TCF Bank 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 29

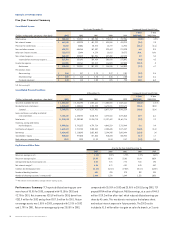

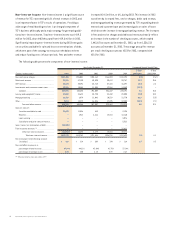

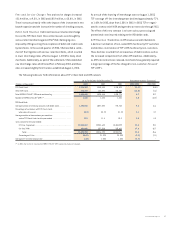

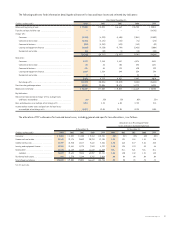

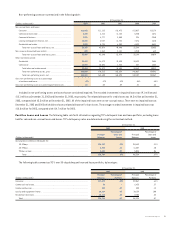

The following tables summarize the servicing portfolio by interest rate tranche, the range of prepayment speed assumptions and the

weighted average remaining life of the loans by interest rate tranche used in the determination of the valuation and amortization of mortgage

servicing rights as of December 31, 2003 and 2002:

(Dollars in thousands) December 31, 2003

Prepayment Speed Assumption Weighted

Weighted Average Life

Interest Rate Tranche Unpaid Balance High Low Average (in Years)

0 to 5.50% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,648,918 15.1% 13.0% 13.3% 7.2

5.51 to 6.00% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,407,315 20.5 17.7 17.9 5.6

6.01 to 6.50% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 830,161 28.8 24.9 25.4 3.8

6.51 to 7.00% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 740,675 35.9 31.0 31.8 2.7

7.01% and higher . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 495,672 39.8 34.4 35.5 2.3

$5,122,741 21.6 18.6 19.0 5.1

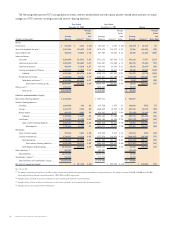

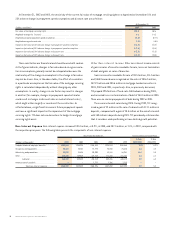

(Dollars in thousands) December 31, 2002

Prepayment Speed Assumption Weighted

Weighted Average Life

Interest Rate Tranche Unpaid Balance High Low Average (in Years)

0 to 5.50% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 387,417 27.4% 9.9% 12.7% 7.4

5.51 to 6.00% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 734,377 36.4 13.2 16.9 6.0

6.01 to 6.50% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,183,572 44.8 16.2 20.8 4.8

6.51 to 7.00% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,944,477 57.8 20.9 26.8 3.5

7.01% and higher . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,326,223 61.3 22.1 28.4 3.1

$5,576,066 48.9 17.7 22.7 4.3

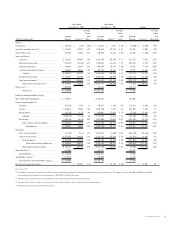

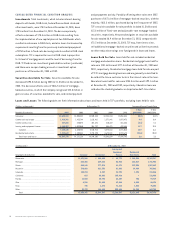

Mortgage banking revenues can be significantly impacted by the

amount of amortization and provision for impairment of mortgage

servicing rights. The valuation of mortgage servicing rights is a critical

accounting estimate for TCF. This estimate is based upon loan types,

note rates and prepayment assumptions. Changes in the mix of

loans, interest rates, defaults or prepayment speeds may have a

material effect on the amortization amount and possible impairment

in valuation. In a declining interest rate environment, prepayment

speed assumptions will increase and result in an acceleration in

the amortization of the mortgage servicing rights as the assumed

underlying portfolio declines and also may result in impairment as

the value of the mortgage servicing rights decline. TCF periodically

evaluates its capitalized mortgage servicing rights for impairment.

During 2003, TCF recorded $21.2 million in provision for impairment

on its capitalized mortgage servicing rights as a result of strong

refinance activity and high prepayments in the servicing portfolio.

In addition, in 2003, TCF recorded $28.5 million of permanent

impairment write-downs on its capitalized mortgage servicing rights.

These permanent impairment write-downs were offset with the

valuation allowance on the capitalized mortgage servicing rights.

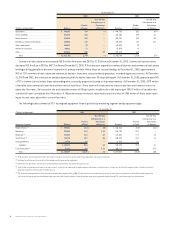

A key component in determining the fair value of mortgage servicing

rights is the projected cash flows of the underlying loan portfolio.

TCF uses projected cash flows and related prepayment assumptions

based on management’s best estimates. The range in prepayment

assumptions at December 31, 2003 and 2002 reflects management’s

assumption of higher initial prepayments in early periods that decline

over time and level off to a constant prepayment speed. In light of

the continued decline in interest rates since December 31, 2002, TCF

lowered the weighted-average discount rate used in the determina-

tion of the fair value of mortgage servicing rights at December 31,

2003. See Notes 1 and 10 of Notes to Consolidated Financial

Statements for additional information concerning TCF’s mortgage

servicing rights.