TCF Bank 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TCF FINANCIAL CORPORATION

2003 Annual Report

INVESTING IN THE FUTURE

Table of contents

-

Page 1

TCF FINANCIAL CORPORATION 2003 Annual Report INVESTING IN THE FUTURE -

Page 2

... Financial Corporation is a Wayzata, Minnesota-based national financial holding company with $11.3 billion in assets. TCF has more than 400 banking offices in Minnesota, Illinois, Michigan, Wisconsin, Colorado and Indiana. Other TCF affiliates provide leasing and equipment finance, mortgage banking... -

Page 3

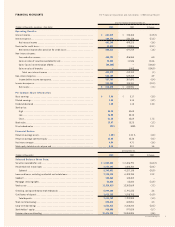

...31, (Dollars in thousands) 2002 % Change Selected Balance Sheet Data: Securities available for sale ...Residential real estate loans ...Subtotal ...Loans and leases excluding residential real estate loans ...Goodwill ...Mortgage servicing rights ...Total assets ...Checking, savings and money market... -

Page 4

... the investment community's recognition of the growth of TCF core businesses, TCF's stock price closed at $51.35 per share at December 31, 2003, up 17.5 percent from $43.69 per share at year-end 2002. Our annualized total return to investors over the past ten years was over 22 percent. Our dividend... -

Page 5

...home equity loans, commercial real estate loans and mortgage-backed securities prepaid or refinanced at unforeseen record levels. Residential loans and mortgage-backed securities shrank $1.5 billion in total during the year. We chose not to replace this runoff with low-yielding, long-term fixed rate... -

Page 6

... $44.8 million in 2003. Increased gains on sales of mortgage loans and mortgage-backed securities offset this expense. 5. The unplanned VISA® debit card litigation settlement reduced TCF's interchange revenues by approximately $6 million in 2003. Although TCF was not a party to this litigation, the... -

Page 7

... 2003, or 14 percent. Certificates of Deposits continued to decline in 2003, as other lower-cost funding sources were available to TCF. The number of checking accounts grew by 106,000 accounts (eight percent) and totaled 1,443,821 accounts at year end. Credit Quality Credit Quality improved in 2003... -

Page 8

... success. "Totally Free Checking," "Free Small Business Checking," home equity loans, debit cards, investment sales and supermarket branch banking have been our most successful innovations. Over the last few years we have introduced TCF Express.com® (our online banking service), TCF Express Trade... -

Page 9

... always a risk (the Visa debit card lawsuit is a good example of this legal risk). New Branch1 Banking Fees & Other Revenue2 (millions of dollars) $126 New Branch1 Total Deposits (millions of dollars) $1,225 $1,088 New Branch Expansion (number of new branches opened) Supermarket 106 Traditional... -

Page 10

... and has no exotic derivatives, foreign loans, bank owned life insurance, etc. In our opinion, TCF's accounting is conservative. A careful reading of this Annual Report will tell you generally everything about our company. We try to keep our financial reporting simple, but as complete as possible... -

Page 11

.... Thank you for your continued support and investment in TCF. We are looking forward to a better year in 2004 and remain optimistic about TCF's future. William A. Cooper Chairman of the Board and Chief Executive Officer Lynn A. Nagorske President and Chief Operating Officer 2003 Annual Report 9 -

Page 12

... in total. being open longer hours seven days a week and open on most holidays. TCF offers a large supermarket branch network, complemented by traditional branches, providing customers with alternative locations to conduct their banking. TCF's free on-line banking services, extensive ATM network and... -

Page 13

...made TCF one of the top performing banks in growing commercial and small business customers. In 2004, TCF plans to open 22 new traditional offices. Supermarket banking continues to play a key role in TCF's ability to the United States. provide the most convenient banking services in the markets we... -

Page 14

... our extensive network of Express Teller ATMs for cash withdrawals, deposits and easy access to account information. Many TCF customers enjoy banking through the Internet using one of TCF's online banking products. During 2003, TCF Totally Free Online 12 TCF Financial Corporation and Subsidiaries -

