TCF Bank 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 35

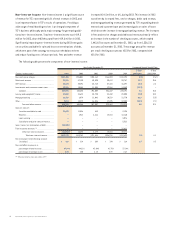

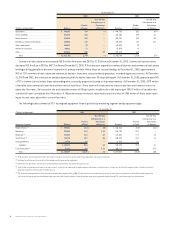

At December 31,

(Dollars in thousands) 2003 2002

Percent of Percent of

Equipment Type Balance Total Balance Total

Technology and data processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 249,515 21.5% $ 291,091 28.0%

Specialty vehicles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 225,073 19.4 149,997 14.4

Manufacturing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 198,321 17.1 140,014 13.5

Construction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 133,104 11.5 87,857 8.5

Trucks and trailers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89,262 7.7 113,587 10.9

Furniture and fixtures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .54,052 4.7 62,153 6.0

Printing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38,977 3.3 31,181 3.0

Medical . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33,462 2.9 23,378 2.2

Material handling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27,111 2.3 24,749 2.4

Aircraft . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,965 2.1 23,420 2.3

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87,555 7.5 91,613 8.8

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,160,397 100.0% $1,039,040 100.0%

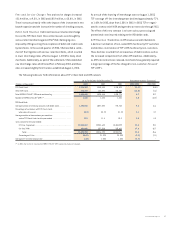

The leasing and equipment finance portfolio increased $121.4

million from December 31, 2002 to $1.2 billion at December 31, 2003

and included the purchase of a specialty vehicles lease portfolio

totaling $58.4 million. This increase was net of a $37.3 million

decline in the Winthrop lease portfolio. Winthrop leases technology

and data processing equipment to companies. Technology spending

by companies has been slow over the past few years. In addition, the

low interest rate environment has led many companies to decide to

purchase instead of lease technology. These factors have contributed

to the reduced levels of new leases at Winthrop. TCF continues to

focus attention on increasing sales efforts at Winthrop to increase

overall balances and maintain its high level of profitability in the busi-

ness. At December 31, 2003, $66.4 million, or 7.4% of TCF’s lease

portfolio, was discounted on a non-recourse basis with other third-

party financial institutions and consequently TCF retains no credit

risk on such amounts. This compares with non-recourse fundings

of $108.7million, or 13.9%, at December 31, 2002. The leasing and

equipment finance portfolio tables above include lease residuals.

Lease residuals represent the estimated fair value of the leased

equipment at the expiration of the initial term of the transaction. At

December 31, 2003, lease residuals, excluding leveraged lease resid-

uals, totaled $34.2 million, down from $35.4 million at December 31,

2002. The lease residuals on leveraged leases are included in invest-

ments in leveraged leases and totaled $18.7 million at December 31,

2003, unchanged from December 31, 2002. Lease residual values are

initially determined at the inception of the lease and are reviewed

on an ongoing basis. Any downward revisions are recorded in the

periods in which they become known.

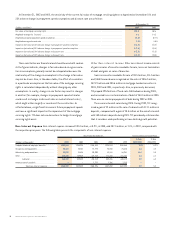

Included in the investment in leveraged leases, at December 31,

2003, is $19.8 million for a 100% equity interest in a Boeing 767-300

aircraft on lease to Delta Airlines in the United States. An economic

slowdown has adversely impacted the airline industry and could

have an adverse impact on the lessee’s ability to meet its lease obli-

gations and the residual value of the aircraft. The lessee is current

on the lease payments and the lease expires in 2010. This lease rep-

resents TCF’s only material direct exposure to the commercial airline

industry. Total loan and lease originations and purchases for TCF’s

leasing businesses were $618.3 million at December 31, 2003, com-

pared with $518.1 million during 2002 and $492.3 million in 2001. The

backlog of approved transactions increased to $155.2 million at

December 31, 2003, from $140.8 million at December 31, 2002. TCF’s

expanded leasing activity is subject to risk of cyclical downturns and

other adverse economic developments. TCF’s ability to increase its

lease portfolio is dependent upon its ability to place new equipment

in service. In an adverse economic environment, there may be a decline

in the demand for some types of equipment which TCF leases, resulting

in a decline in the amount of new equipment being placed into service

as well as a decline in equipment values for equipment previously

placed in service. TCF Leasing has originated most of its portfolio

during recent periods, and consequently the performance of this

portfolio may not be reflective of future results and credit quality.