TCF Bank 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 TCF Financial Corporation and Subsidiaries

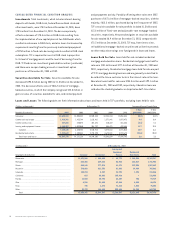

Borrowings Borrowings totaled $2.4 billion at December 31, 2003,

down $695.5 million from year-end 2002. The decrease was primarily

due to decreases in residential real estate loans and mortgage-

backed securities which reduces TCF’s reliance on borrowings. See

Notes 12 and 13 of Notes to Consolidated Financial Statements for

detailed information on TCF’s borrowings. Included in long-term

borrowings at December 31, 2003 are $767.5 million of fixed-rate

FHLB advances and repurchase agreements with other financial

institutions which are callable by the counterparty at par on certain

anniversary dates and, for most, quarterly thereafter until maturity.

If called, replacement funding will be provided by the counterparties

at the then-prevailing short-term market rate of interest for the

remaining term-to-maturity of the advances and repurchase agree-

ments, subject to standard terms and conditions. The weighted-

average rate on borrowings decreased to 3.24% at December 31,

2003, from 4.43% at December 31, 2002 as a result of the previously

discussed prepayments of FHLB advances and generally lower inter-

est rates on short-term borrowings.

TCF does not utilize unconsolidated subsidiaries or special purpose

entities to provide off-balance-sheet borrowings. See Note 20 of

Notes to Consolidated Financial Statements for information relating

to off-balance-sheet instruments.

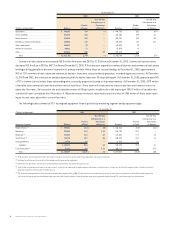

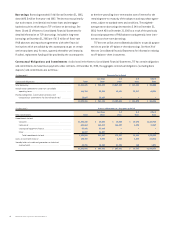

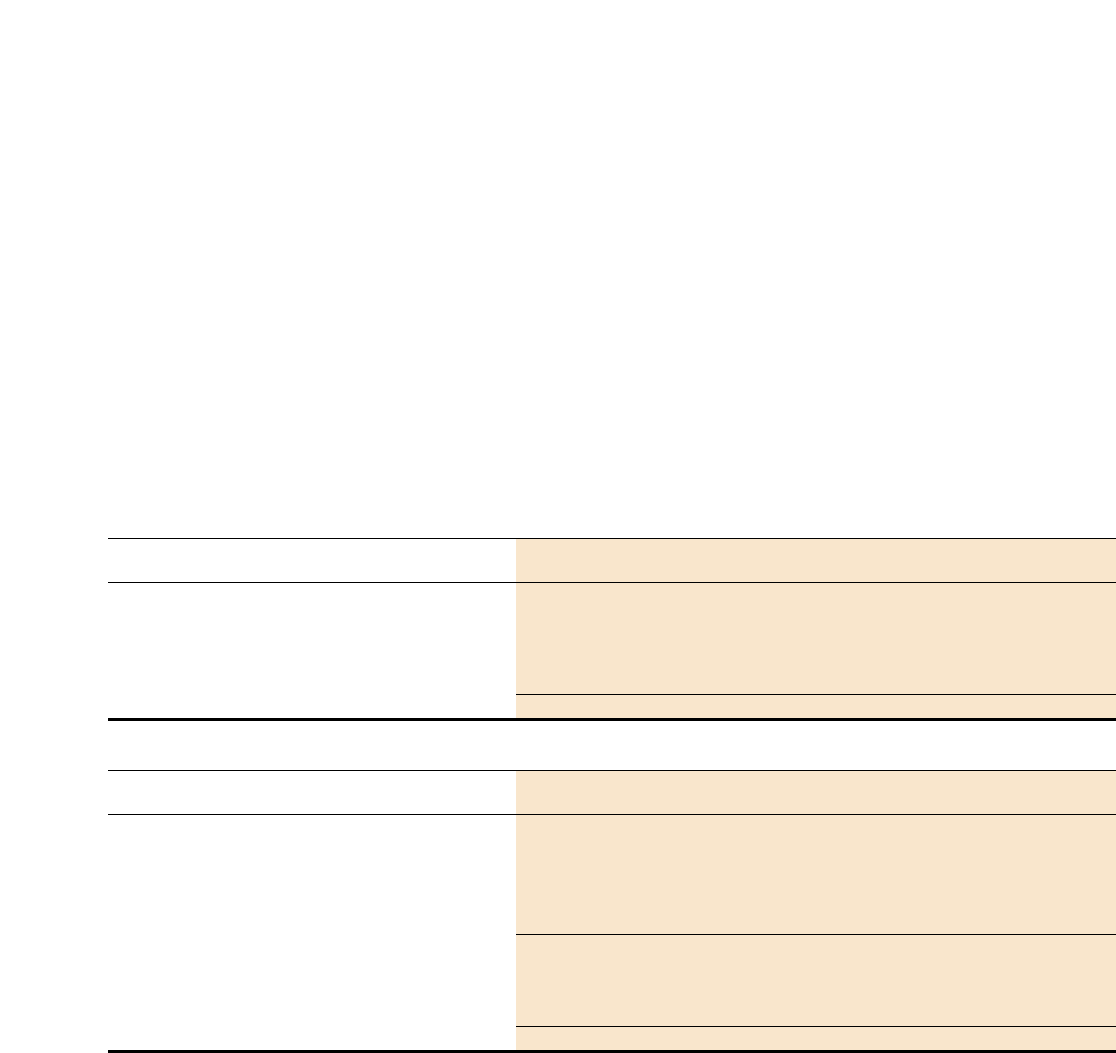

Contractual Obligations and Commitments As disclosed in the Notes to Consolidated Financial Statements, TCF has certain obligations

and commitments to make future payments under contracts. At December 31, 2003, the aggregate contractual obligations (excluding bank

deposits) and commitments are as follows:

(In thousands) Payments Due by Period

Less than 1-3 4-5 After 5

Contractual Obligations Total 1 Year Years Years Years

Total borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,414,825 $ 925,019 $1,067,253 $ 122,553 $ 300,000

Annual rental commitments under non-cancelable

operating leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 164,784 22,310 42,601 31,517 68,356

Purchase obligations (construction contracts and

land purchase commitments for future branch sites) . . . . . . . . . . 13,807 13,807 – – –

$2,593,416 $ 961,136 $1,109,854 $ 154,070 $ 368,356

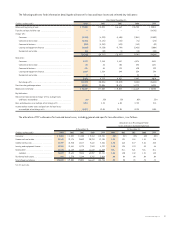

(In thousands) Amount of Commitment – Expiration by Period

Less than 1-3 4-5 After 5

Other Commitments Total 1 Year Years Years Years

Commitments to lend:

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,382,348 $ 25,083 $ 15,050 $ 19,470 $1,322,745

Commercial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 624,664 443,012 164,507 4,598 12,547

Leasing and equipment finance . . . . . . . . . . . . . . . . . . . . . . . . . . 57,485 57,485 – – –

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56,007 56,007 – – –

Total commitments to lend . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,120,504 581,587 179,557 24,068 1,335,292

Loans serviced with recourse . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 130,765 3,096 6,828 6,529 114,312

Standby letters of credit and guarantees on industrial

revenue bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,796 18,369 21,196 160 1,071

$2,292,065 $ 603,052 $ 207,581 $ 30,757 $1,450,675