Page 15

..., account history, stock research, and order placement is available 24 hours a day, seven days a week. Customers preferring personal service can contact a personal trading representative. Small business customers may also take advantage of TCF's Internet banking services. Totally Free Online Banking... -

Page 16

... product. In 2003, we added over 105,000 checking accounts from our 401-branch network, increasing our total to 1,443,821 check- prolonged period of low rates and increased refinancing activity. Also experiencing high refinance activity for most of the year, TCF Mortgage Corporation funded... -

Page 17

...® ATMs, TCF Express Cards, phone banking and Internet banking. • TCF operates like a partnership. We're organized geographically and by function, with profit center goals and objectives. TCF emphasizes return on average assets, return on average equity, and earnings per 2003 Annual Report 15 -

Page 18

... cost checking • TCF places a high priority on the development of technology to enhance accounts by offering convenient products, such as "Totally Free productivity, customer service and new products. Properly applied Checking". TCF uses the checking account as its core deposit account technology... -

Page 19

... Taxes Consolidated Financial Condition Analysis Investments Securities Available for Sale Loans Held for Sale Loans and Leases Allowance for Loan and Lease Losses Non-Performing Assets Past Due Loans and Leases Potential Problem Loans and Leases Liquidity Management Deposits New Branch Expansion... -

Page 20

... supermarket bank branches, campus banking, EXPRESS TELLER® ATMs, VISA® debit cards, commercial lending, small business banking, consumer lending, mortgage banking, leasing and equipment finance and investment, brokerage and insurance services. TCF emphasizes the "Totally Free" checking account as... -

Page 21

... of debit cards. TCF's mortgage banking business originates residential mortgage loans and sells them to investors, primarily retaining the servicing rights and related servicing revenue. Generally accepted accounting principles require TCF to record the value of the servicing rights on the balance... -

Page 22

... 16.2 Consolidated Financial Condition: At December 31, (Dollars in thousands, except per-share data) Securities available for sale ...Residential real estate loans ...Subtotal ...Loans and leases excluding residential real estate loans ...Total assets ...Checking, savings and money market deposits... -

Page 23

... per diluted common share in 2001. Operating Segment Results BANKING, comprised of deposits and investment products, commercial banking, small business banking, consumer lending, residential lending and treasury services, reported net income of $181 million for 2003, down 10% from $201.1 million in... -

Page 24

...101) (67) (89) (87) (Dollars in thousands) Assets: Investments ...Securities available for sale (2) ...Loans held for sale ...Loans and leases: Consumer ...Commercial real estate ...Commercial business ...Leasing and equipment finance ...Subtotal ...Residential real estate ...Total loans and leases... -

Page 25

(Dollars in thousands) Assets: Investments ...Securities available for sale (2) ...Loans held for sale ...Loans and leases: Consumer ...Commercial real estate ...Commercial business ...Leasing and equipment finance ...Subtotal ...Residential real estate ...Total loans and leases (3) ...Total ... -

Page 26

... sale ...Loans and leases: Consumer ...Commercial real estate ...Commercial business ...Leasing and equipment finance ...Residential real estate ...Total interest income ...Interest expense: Checking ...Savings ...Money market ...Certificates ...Short-term borrowings ...Long-term borrowings ...Total... -

Page 27

...due to rate changes. The increases in 2001, in net interest income and net interest margin were primarily due to the growth in higher yielding commercial and consumer loans and leasing and equipment finance along with the strong growth in low-cost checking, savings and money market deposits, as well... -

Page 28

... by TCF's expanding branch network and customer base and increased gains on sales of loans which drove the increase in mortgage banking revenue. The increases in fees and service charges and debit card revenue primarily reflect an increase in the number of checking accounts, which totaled 1,443... -

Page 29

... and ATM network: (Dollars in thousands) TCF Check Cards ...Other ATM Cards ...Total EXPRESS TELLER® ATM cards outstanding ...Number of EXPRESS TELLER® ATM's (1) ...TCF Check Card: Average number of checking accounts with debit cards ...Percentage of customers with TCF Check Cards who were active... -

