Sharp 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sharp Annual Report 2007 59

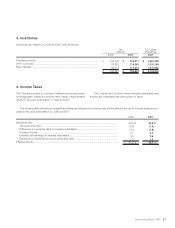

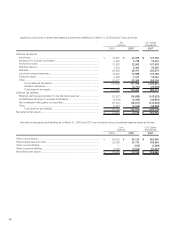

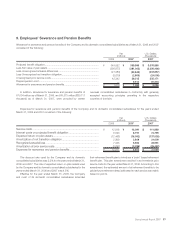

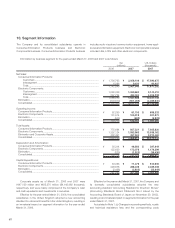

9. Employees’ Severance and Pension Benefits

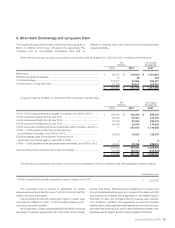

Projected benefit obligation...............................................................................

Less-Fair value of plan assets ...........................................................................

Less-Unrecognized actuarial differences...........................................................

Less-Unrecognized net transition obligation......................................................

Unrecognized prior service costs ......................................................................

Prepaid pension cost........................................................................................

Allowance for severance and pension benefits..................................................

In addition, allowance for severance and pension benefits of

¥7,034 million as of March 31, 2006, and ¥9,373 million ($80,111

thousand) as of March 31, 2007, were provided by certain

overseas consolidated subsidiaries in conformity with generally

accepted accounting principles prevailing in the respective

countries of domicile.

$ 3,076,880

(3,256,436)

(203,837)

(24,008)

335,171

81,316

$ 9,086

¥ 359,995

(381,003)

(23,849)

(2,809)

39,215

9,514

¥ 1,063

¥ 349,052

(356,977)

(27,280)

(5,619)

42,342

—

¥ 1,518

200720072006

Yen

(millions) U.S. Dollars

(thousands)

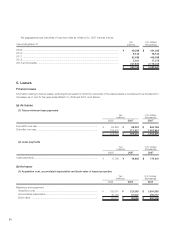

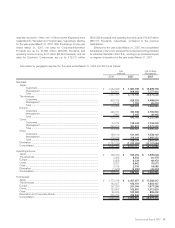

Service costs .......................................................................................

Interest costs on projected benefit obligation .......................................

Expected return on plan assets............................................................

Amortization of net transition obligation................................................

Recognized actuarial loss ......................................................................

Amortization of prior service costs..........................................................

Expenses for severance and pension benefits......................................

$ 111,889

74,795

(137,538)

24,009

28,991

(26,462)

$ 75,684

¥ 13,091

8,751

(16,092)

2,809

3,392

(3,096)

¥ 8,855

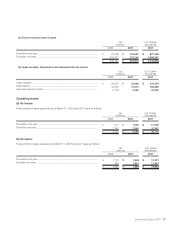

The discount rate used by the Company and its domestic

consolidated subsidiaries was 2.5% for the years ended March 31,

2006 and 2007. The rate of expected return on plan assets used

by the Company and its domestic consolidated subsidiaries for the

years ended March 31, 2006 and 2007 was 4.5%.

Effective for the year ended March 31, 2006, the Company

and most of its domestic consolidated subsidiaries amended

their retirement benefit plan to introduce a “point” based retirement

benefit plan. This plan amendment resulted in an immaterial prior

service costs for the year ended March 31, 2006. According to this

amendment, the estimated amount of all retirement benefits to be

paid at future retirement dates is allocated to each service year mainly

based on points.

20072007

Yen

(millions) U.S. Dollars

(thousands)

¥ 12,918

8,520

(12,468)

2,809

7,235

(3,097)

¥ 15,917

2006

Expenses for severance and pension benefits of the Company and its domestic consolidated subsidiaries for the years ended

March 31, 2006 and 2007 consisted of the following:

Allowance for severance and pension benefits of the Company and its domestic consolidated subsidiaries as of March 31, 2006 and 2007

consisted of the following: