Auto Other Credit card Total personal Real estate Residential Non-residential Total real estate Total business and government (including real estate) Total loans - Canada United... -

Page 118

... other ACI loans. Other adjustments are required as a result of the accounting for FDIC covered loans. For additional information, see "FDIC Covered Loans" section in Note 8 of the Bank's Consolidated Financial Statements. 116 TD BANK GROUP ANNUAL REPORT 2014 MANAGEMENT'S DISCUSSION AND ANALYSIS -

Page 119

...) 2014 2013 2012 (millions of Canadian dollars, except as noted) United States Residential mortgages Consumer instalment and other personal HELOC Indirect Auto Other Credit card Total personal Real estate Residential Non-residential Total real estate Total business and government (including... -

Page 120

...October 31 2013 October 31 2012 (millions of Canadian dollars, except as noted) 2014 Obligations related to securities sold under repurchase agreements Balance at year-end Average balance during the year Maximum month-end balance Weighted-average rate at October 31 Weighted-average rate during the... -

Page 121

... Standards Board, as well as the requirements of the Bank Act (Canada) and related regulations have been applied and management has exercised its judgment and made best estimates where appropriate. The Bank's accounting system and related internal controls are designed, and supporting procedures... -

Page 122

... and our report dated December 3, 2014, expressed an unqualified opinion on The Toronto-Dominion Bank's internal control over financial reporting. Ernst & Young LLP Chartered Professional Accountants Licensed Public Accountants Toronto, Canada December 3, 2014 120 TD BANK GROUP ANNUAL REPORT 2014... -

Page 123

... AUDITORS' REPORT OF REGISTERED PUBLIC ACCOUNTING FIRM TO SHAREHOLDERS Report on Internal Control under Standards of the Public Company Accounting Oversight Board (United States) We have audited The Toronto-Dominion Bank's internal control over financial reporting as of October 31, 2014, based... -

Page 124

... (millions of Canadian dollars, except as noted) October 31 2014 As at October 31 2013 ASSETS Cash and due from banks Interest-bearing deposits with banks Trading loans, securities, and other (Notes 5, 7) Derivatives (Notes 5, 11) Financial assets designated at fair value through profit or loss... -

Page 125

...of Canadian dollars, except as noted) 2014 2013 2012 Interest income Loans Securities Interest Dividends Deposits with banks Interest expense Deposits Securitization liabilities Subordinated notes and debentures Other Net interest income Non-interest income Investment and securities services Credit... -

Page 126

... - income tax recovery of $289 million). Certain comparative amounts have been restated to conform with the presentation adopted in the current period. The accompanying Notes are an integral part of these Consolidated Financial Statements. 124 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 127

Consolidated Statement of Changes in Equity For the years ended October 31 (millions of Canadian dollars) 2014 2013 2012 Common shares (Note 21) Balance at beginning of year Proceeds from shares issued on exercise of stock options Shares issued as a result of dividend reinvestment plan Purchase of ... -

Page 128

... assets Changes in securities purchased (sold) under reverse repurchase agreements Net cash acquired from (paid for) divestitures, acquisitions, and the sale of TD Ameritrade shares (Notes 12, 13) Net cash from (used in) investing activities Effect of exchange rate changes on cash and due from banks... -

Page 129

..., Guarantees, Pledged Assets, and Collateral 199 Related Party Transactions 203 Segmented Information 204 Interest Rate Risk 206 Credit Risk 208 Regulatory Capital 212 Risk Management 213 Information on Subsidiaries 213 Subsequent Event 214 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS 127 -

Page 130

...in Canada with its registered and principal business offices located at 66 Wellington Street West, Toronto, Ontario. TD serves customers in three business segments operating in a number of locations in key financial centres around the globe: Canadian Retail, U.S. Retail, and Wholesale Banking. BASIS... -

Page 131

... designation is available only for those financial instruments for which a reliable estimate of fair value can be obtained. Once financial assets and liabilities are designated at fair value through profit or loss, the designation is irrevocable. TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS... -

Page 132

... and adjusted based on any changes in management's estimate of the future cash flows estimated to be recovered. Credit losses on impaired loans continue to be recognized by means of an allowance for credit losses until a loan is written off. 130 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 133