Page 30

...fund sales volumes totaled $239.5 million for the year ended December 31, 2003, compared with $242.7 million during 2002. The decreased sales volumes during 2003 were the result of the lower interest rate environment which reduced the rate of return on annuity products offered by insurance companies... -

Page 31

... and provision for impairment of mortgage servicing rights. The valuation of mortgage servicing rights is a critical accounting estimate for TCF. This estimate is based upon loan types, note rates and prepayment assumptions. Changes in the mix of loans, interest rates, defaults or prepayment speeds... -

Page 32

... servicing rights. TCF does not use derivatives to hedge its mortgage servicing rights asset. Other Non-interest Income Other non-interest income consists of gains on sales of securities available for sale, losses on termination of debt and gains on sales of branches. Gains on securities available... -

Page 33

... to increases in retail banking activities and promotional expenses associated with the TCF Express Phone Card rewards program. Other non-interest expense increased $3.4 million, or 2.4%, in 2003, primarily the result of higher levels of mortgage banking production and prepayment activity. In 2002... -

Page 34

... Annual Growth Rate 1-Year 5-Year 2003/2002 2003/1998 20.8% 14.1% 4.4 18.8 (2.8) 8.1 11.7 23.8 12.9 16.1 (32.6) (20.3) 2.8 3.2 (In thousands) Geographic Distribution: Minnesota ...Michigan ...Illinois ...Wisconsin ...Colorado ...California ...Florida ...Ohio ...Texas ...Other ...Total ... Consumer... -

Page 35

... TCF's residential real estate loan portfolio was comprised of $894.3 million of fixed-rate loans and $312.4 million of adjustable-rate loans. Consumer loans increased $624.5 million from year-end 2002 to $3.6 billion at December 31, 2003, driven by an increase of $632.4 million in home equity loans... -

Page 36

... its commercial business and commercial real estate lending activity generally to borrowers located in its primary markets. With a focus on secured lending, at December 31, 2003, approximately 99% of TCF's commercial real estate and commercial business loans were secured either by properties or... -

Page 37

...leasing activity is subject to risk of cyclical downturns and other adverse economic developments. TCF's ability to increase its lease portfolio is dependent upon its ability to place new equipment in service. In an adverse economic environment, there may be a decline in the demand for some types of... -

Page 38

... consumer loans and $379 million of variable-rate commercial real estate and commercial business loans at their interest rate floor. (2) Allowance for Loan and Lease Losses Credit risk is the risk of loss from a customer default on a loan or lease. TCF has in place a process to identify and manage... -

Page 39

... sets forth information detailing the allowance for loan and lease losses and selected key indicators: (Dollars in thousands) Balance at beginning of year ...Transfers to loans held for sale ...Charge-offs: Consumer ...Commercial real estate ...Commercial business ...Leasing and equipment finance... -

Page 40

... and commercial real estate, consumer and leasing and equipment finance charge-offs and the reduction in non-accrual loans and leases, partially offset by growth in loans and leases. The following table sets forth additional information regarding net charge-offs: Year Ended December 31, 2003 Net... -

Page 41

... following table summarizes TCF's over 30-day delinquent loan and lease portfolio, by loan type: At December 31, 2003 (Dollars in thousands) Consumer ...Commercial real estate ...Commercial business ...Leasing and equipment finance ...Residential real estate ...Total ...Principal Balances $17,673 58... -

Page 42

...parent company only) include cash dividends from TCF's wholly owned bank subsidiary, issuance of equity securities and borrowings under a $105 million line of credit. TCF's National Bank's ability to pay dividends or make other capital distributions to TCF is restricted by regulation and may require... -

Page 43

...Ended December 31, (Dollars in thousands) Number of new branches opened during the year Traditional ...Supermarket ...Total ...Number of new branches* at year-end Traditional ...Supermarket ...Total ...Percent of total branches ...Number of checking accounts ...Deposits: Checking ...Savings ...Money... -

Page 44

... real estate loans and mortgagebacked securities which reduces TCF's reliance on borrowings. See Notes 12 and 13 of Notes to Consolidated Financial Statements for detailed information on TCF's borrowings. Included in long-term borrowings at December 31, 2003 are $767.5 million of fixed-rate... -

