TCF Bank 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 13

Cultivating Our Business Power Assets

and Power Liabilities remain the cornerstone of

TCF’s growth, profitability and success.

Banking was enhanced to provide customer ability to access multiple

TCF accounts via one screen and view an extensive account history

with robust transaction history detail. Customers can also easily

search for specific transactions by various attributes and set up auto-

matic recurring transfers. Through “My TCF,” customers can track

a personal list of stock quotes and stock indices, receive weather

information by zip code and access national, local and feature head-

lines with links to full articles. TCF Preferred Online Banking also allows

customers to request automatic account balance alerts sent by email

accessible by a computer terminal or by an email-enabled cell phone

or pager. In 2004, TCF will introduce enhancements to its bill paying

service and redesign the TCFExpress website to make it even more

customer friendly.

Online at TCF Express Trade, customers can buy and sell stocks, mutual

funds and other securities. Access to investment holdings, account

history, stock research, and order placement is available 24 hours a

day, seven days a week. Customers preferring personal service can

contact a personal trading representative.

Small business customers may also take advantage of TCF’s Internet

banking services. Totally Free Online Banking for Business provides

basic Internet banking services with no access fee. TCF Preferred Online

Business Banking provides expanded account history and the ability

to download transaction detail into financial software applications,

helping small business owners manage their businesses.

TCF Express Business provides commercial customers the ability to access

complete balance reporting, initiate transfers, stop payments, and

make ACH transactions from any personal computer worldwide, 24 hours

a day, 365 days a year. TCF Express Business has become an important

and popular product in TCF’s growing commercial banking operation.

The definition of convenience changes as a customer’s life and business

needs evolve. At TCF we are committed to being the most convenient

bank in the markets we serve by continuing to develop and enhance

new and innovative convenience products and services.

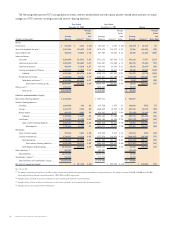

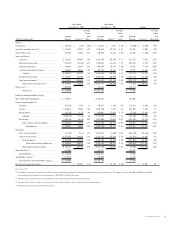

POWER ASSETS AND

POWER LIABILITIES

In 2003, TCF continued its focus on building Power Assets and Power

Liabilities. TCF defines Power Assets as higher-yielding commercial

loans, commercial real estate loans, leases, and consumer home

equity loans. Power Liabilities include checking, savings, money mar-

ket accounts, and certificates of deposits. Power Assets and Power

Liabilities now comprise over 66 percent of TCF’s balance sheet and in

2003 contributed over 83 percent of net income.