... is the present value of the estimated future cash flows, discounted using the loan's original EIR. Collectively Assessed Allowance for Individually Insignificant Impaired Loans Individually insignificant impaired loans, such as the Bank's personal and small business loans and credit cards, are... -

Page 134

...commodity prices, equities, or other financial or non-financial measures. Such instruments include interest rate, foreign exchange, equity, commodity, and credit derivative contracts. The Bank uses these instruments for trading and non-trading purposes to manage the risks associated with its funding... -

Page 135

... characteristics and risks are not closely related to those of the host instrument, a separate instrument with the same terms as the embedded derivative would meet the definition of a derivative, and the combined contract is not held for trading or designated at fair value through profit or loss... -

Page 136

...the terms of the existing liability are substantially modified, the original liability is derecognized and a new liability is recognized with the difference in the respective carrying amounts recognized on the Consolidated Statement of Income. 134 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 137

... increase to the carrying amount of the asset. The asset is depreciated on a straight-line basis over its remaining useful life while the liability is accreted to reflect the passage of time until the eventual settlement of the obligation. TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS... -

Page 138

... mortality rates, which are reviewed annually with the Bank's actuaries. The discount rate used to value liabilities is based on long-term corporate AA bond yields as of the measurement date. The expense recognized includes the cost of benefits for employee service provided in the current year, net... -

Page 139

... are discounted using a discount rate that reflects the current market assessments of the time value of money and the risks specific to the obligation, as required by Canadian accepted actuarial practices, and makes explicit provision for adverse deviation. For life and health insurance, actuarial... -

Page 140

...experience of the Bank in conjunction with market-related data and considers if the market-related data indicates there is any prolonged or significant impact on the assumptions. The discount rate used to measure plan obligations is based on long-term high quality corporate bond yields as at October... -

Page 141

... variable returns, unless an analysis of the factors above indicates otherwise. The decisions above are made with reference to the specific facts and circumstances relevant for the structured entity and related transaction(s) under consideration. TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS... -

Page 142

... fair value using the assumptions that market participants would use when pricing the asset or liability under current market conditions. IFRS 13 is effective for annual periods beginning on or after January 1, 2013, which was November 1, 2013 for the Bank, and is applied prospectively. This new... -

Page 143

... at specific points in time in accordance with their applicable legislation. This change in timing of recognition is not expected to have a material impact on the financial position, cash flows, or earnings of the Bank on an annual basis. TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS 141 -

Page 144

...) market prices, the applicable indices, and metrics such as the coupon, maturity, and weighted average maturity of the pool. Market inputs used in the valuation model include, but are not limited to, indexed yield curves and trading spreads. 142 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 145

... is partly a function of collateralization. The Bank uses the relevant overnight index swap (OIS) curve to discount the cash flows for collateralized derivatives as most collateral is posted in cash and can be funded at the overnight rate. TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS 143 -

Page 146

...quoted market prices for similar issues or current rates offered to the Bank for debt of equivalent credit quality and remaining maturity. Other Financial Liabilities Designated at Fair Value For deposits designated at fair value through profit or loss, fair value is determined using discounted cash... -

Page 147

... deposits with banks Trading loans, securities, and other Government and government-related securities Other debt securities Equity securities Trading loans Commodities Retained interests Total trading loans, securities, and other Derivatives Financial assets designated at fair value through profit... -

Page 148

... Derivatives Interest rate contracts Foreign exchange contracts Credit contracts Equity contracts Commodity contracts Financial assets designated at fair value through profit or loss Securities Loans Available-for-sale securities Government and government-related securities Canadian government debt... -

Page 149

...levels of the fair value hierarchy using the fair values as at the end of each reporting period. Assets are transferred between Level 1 and Level 2 depending on if there is sufficient frequency and volume in an active market. During the year ended October 31, 2014, the Bank transferred $1 billion of... -

Page 150

... 3 2014 still held3 FINANCIAL LIABILITIES Trading deposits Derivatives4 Interest rate contracts Foreign exchange contracts Credit contracts Equity contracts Commodity contracts Other financial liabilities designated at fair value through profit or loss Obligations related to securities sold short... -