Page 45

..., the total commitment amounts do not necessarily represent future cash requirements. Collateral predominantly consists of residential and commercial real estate. Loans serviced with recourse represent a contingent guarantee based upon the failure to perform by another party. These loans consist of... -

Page 46

... rate consumer loans and $303.9 million of variable rate commercial loans currently at their floor rates. Additionally, increases in interest rates could have an adverse impact on TCF's checking account balances, if customers transfer some of these funds to higher interest rate deposit products... -

Page 47

...Securities available for sale (1) ...Real estate loans (1) ...Leasing and equipment finance (1) ...Other loans (1) (2) ...Investments ...Interest-bearing liabilities: Checking deposits (3) ...Savings deposits (3) ...Money market deposits (3) ...Certificate deposits ...Short-term borrowings ...Long... -

Page 48

... TCF's conference calls can be obtained from the investor relations section within TCF's website at www.tcfexpress.com or by contacting TCF's Corporate Communications Department at (952) 745-2760. The website also includes free access to company news releases, TCF's annual report, quarterly reports... -

Page 49

...; changes in credit and other risks posed by TCF's loan, lease and investment portfolios; technological, computer-related or operational difficulties; adverse changes in securities markets; the risk that TCF could be unable to effectively manage the volatility of its mortgage banking business... -

Page 50

... data) 2003 2002 Assets Cash and due from banks ...Investments ...Securities available for sale ...Loans held for sale ...Loans and leases: Consumer ...Commercial real estate ...Commercial business ...Leasing and equipment finance ...Subtotal ...Residential real estate ...Total loans and leases... -

Page 51

... for credit losses ...Non-interest income: Fees and service charges ...Debit card revenue ...ATM revenue ...Investments and insurance commissions ...Subtotal ...Leasing and equipment finance ...Mortgage banking ...Other ...Fees and other revenue ...Gains on sales of securities available for sale... -

Page 52

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Dollars in thousands) Balance, December 31, 2000 ......Change in shares held in trust for deferred compensation plans, at cost ...Balance, December 31, 2003 ...See accompanying notes to consolidated financial statements. 50 TCF Financial Corporation... -

Page 53

Number of Common Shares Issued Common Stock Additional Paid-in Capital Retained Earnings Accumulated Other Comprehensive Income (Loss) Treasury Stock and Other Total 92,755,659 36,115) - - - - - 92,719,544 80,607) - -...,029) (150,356) - (1,228) 9,701 3,322 - $ 920,858 2003 Annual Report 51 -

Page 54

...Cash and due from banks at end of year ...Supplemental disclosures of cash flow information: Cash paid for: Interest on deposits and borrowings ...Income taxes ...Transfer of loans and leases to other assets ...See accompanying notes to consolidated financial statements. 52 TCF Financial Corporation... -

Page 55

... estimates. POLICIES RELATED TO CRITICAL ACCOUNTING ESTIMATES conditions and other relevant factors. Impaired loans include all non-accrual and restructured commercial real estate and commercial business loans and equipment finance loans. Consumer loans, residential real estate loans and leases... -

Page 56

... known. Pension Plan As summarized in Note 18, TCF provides pension benefits to eligible employees in the TCF Cash Balance Pension Plan. In accordance with Statement of Financial Accounting Standards ("SFAS") No. 87 "Employers' Accounting for Pensions," the Company does not consolidate the assets... -

Page 57

...impaired, are reviewed regularly by management and are placed on non-accrual status when the collection of interest or principal is 90 days or more past due (150 days or six payments or more past due for loans secured by residential real estate), unless the loan or lease is adequately secured and in... -

Page 58

... credit and forward mortgage loan sales commitments. See Notes 19 and 20 for additional information concerning these derivative financial instruments. Note 2. Cash and Due from Banks At December 31, 2003, TCF was required by Federal Reserve Board ("FRB") regulations to maintain reserve balances... -

Page 59

...: (Dollars in thousands) Consumer: Home equity ...Other secured ...Unsecured ...Total consumer ...Commercial: Commercial real estate: Permanent ...Construction and development ...Total commercial real estate ...Commercial business ...Total commercial ...Leasing and equipment finance: Equipment... -

