TCF Bank 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 TCF Financial Corporation and Subsidiaries

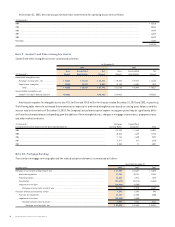

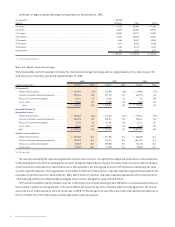

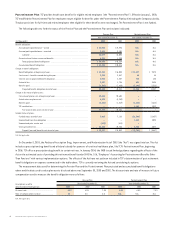

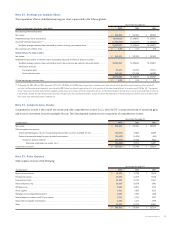

Note 17. Incentive Stock Program

The TCF Financial 1995 Incentive Stock Program (the “Program”)

was adopted to enable TCF to attract and retain key personnel.

Under the Program, no more than 5% of the shares of TCF common

stock outstanding on the date of initial shareholder approval may

be awarded. At December 31, 2003, there were 2,707,627 shares

reserved for issuance under the Program, including 240,848 shares

related to outstanding stock options.

At December 31, 2003, there were 1,071,123 shares of

performance-based restricted stock that will vest only if certain

earnings per share goals are achieved by 2008. Failure to achieve

the goals will result in all or a portion of the shares being forfeited.

Other restricted stock grants generally vest over periods from

three to eight years. The weighted-average grant date fair value

of restricted stock was $45.00, $48.93 and $39.53 in 2003, 2002

and 2001, respectively. Compensation expense for restricted stock

totaled $9.7 million, $11.6 million and $11.1 million in 2003, 2002

and 2001, respectively.

TCF has also issued stock options under the Program that generally

become exercisable over a period of one to 10 years from the date

of the grant and expire after 10 years. All outstanding options have

a fixed exercise price equal to the market price of TCF common stock

on the date of grant.

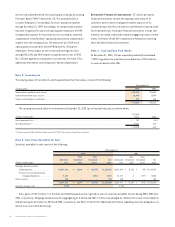

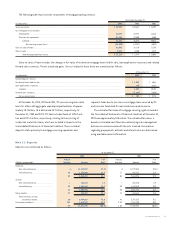

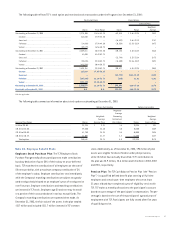

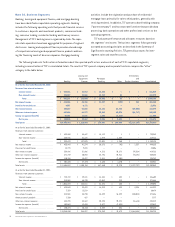

The following table sets forth TCF’s and TCF National Bank’s regulatory tier 1 leverage, tier 1 risk-based and total risk-based capital levels,

and applicable percentages of adjusted assets, together with the excess over minimum capital requirements:

Minimum Capital

Actual Requirement Excess

(Dollars in thousands) Amount Ratio Amount Ratio Amount Ratio

As of December 31, 2003:

Tier 1 leverage capital

TCF Financial Corporation . . . . . . . . . . . . . . $765,271 6.87% $334,402 3.00% $430,869 3.87%

TCF National Bank . . . . . . . . . . . . . . . . . . . . 754,599 6.83 331,649 3.00 422,950 3.83

Tier 1 risk-based capital

TCF Financial Corporation . . . . . . . . . . . . . . 765,271 9.75 313,825 4.00 451,446 5.75

TCF National Bank . . . . . . . . . . . . . . . . . . . . 754,599 9.64 313,143 4.00 441,456 5.64

Total risk-based capital

TCF Financial Corporation . . . . . . . . . . . . . . 841,982 10.73 627,650 8.00 214,332 2.73

TCF National Bank . . . . . . . . . . . . . . . . . . . . 831,310 10.62 626,286 8.00 205,024 2.62

As of December 31, 2002:

Tier 1 leverage capital

TCF Financial Corporation . . . . . . . . . . . . . . $ 773,594 6.42% $ 361,435 3.00% $ 412,159 3.42%

TCF National Bank . . . . . . . . . . . . . . . . . . . . 750,935 6.24 361,017 3.00 389,918 3.24

Tier 1 risk-based capital

TCF Financial Corporation . . . . . . . . . . . . . . 773,594 9.96 310,828 4.00 462,766 5.96

TCF National Bank . . . . . . . . . . . . . . . . . . . . 750,935 9.68 310,247 4.00 440,688 5.68

Total risk-based capital

TCF Financial Corporation . . . . . . . . . . . . . . 850,694 10.95 621,657 8.00 229,037 2.95

TCF National Bank . . . . . . . . . . . . . . . . . . . . 828,035 10.68 620,493 8.00 207,542 2.68

At December 31, 2003, TCF and TCF National Bank exceeded their regulatory capital requirements and are considered “well-capitalized”

under guidelines established by the FRB and the OCC pursuant to the Federal Deposit Insurance Corporation Improvement Act of 1991.