Page 151

... 2013 still held3 FINANCIAL LIABILITIES Trading deposits Derivatives4 Interest rate contracts Foreign exchange contracts Credit contracts Equity contracts Commodity contracts Other financial liabilities designated at fair value through profit or loss Obligations related to securities sold short... -

Page 152

... yields can be derived from the repo or forward price of the actual stock being fair valued. Spot dividend yields can also be obtained from pricing sources, if it can be demonstrated that spot yields are a good indication of future dividends. 150 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 153

... points points % % % Retained interests Other financial assets designated at fair value through profit or loss Derivatives Interest rate contracts Foreign exchange contracts Credit contracts Equity contracts 48 n/a Discounted cash flow - 10 % 5 n/a Market comparable Bond price equivalent... -

Page 154

...31, 2013 Impact to net assets Increase in fair value FINANCIAL ASSETS Trading loans, securities, and other Equity securities Common shares Preferred shares Retained interests Derivatives Interest rate contracts Foreign exchange contracts Equity contracts Available-for-sale securities Government and... -

Page 155

...). As at October 31, 2014, the fair value of deposits designated at fair value through profit or loss includes $5 million of the Bank's own credit risk (October 31, 2013 - nil). Due to the short-term nature of these loan commitments, changes in the Bank's own credit do not have a significant impact... -

Page 156

... AND FINANCIAL LIABILITIES The Bank enters into netting agreements with counterparties (such as clearing houses) to manage the credit risks associated primarily with repurchase and reverse repurchase transactions, securities borrowing and lending, and over-the-counter and exchange-traded derivatives... -

Page 157

...-for-sale securities on the Consolidated Statement of Comprehensive Income. The impact of this amortization on net interest income is offset by the amortization of the corresponding net reclassification premium on these debt securities. TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS 155 -

Page 158

... October 31 2014 2013 Remaining terms to maturities1 Within 1 year Over 1 year to 3 years Over 3 years to 5 years Over 5 years to 10 years Over 10 years With no specific maturity Total Total Trading securities Government and government-related securities Canadian government debt Federal Provinces... -

Page 159

...) 57,326 29,961 $ (173) $ 120,334 $ 108,789 8 - 9 17 90 $ 1,023 - 1,247 - - (13) 2,828 (13) 4,075 (101) 29,950 $ (318) $ 109,494 Includes the foreign exchange translation of amortized cost balances at the period-end spot rate. TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS 157 -

Page 160

...the impairment losses for the years ended October 31, 2014, or 2013 related to debt securities in the reclassified portfolio as described in the "Reclassification of Certain Debt Securities - Trading to Available-for-Sale" section of the Note. 158 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 161

... appraisals to determine the carrying value of foreclosed assets. Foreclosed assets held for sale were $180 million as at October 31, 2014 (October 31, 2013 - $233 million) and were recorded in Other assets on the Consolidated Balance Sheet. TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS 159 -

Page 162

... of Canadian dollars) Balance as at November 1 2013 Provision for credit losses Foreign exchange and other adjustments Balance as at October 31 2014 Write-offs Recoveries Disposals Counterparty-specific allowance Business and government Debt securities classified as loans Total counterparty... -

Page 163

... of Canadian dollars) Balance as at November 1 2012 Provision for credit losses Foreign exchange and other adjustments Balance as at October 31 2013 Write-offs Recoveries Disposals Counterparty-specific allowance Business and government Debt securities classified as loans Total counterparty... -

Page 164

... terms and conditions of the loan and/or the loan is considered impaired. Management considers the nature of the collateral, seniority ranking of the debt, and loan structure in assessing the value of collateral. These estimated cash flows are reviewed at least annually, or more frequently when new... -

Page 165

... of Canadian dollars) October 31, 2014 Fair value Carrying amount Fair value As at October 31, 2013 Carrying amount Nature of transaction Securitization of residential mortgage loans Securitization of business and government loans Other financial assets transferred related to securitization1 Total... -

Page 166

...The gain (loss) on sale of the loans for the year ended October 31, 2014, was $7 million (October 31, 2013 - $41 million). TRANSFER OF DEBT SECURITIES CLASSIFIED AS LOANS During the year ended October 31, 2014, the Bank did not sell any of its non-agency collateralized mortgage obligation securities... -