Page 60

... the ordinary course of business on normal credit terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unrelated persons. The aggregate amount of loans to executive officers of TCF was $25 thousand at December 31, 2003 and 2002. During 2002... -

Page 61

...of total loan and lease balances at year end ...2003 $ 77,008 12,532 (16,369) 3,448 (12,921) $ 76,619 .16% .92 Year Ended December 31, 2002 $ 75,028 22,006 (24,361) 4,335 (20,026) $ 77,008 .25% .95 2001 $ 66,669 20,878 (16,951) 4,432 (12,519) $ 75,028 .15% .91 Information relating to impaired loans... -

Page 62

... Year Ended December 31,: 2004 ...2005 ...2006 ...2007 ...2008 ...Mortgage Servicing Rights $12,389 10,063 7,763 5,917 4,540 Deposit Base Intangibles $ 1,662 1,659 1,630 913 17 Total $14,051 11,722 9,393 6,830 4,557 Note 10. Mortgage Banking The activity in mortgage servicing rights and the related... -

Page 63

... of Financial Condition. These custodial deposits relate primarily to mortgage servicing operations and represent funds due to investors on mortgage loans serviced by TCF and customer funds held for real estate taxes and insurance. The estimated fair value of mortgage servicing rights included in... -

Page 64

... and loan note payable ...Line of credit ...Total ...Maximum month-end balance Federal funds purchased ...Securities sold under repurchase agreements ...Treasury, tax and loan note payable ...Line of credit ...N.A. Not applicable. 2003 Amount $ 219,000 607,631 14,781 37,000 $ 878,412 2002 Rate .95... -

Page 65

...for the callable advances and repurchase agreements outstanding at December 31, 2003 were as follows (dollars in thousands): WeightedAverage Rate 6.20% 5.46 5.25 6.02 4.85 5.67 Year 2005 2006 2009 2010 2011 ... Stated Maturity $342,000 3,000 122,500 100,000 200,000 $767,500 2003 Annual Report 63 -

Page 66

...Deferred tax liabilities: Lease financing ...Subsidiary tax year-end ...Loan fees and discounts ...Mortgage servicing rights ...Pension plan ...Securities available for sale ...Other, net ...Total deferred tax liabilities ...Net deferred tax liabilities ...At December 31, 2003 $ 34,325 27,108 61,433... -

Page 67

... general, TCF National Bank may not declare or pay a dividend to TCF in excess of 100% of its net profits for that year combined with its retained net profits for the preceding two calendar years without prior approval of the Office of the Comptroller of the Currency ("OCC"). 2003 Annual Report 65 -

Page 68

... total risk-based capital levels, and applicable percentages of adjusted assets, together with the excess over minimum capital requirements: Actual (Dollars in thousands) As of December 31, 2003: Tier 1 leverage capital TCF Financial Corporation ...TCF National Bank ...Tier 1 risk-based capital TCF... -

Page 69

...TCF Cash Balance Pension Plan (the "Pension Plan") is a qualified defined benefit plan covering all full time employees and certain part-time employees who are at least 21 years old and have completed a year of eligibility service with TCF. TCF makes a monthly allocation to the participant's account... -

Page 70

... 6.5% 4.5 Postretirement Plan Year Ended December 31, 2002 6.5% N.A. Assumptions used to determine benefit obligations Discount rate ...Rate of compensation increase ...N.A. Not applicable. 2003 6.0% 4.5 2001 7.5% 4.5 2003 6.0% N.A. 2001 7.5% N.A. 68 TCF Financial Corporation and Subsidiaries -

Page 71

... Plan Assets at December 31 2003 2002 75% 67% 21 26 2 5 2 2 100% 100% Asset Category Equity securities, excluding TCF Financial Corporation common stock ...Fixed income securities ...Cash equivalents ...TCF Financial Corporation common stock ...Total ... The assets in TCF's pension plan are managed... -

Page 72

... on management's credit evaluation of the customer. Financial instruments with off-balance sheet risk are summarized as follows: (In thousands) Commitments to extend credit: Consumer ...Commercial ...Leasing and equipment finance ...Other ...Total commitments to extend credit ...Loans serviced with... -

