TCF Bank 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 43

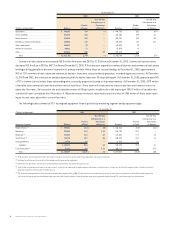

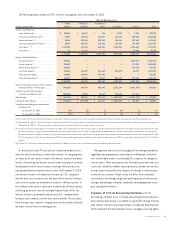

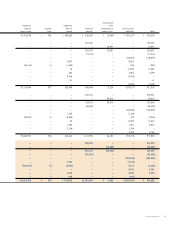

Commitments to lend are agreements to lend to a customer pro-

vided there is no violation of any condition in the contract. These

commitments generally have fixed expiration dates or other termi-

nation clauses and may require payment of a fee. Since certain of

the commitments are expected to expire without being drawn upon,

the total commitment amounts do not necessarily represent future

cash requirements. Collateral predominantly consists of residential

and commercial real estate.

Loans serviced with recourse represent a contingent guarantee

based upon the failure to perform by another party. These loans con-

sist of $126 million of Veterans Administration (“VA”) loans and $4.8

million of loans sold with recourse to the Federal National Mortgage

Association (“FNMA”). As is typical of a servicer of VA loans, TCF

must cover any principal loss in excess of the VA’s guarantee if the

VA elects its “no-bid” option upon the foreclosure of a loan. TCF has

established a liability of $100 thousand relating to the VA “no-bid”

exposure on VA loans serviced with partial recourse at December 31,

2003 which was recorded in other liabilities. No claims have been

made under the “no-bid” option during 2003 or 2002. Loans sold

with recourse to FNMA represent residential real estate loans sold

to FNMA prior to 1982. TCF no longer sells loans on a recourse basis,

and thus has limited the amount of loans subject to this contingent

guarantee. The contingent guarantee related to both types of

recourse remains in effect for the duration of the loans and thus

expires in various years through the year 2033. All loans sold with

recourse are collateralized by residential real estate. Since condi-

tions under which TCF would be required either to cover any principal

loss in excess of the VA’s guarantee or repurchase the loan sold to

FNMA may not materialize, the actual cash requirements are expected

to be significantly less than the amount provided in the table above.

Standby letters of credit and guarantees on industrial revenue

bonds are conditional commitments issued by TCF guaranteeing the

performance of a customer to a third party. These conditional com-

mitments expire in various years through the year 2011. Since the

conditions under which TCF is required to fund these commitments

may not materialize, the cash requirements are expected to be less

than the total outstanding commitments. Collateral held on these

commitments primarily consists of commercial real estate mortgages.

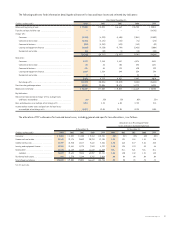

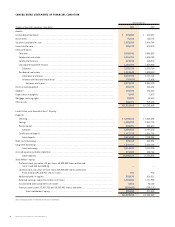

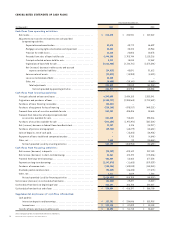

Stockholders’ Equity Stockholders’ equity at December 31, 2003

was $920.9 million, or 8.1% of total assets, down from $977 million,

or 8% of total assets, at December 31, 2002. The decrease in stock-

holders’ equity was primarily due to the repurchase of 3.5 million

shares of TCF’s common stock at a cost of $150.4 million, the payment

of $93 million in dividends on common stock and a $40.5 million

decrease in accumulated comprehensive income, partially offset by

net income of $215.9 million for the year ended December 31, 2003.

On July 21, 2003, TCF’s Board of Directors authorized the repurchase

of up to an additional 5% of TCF’s common stock, or 3.6 million

shares. At December 31, 2003, 3.7 million shares remain available

under remaining authorizations from the Board of Directors. Since

January 1, 1998, the Company has repurchased 25.1 million shares of

its common stock at an average cost of $33.33 per share. For the year

ended December 31, 2003, average total equity to average assets was

8.03% compared with 7.91% for the year ended December 31, 2002.

Dividends paid to common shareholders on a per share basis totaled

$1.30 in 2003, an increase of 13% from $1.15 in 2002. TCF’s dividend

payout ratio was 42.62% in 2003 and 36.51% in 2002. The Company’s

primary funding sources for common dividends are dividends received

from its subsidiary bank. At December 31, 2003, TCF and TCF National

Bank exceeded their regulatory capital requirements and are consid-

ered “well-capitalized” under guidelines established by the Federal

Reserve Board and the Office of the Comptroller of the Currency. See

Notes 15 and 16 of Notes to Consolidated Financial Statements.

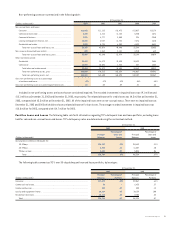

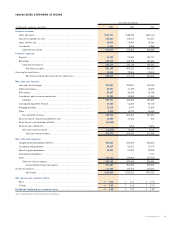

TCF has used stock options as a form of employee compensation

only to a limited extent. At December 31, 2003, the number of incen-

tive stock options outstanding was 240,848 or .34% of total shares

outstanding.

Interest-Rate Risk TCF’s results of operations are dependent to

a large degree on its net interest income and its ability to manage its

interest rate risk. Although TCF manages other risks, such as credit

and liquidity risk, in the normal course of its business, the Company

considers interest rate risk to be its most significant market risk.

Since TCF does not hold a trading portfolio, the Company is not

exposed to market risk from trading activities. The mismatch

between maturities, interest rate sensitivities and prepayment

characteristics of assets and liabilities results in interest rate risk.