Page 167

... Financial Statements. Aside from any seed capital investments, the Bank's interest in these entities is generally limited to fees earned for the provision of asset management services. The Bank does not typically provide guarantees over the performance of these funds. The Bank also sponsors the TD... -

Page 168

..., as well as holdings in TDsponsored asset management funds and trusts. Amounts in Other are predominantly related to investments in community-based U.S. tax-advantage entities described in Note 12, Investment in Associates and Joint Ventures. 166 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 169

...Canadian dollars) October 31, 2014 Investment Funds and Trusts Investment Funds and Trusts As at October 31, 2013 Securitizations Other Total Securitizations Other Total FINANCIAL ASSETS Trading loans, securities, and other Derivatives1 Financial assets designated at fair value through profit... -

Page 170

... is managed through the same approval, limit, and monitoring processes that is used for all counterparties to which the Bank has credit exposure. Credit derivatives are OTC contracts designed to transfer the credit risk in an underlying financial instrument (usually termed as a reference asset) from... -

Page 171

... the market risk nor indicative of the credit risk associated with derivative financial instruments. Fair Value of Derivatives (millions of Canadian dollars) Average fair value for the year1 Positive Negative October 31, 2014 Fair value as at balance sheet date Positive Negative October 31, 2013... -

Page 172

... contracts Foreign exchange contracts Forward contracts Swaps Cross-currency interest rate swaps Total foreign exchange contracts Credit derivatives Credit default swaps - protection purchased Total credit derivatives Other contracts Equity contracts Total other contracts Fair value - non-trading... -

Page 173

... non-interest income, as applicable. Amounts are recorded in non-interest income. Includes non-derivative instruments designated as hedging instruments in qualifying hedge accounting relationships (for example, foreign denominated liabilities). TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS 171 -

Page 174

... instruments. Gains (Losses) on Non-Trading Derivatives not Designated in Qualifying Hedge Accounting Relationships1 (millions of Canadian dollars) For the years ended October 31 2014 2013 2012 Interest rate contracts Foreign exchange contracts Credit derivatives Equity Total 1 $ (66) 13 (100) 10... -

Page 175

... under current market conditions for contracts with the same terms and the same remaining period to expiry. The potential for derivatives to increase or decrease in value as a result of the foregoing factors is generally referred to as market risk. This market risk is managed by senior officers... -

Page 176

... ratings; and (2) funding totalling $1 million (October 31, 2013 - $4 million) following the termination and settlement of outstanding derivative contracts in the event of a one-notch or two-notch downgrade in the Bank's senior debt ratings. 174 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 177

... 2014, the Bank's reported investment in TD Ameritrade was 40.97% (October 31, 2013 - 42.22%) of the outstanding shares of TD Ameritrade with a fair value of $8 billion (October 31, 2013 - $7 billion) based on the closing price of US$33.74 (October 31, 2013 - US$27.26) on the New York Stock Exchange... -

Page 178

... The gross amount of revenue and credit losses have been recorded on the Consolidated Statement of Income since that date. Target Corporation shares in a fixed percentage of the revenue and credit losses incurred. Target Corporation's share of 176 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 179

... value-in-use, the estimated future cash flows based on the Bank's internal forecast are discounted using an appropriate pre-tax discount rate. The following were the key assumptions applied in the goodwill impairment testing: Discount Rate The pre-tax discount rates used reflect current market... -

Page 180

... Canadian dollars) Core deposit intangibles Credit card related intangibles Internally generated software Other Software Other intangibles Total Cost At November 1, 2012 Additions Disposals Impairment Fully amortized intangibles Foreign currency translation adjustments and other At October 31, 2013... -

Page 181

...O T E 16 OTHER ASSETS Other Assets (millions of Canadian dollars) October 31 2014 As at October 31 2013 Accounts receivable and other items1 Accrued interest Current income tax receivable Defined benefit asset Insurance-related assets, excluding investments Prepaid expenses Total 1 $ 6,540 1,330... -

Page 182

... denominated in other foreign currencies. Deposits by Country (millions of Canadian dollars) October 31 2014 Canada United States International Total As at October 31 2013 Total Personal Banks Business and government Designated at fair value through profit or loss1 Trading Total 1 $ 177,681 6,284... -