Page 73

... are estimated by discounting contractual cash flows adjusted for prepayment estimates, using interest rates currently being offered for loans with similar terms to borrowers with similar credit risk characteristics. Deposits The fair value of checking, savings and money market deposits is deemed... -

Page 74

... mortgage loan sales commitments (1) ...Loans: Consumer ...Commercial real estate ...Commercial business ...Equipment finance loans ...Residential real estate ...Allowance for loan losses (2) ...Financial instrument liabilities: Checking, savings and money market deposits ...Certificates of deposit... -

Page 75

... the following: (In thousands) Deposit account losses ...Postage and courier ...Telecommunication ...Debit card processing ...ATM processing ...Office supplies ...Mortgage servicing liquidation expense ...Federal deposit insurance and OCC assessments ...Deposit base intangible amortization ...Other... -

Page 76

... as reportable operating segments. Banking includes the following operating units that provide financial services to customers: deposits and investment products, commercial lending, consumer lending, residential lending and treasury services. Management of TCF's banking area is organized by state... -

Page 77

...for the years ended December 31, 2003, 2002 and 2001 are as follows: Condensed Statements of Financial Condition (In thousands) Assets: Cash ...Interest-bearing deposits with banks ...Investment in TCF National Bank ...Premises and equipment ...Dividends receivable from TCF National Bank ...Accounts... -

Page 78

... ...Total adjustments ...Net cash provided by operating activities ...Cash flows from investing activities: Net (increase) decrease in interest-bearing deposits with banks ...Investments in TCF National Bank, net ...Loan to deferred compensation plans, net ...Purchases of premises and equipment, net... -

Page 79

... of financial condition of TCF Financial Corporation and subsidiaries as of December 31, 2003 and 2002, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the years in the three-year period ended December 31, 2003. These consolidated financial... -

Page 80

...: Securities available for sale ...Residential real estate loans ...Subtotal ...Loans and leases excluding residential real estate loans ...Total assets ...Checking, savings and money market deposits ...Certificates of deposit ...Total deposits ...Borrowings ...Stockholders' equity ...Dec. 31, 2003... -

Page 81

... JASPER Executive Vice Presidents PAUL B. BRAWNER WALLACE A. FUDOLD GREGG R. GOUDY TCF NATIONAL BANK ILLINOIS/WISCONSIN/ INDIANA President TIMOTHY P. BAILEY Senior Vice Presidents MATTHEW G. LAMB EDWARD F. TIERNEY CHARLES A. SELL, JR. ROBERT J. STARK Chief Operating Officer, Retail Senior Vice... -

Page 82

...WINTHROP RESOURCES CORPORATION Headquarters 11100 WAYZATA BOULEVARD SUITE 800 MINNETONKA, MN 55305 (952) 936-0226 President and Chief Operating Officer Supermarket Branches CHICAGOLAND (157) MILWAUKEE AREA (13) KENOSHA/RACINE AREA (3) INDIANA (5) MICHIGAN Headquarters 401 EAST LIBERTY STREET ANN... -

Page 83

...'s report on Form 10-K is filed with the Securities and Exchange Commission and is available to shareholders without charge. Information may also be obtained from: TCF Financial Corporation Corporate Communications 200 Lake Street East EX0-02-C Wayzata, MN 55391-1693 (952) 745-2760 CORPORATE WEBSITE... -

Page 84

... in Security Prices, Graduate School of Business, The University of Chicago 2004. Used with permission. All rights reserved. crsp.com. Credit Ratings Last Rating Action Moody's TCF National Bank: Outlook Issuer Long-term deposits Short-term deposits Bank financial strength Last Review February 2003... -

Page 85

ILLUSTRATION: ©TIM ZELTNER www.i2iart.com -

Page 86

TCF Financial Corporation 200 Lake Street East Wayzata, MN 55391-1693 www.tcfexpress.com E In an effort to help save our natural resources, the cover and inside pages of this annual report are printed on paper stock made from 30% post-consumer waste and a total 50% recycled fiber content. This ...