TCF Bank 2003 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

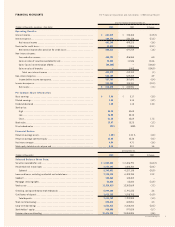

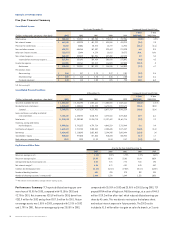

10 TCF Financial Corporation and Subsidiaries

STRATEGIES

In 1989, TCF Chairman and CEO Bill Cooper sat down with a group of TCF

executives to commit to writing the underlying banking philosophies

that has guided TCF’s business strategies. These strategies have

become the principles by which TCF conducts its business. TCF’s long-

term strategies for growth are somewhat unique among our competi-

tors, however they have served and continue to serve our customers

and shareholders well.

TCF’s strategies begin with the premise that every customer is valu-

able, and we must listen to them. We are “The Leader in Convenience

Banking,” and we use our premier convenience services to attract

a large and economically diverse customer base. Each of our many

customers contributes incrementally to our revenue. TCF does not

believe in focusing only on one “profitable” customer segment. Every

customer is potentially profitable and may become more so over time.

TCF provides convenience to our large and growing customer base by

being open longer hours seven days a week and open on most holidays.

TCF offers a large supermarket branch network, complemented by

traditional branches, providing customers with alternative locations

to conduct their banking. TCF’s free on-line banking services, exten-

sive ATM network and automated telephone service provide even more

convenient options – meeting customers needs. Adding new branches

where they can best support and increase our customer base, and

introducing new and enhancing existing products or services, are

strategies that have worked well for TCF over the last decade.

Since 1989, TCF has placed equal emphasis on what it defines as Power

Assets (higher-yielding consumer loans, commercial loans and leas-

ing assets) and Power Liabilities (lower-cost checking, savings, money

market and certificate of deposit accounts). A principle strategy of

TCF’s Power Assets is that TCF lends on a secured basis. Our strong

credit quality is evidence that this important strategy is working. TCF

has one of the lowest charge-off ratios in the banking industry. Power

Liabilities are proven profit drivers at TCF. By focusing on both Power

Assets and Power Liabilities, we recognize the important contributions

to overall profitability by both the liability and asset side of the bal-

ance sheet. Earning at least one percent on each side of the balance

sheet, we can provide synergistic earnings greater than two percent

in total.

TCF’s superior earnings performance allows us to regularly buy back

our own stock. In evaluating potential acquisitions, we look at the

stock buy back opportunity as an acquisition alternative that can

provide superior results. Investing in our own stock has been good for

TCF and its shareholders.

Planning for Growth Simple, straightforward,

and enduring strategies, which are based on a well-

grounded philosophy coupled with successful execution

and solid management, have made TCF one of the top

performing banks in the country.