Page 183

Term Deposits due within a Year (millions of Canadian dollars) October 31 2014 Within 3 months Over 3 months to 6 months Over 6 months to 12 months As at October 31 2013 Total Total Personal Banks Business and government Designated at fair value through profit or loss1 Trading Total 1 $ 11,752 ... -

Page 184

...%. From and including September 15, 2009, to but excluding June 30, 2021. Starting on June 30, 2021, and on every fifth anniversary thereafter, the interest rate will reset to equal the then 5 year Government of Canada yield plus 4.0%. 182 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 185

... 5-Year Rate Reset Preferred Shares, Series AI, at a redemption price of $25 per share. On July 31, 2014, the Bank redeemed all of its outstanding 5-Year Rate Reset Preferred Shares, Series AK, at a redemption price of $25 per share. TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS 183 -

Page 186

...number of common shares that could be issued based on the formula for conversion applicable to the Series 1 shares, and assuming there are no declared and unpaid dividends on the Series 1 shares or Series 2 shares, as applicable, would be 100 million. 184 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL... -

Page 187

... of the plan, cash dividends on common shares are used to purchase additional common shares. At the option of the Bank, the common shares may be issued from the Bank's treasury at an average market price based on the last five trading days before the date of the dividend payment, with a discount of... -

Page 188

...years ended October 31 2014 2013 2012 Net interest income (loss) Trading income (loss) Financial instruments designated at fair value through profit or loss1 Total By product Interest rate and credit portfolios Foreign exchange portfolios Equity and other portfolios Financial instruments designated... -

Page 189

...of the risk management activities within the business. The Bank's Insurance Risk Management Framework and Insurance Risk Policy collectively outline the internal risk and control structure to manage insurance risk and include risk appetite, policies, processes as well as limits and governance. These... -

Page 190

... estimates are evaluated monthly for redundancy or deficiency. The evaluation is based on actual payments in full or partial settlement of claims and current estimates of claims liabilities for claims still open or claims still unreported. 188 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 191

... Insurance Contract Liabilities (millions of Canadian dollars) October 31, 2014 Impact on net income (loss) before income tax Impact on net income (loss) before income tax As at October 31, 2013 Impact on equity Impact on equity Impact of an absolute change of 1% in key assumptions Discount rate... -

Page 192

...projected earned rates, and liabilities are calculated using the Canadian Asset Liability Method (CALM). A sensitivity analysis for possible movements in the life and health insurance business assumptions was performed and the impact is not significant to the Bank's Consolidated Financial Statements... -

Page 193

... for the twelve months ended October 31. Assumptions Used for Estimating Fair Value of Options (in Canadian dollars, except as noted) 2014 2013 2012 Risk-free interest rate Expected option life (years) Expected volatility1 Expected dividend yield Exercise price/share price 1 1.90% 6.2 years 27.09... -

Page 194

...Debt instruments generally must meet or exceed a credit rating of BBB at the time of purchase and during the holding period. There are no limitations on the maximum amount allocated to each credit rating above BBB for the total debt portfolio. 192 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 195

... retirement plans were frozen as of April 1, 2012. In addition, TD Auto Finance provides limited postretirement benefit programs, including medical coverage and life insurance benefits to certain employees who meet minimum age and service requirements. TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL... -

Page 196

... be earned after that date. Certain TD Auto Finance defined benefit pension plans were frozen as of April 1, 2012, and no service credits can be earned after March 31, 2012. Certain TD Auto Finance retirement plans were curtailed during 2012. 194 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 197

...-average durations of the defined benefit obligations for the Bank's principal pension plans, principal non-pension postretirement benefit plan and other pension and retirement plans at the end of the reporting period are 21 years (2013 - 20 years, 2012 - 20 years), 18 years (2013 - 17 years, 2012... -

Page 198

...of Canadian dollars) October 31 2014 For the years ended October 31 2013 October 31 2012 Actuarial gains (losses) recognized in Other Comprehensive Income Principal pension plans Principal non-pension post-retirement benefit plan Other pension and retirement plans Other employee benefit plans Total... -

