TCF Bank 2003 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 TCF Financial Corporation and Subsidiaries

Note 19. Derivative Instruments and Hedging Activities

All derivative instruments as defined, including derivatives embedded

in other financial instruments or contracts, are recognized as either

assets or liabilities in the Consolidated Statements of Financial

Condition at fair value. Changes in the fair value of a derivative are

recorded in the Consolidated Statements of Income.

TCF’s pipeline of locked residential mortgage loan commitments,

adjusted for loans not expected to close, and forward sales contracts

are considered derivatives and are recorded at fair value, with the

changes in fair value recognized in gains on sales of loans under

mortgage banking revenue in the Consolidated Statements of

Income. TCF utilizes forward sales contracts to hedge its risk of

changes in the fair value, due to changes in interest rates, of both

its locked residential mortgage loan commitments and its residen-

tial loans held for sale. Residential mortgage loans held for sale are

carried at the lower of cost or market as adjusted for the effects of

fair value hedges using quoted market prices. Because the fair value

of the residential loans held for sale are hedged with forward sales

contracts of the same loan types, or substantially the same loan

types, the hedges are highly effective at managing the risk of chang-

ing fair values of such loans. Any differences between the changes

in fair value of the hedged residential loans held for sale and in the

fair value of the forward sales contracts are not expected to be

and were not material due to the nature of the hedging instruments

and were recorded in gains on sales of loans and was not material.

Forward mortgage loan sales commitments totaled $149.1 million

and $511 million at December 31, 2003 and 2002, respectively.

Note 20. Financial Instruments with

Off-Balance-Sheet Risk

TCF is a party to financial instruments with off-balance-sheet risk,

primarily to meet the financing needs of its customers. These finan-

cial instruments, which are issued or held by TCF for purposes other

than trading, involve elements of credit and interest-rate risk in

excess of the amount recognized in the Consolidated Statements

of Financial Condition.

TCF’s exposure to credit loss in the event of non-performance

by the counterparty to the financial instrument for commitments

to extend credit and standby letters of credit is represented by the

contractual amount of the commitments. TCF uses the same credit

policies in making these commitments as it does for on-balance-

sheet instruments. TCF evaluates each customer’s creditworthiness

on a case-by-case basis. The amount of collateral obtained is based

on management’s credit evaluation of the customer.

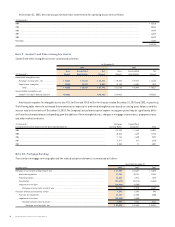

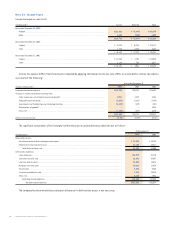

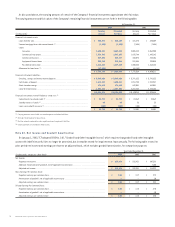

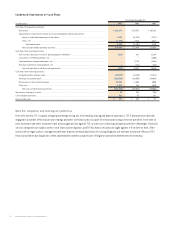

Assumed health care cost trend rates have an effect on the amounts reported for the Postretirement Plan. A one-percentage-point change

in assumed health care cost trend rates would have the following effects:

1-Percentage- 1-Percentage-

(In thousands) Point Increase Point Decrease

Effect on total of service and interest cost components . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 38 $ (35)

Effect on postretirement benefits obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 610 (545)

TCF currently has no plans to pre-fund the Postretirement Plan in 2004.

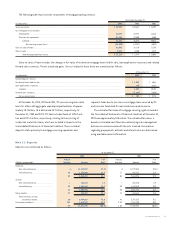

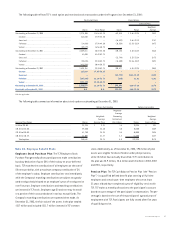

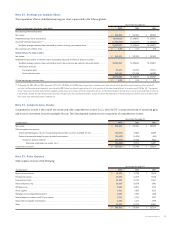

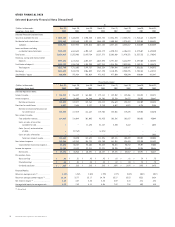

Financial instruments with off-balance sheet risk are summarized as follows:

At December 31,

(In thousands) 2003 2002

Commitments to extend credit:

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,382,348 $1,154,133

Commercial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 624,664 576,568

Leasing and equipment finance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57,485 67,006

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56,007 32,419

Total commitments to extend credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,120,504 1,830,126

Loans serviced with recourse . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 130,765 180,285

Standby letters of credit and guarantees on industrial revenue bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,796 27,094

$2,292,065 $2,037,505