Page 199

... (millions of Canadian dollars) 2014 For the years ended October 31 2013 2012 Provision for income taxes - Consolidated Statement of Income Current income taxes Provision for (recovery of) income taxes for the current period Adjustments in respect of prior years and other Total current income taxes... -

Page 200

... 2014 Consolidated Statement of Income Other Comprehensive Income Business Combinations and Other 2013 Total Total Deferred income tax expense (recovery) Allowance for credit losses Land, buildings, equipment, and other depreciable assets Deferred (income) expense Trading loans Derecognition... -

Page 201

... stock dividend, as discussed in Note 21, on the Bank's basic and diluted earnings per share, as if it was retrospectively applied to all periods presented. For the years ended October 31 2014 2013 2012 Basic earnings per share Net income attributable to common shareholders Weighted-average number... -

Page 202

...challenging TD Bank, N.A.'s overdraft practices on behalf of certain individuals who opened a chequing account after August 15, 2010, or were not included in the prior overdraft class action settlements. This case is in its preliminary stages. 200 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 203

...10. The values of credit instruments reported as follows represent the maximum amount of additional credit that the Bank could be obligated to extend should contracts be fully utilized. Credit Instruments (millions of Canadian dollars) As at October 31 October 31 2014 2013 Financial and performance... -

Page 204

...of Future Payments (millions of Canadian dollars) As at October 31 October 31 2014 2013 Financial and performance standby letters of credit Assets sold with contingent repurchase obligations Total $ 18,395 267 $ 18,662 $ 16,503 341 $ 16,844 202 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 205

... Business loans Total 4 262 $ 266 $ 3 181 $ 184 $ COMPENSATION The remuneration of key management personnel was as follows: Compensation (millions of Canadian dollars) For the years ended October 31 2014 2013 2012 Short-term employee benefits Post-employment benefits Share-based payments Total... -

Page 206

... provides financial products and services to personal, small business, and commercial customers, TD Auto Finance Canada, the Canadian credit card business, the Canadian wealth business, which provides investment products and services to institutional and retail investors, and the insurance business... -

Page 207

... Results by Business Segment (millions of Canadian dollars, except as noted) Canadian Retail U.S. Retail Wholesale Banking For the years ended October 31 2014 Corporate Total Net interest income (loss) Non-interest income (loss) Provision for (reversal of) credit losses Insurance claims and related... -

Page 208

... in the floating rate category. The Bank's risk management policies and procedures relating to credit, market, and liquidity risks as required under IFRS 7 are outlined in the shaded sections of the "Managing Risk" section of the MD&A. 206 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 209

...31, 2014 Floating rate Within 3 months 3 months to 1 year Over 5 years Total Assets Cash resources and other Effective yield Trading loans, securities, and other Effective yield Financial assets designated at fair value through profit or loss Effective yield Available-for-sale Effective yield Held... -

Page 210

... 31, 2014 (October 31, 2013 - 12%). No other industry segment exceeded 5% of the total. Debt securities classified as loans were 1% as at October 31, 2014 (October 31, 2013 - 1%) of the total loans and customers' liability under acceptances. 208 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 211

... Maximum Credit Risk Exposure (millions of Canadian dollars) October 31 2014 As at October 31 2013 Cash and due from banks Interest-bearing deposits with banks Securities1 Trading Government and government-insured securities Other debt securities Retained interest Available-for-sale Government and... -

Page 212

... approach. Financial Assets Subject to the Standardized Approach by Risk-Weights (millions of Canadian dollars) As at October 31, 2014 0% Loans Residential mortgages Consumer instalment and other personal Credit card Business and government Debt securities classified as loans Total loans Held-to... -

Page 213

...bearing deposits with banks. Retail Financial Assets Subject to the AIRB Approach by Risk Rating1 (millions of Canadian dollars) Low risk Normal risk Medium risk High risk Default As at October 31, 2014 Total Loans Residential mortgages2 Consumer instalment and other personal2 Credit card Business... -

Page 214

... weighted (previously deducted from capital), and new capital charges for derivatives credit valuation adjustment and credit risk related to asset value correlation for financial institutions. Regulatory capital ratios are calculated by dividing CET1, Tier 1, and Total Capital by RWA. The BCBS is... -

Page 215

... Investment Partners, Inc. TD Bank USA, National Association TD Bank, National Association TD Auto Finance LLC TD Equipment Finance, Inc. TD Private Client Wealth LLC TD Wealth Management Services Inc. TD Vermillion Holdings ULC TD Financial International Ltd. Canada Trustco International Limited TD... -

Page 216

...25 billion of fixed rate medium term notes and US$500 million of floating rate 5-year senior medium term notes. Covered Bonds On November 6, 2014, the Bank issued AUD $1 billion of 5-year floating rate covered bond in the Australian market. 214 TD BANK GROUP ANNUAL REPORT 2014 FINANCIAL RESULTS -

Page 217

... Investment Partners, Inc. TD Bank USA, National Association TD Bank, National Association TD Auto Finance LLC TD Equipment Finance, Inc. TD Private Client Wealth LLC TD Wealth Management Services Inc. TD Vermillion Holdings ULC TD Financial International Ltd. Canada Trustco International Limited TD... -

Page 218

... Canadian dollars) International NatWest Personal Financial Management Limited NatWest Stockbrokers Limited TD Bank International S.A. TD Bank N.V. TD Ireland TD Global Finance TD Luxembourg International Holdings TD Ameritrade Holding Corporation (40.97%)3 TD Wealth Holdings (UK) Limited TD Direct... -

Page 219

...the 2014 Consolidated Financial Statements, and restatements to conform with the presentation adopted in the current period. Includes available-for-sale securities and financial assets designated at fair value through profit or loss. TD BANK GROUP ANNUAL REPORT 2014 TEN-YEAR STATISTICAL REVIEW 217 -

Page 220

... and the impact of the January 31, 2014 stock dividend, as discussed in Note 4 and Note 21, respectively, of the 2014 Consolidated Financial Statements, and restatements to conform with the presentation adopted in the current period. 218 TD BANK GROUP ANNUAL REPORT 2014 TEN-YEAR STATISTICAL REVIEW -

Page 221

... ratio 22 23 24 25 26 27 28 Common equity to total assets Number of common shares outstanding (thousands) Market capitalization (millions of Canadian dollars) Average number of full-time equivalent staff11 Number of retail outlets12 Number of retail brokerage offices Number of automated banking... -

Page 222

... reverse repurchase agreements Loans, net of allowance for loan losses Other Total assets LIABILITIES Deposits Other Subordinated notes and debentures Liabilities for preferred shares and capital trust securities Non-controlling interest in subsidiaries EQUITY Common shares Preferred shares Treasury... -

Page 223

... reconciliation with reported results. Effective 2008, treasury shares have been reclassified from common and preferred shares and are shown separately. Prior to 2008, the amounts for treasury shares were not reasonably determinable. TD BANK GROUP ANNUAL REPORT 2014 TEN-YEAR STATISTICAL REVIEW 221 -

Page 224

... equity Return on risk-weighted assets Efficiency ratio4 Common dividend payout ratio Price earnings ratio6 $ 3.43 3.41 15.4% 2.95 57.9 38.1 11.0 $ 2010 2.91 2.89 13.7% 2.63 58.6 42.1 12.7 $ 2009 2.69 2.68 12.9% 2.27 59.2 45.6 11.6 222 TD BANK GROUP ANNUAL REPORT 2014 TEN-YEAR STATISTICAL REVIEW -

Page 225

...the "Credit Portfolio Quality" section of the 2014 MD&A. 9 Reflects the number of employees on an average full-time equivalent basis. 10 Includes retail bank outlets, private client centre branches, and estate and trust branches. 1 2 TD BANK GROUP ANNUAL REPORT 2014 TEN-YEAR STATISTICAL REVIEW 223 -

Page 226

... of total revenue; the efficiency ratio measures the efficiency of the Bank's operations. Fair Value: The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions... -

Page 227

... e-mailing [email protected]. AUDITORS FOR FISCAL 2014 Ernst & Young LLP DIVIDENDS Direct dividend depositing: Shareholders may have their dividends deposited directly to any bank account in Canada or the U.S. For this service, please contact the Bank's transfer agent at the address below. U.S. dollar... -

Page 228

FSC Logo ® The TD logo and other trade-marks are the property of The Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or other countries.