Sharp 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sharp Annual Report 2007 49

between fair market values and the carrying amount is recognized

as loss in the period of decline. If the net asset value of other secu-

rities, except for interest-bearing securities, with no available fair mar-

ket values declines significantly, such securities are written down to

the net asset value by charging to income. In these cases, such fair

market value or the net asset value is carried forward to the next year.

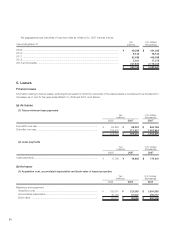

( f ) Leases

Finance leases, except those leases for which the ownership of the

leased assets is considered to be transferred to the lessee, are pri-

marily accounted for as operating leases.

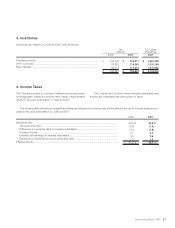

(g) Inventories

Finished products are principally stated at the lower of moving aver-

age cost or market, however, finished products held by overseas

consolidated subsidiaries are principally valued at the lower of first-

in, first-out cost or market. Work in process and raw materials are

principally stated at the current production and purchase costs,

respectively, not in excess of estimated realizable value.

(h) Depreciation and amortization

Depreciation of plant and equipment is primarily computed

on the declining-balance method, except for machinery and equip-

ment in the Mie and Kameyama plants, which are depreciated on

the straight line method, over the estimated useful lives. Buildings

acquired by the Company and its domestic consolidated subsidiaries

on and after April 1, 1998 are depreciated on the straight-line method.

Properties at overseas consolidated subsidiaries are mainly depre-

ciated on the straight-line method.

Maintenance and repairs including minor renewals and better-

ments are charged to income as incurred.

( i ) Accrued bonuses

The Company and its domestic consolidated subsidiaries accrue

estimated amounts of employees’ bonuses based on estimated

amounts to be paid in the subsequent period.

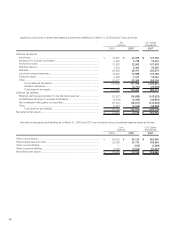

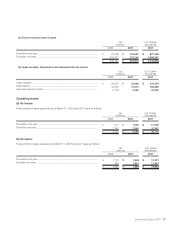

( j ) Income taxes

The asset and liability approach is used to recognize deferred tax

assets and liabilities for the expected future tax consequences of

temporary differences between the carrying amounts of assets and

liabilities for financial reporting purposes and the amounts used for

income tax purposes.

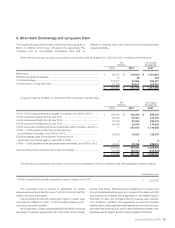

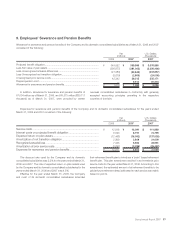

(k) Severance and pension benefits

The Company and its domestic consolidated subsidiaries have pri-

marily a trusteed noncontributory defined benefit pension plan for

their employees to supplement a governmental welfare pension plan.

Certain overseas consolidated subsidiaries primarily have

defined contribution pension plans and lump-sum retirement

benefit plans.

The Company and its domestic consolidated subsidiaries

provide the allowance for severance and pension benefits based on

the estimated amounts of projected benefit obligation and the fair

value of the plan assets at the balance sheet date. Projected ben-

efit obligation and expenses for severance and pension benefits are

determined based on the amounts actuarially calculated using cer-

tain assumptions.

The excess of the projected benefit obligation over the total of

the fair value of pension assets as of April 1, 2001 and the allowance

for severance and pension benefits recorded as of April 1, 2001 (the

“net transition obligation”) amounted to ¥69,090 million. The net tran-

sition obligation is being amortized in equal amounts over 7 years

commencing with the year ended March 31, 2002. Prior service costs

are amortized using the straight-line method over the average of the

estimated remaining service lives (16 years) commencing with the

current period. Actuarial gains and losses are primarily amortized using

the straight-line method over the average of the estimated remain-

ing service lives (16 years) commencing with the following period.

Effective for the year ended March 31, 2006, the Company and

its domestic consolidated subsidiaries adopted the new account-

ing standard “Partial Revision to Standards for Accounting for

Retirement Benefits” (Accounting Standards Board Statement

No.3 issued by the Accounting Standards Board of Japan on March

16, 2005), resulting in no impact on the financial statements for the

year ended March 31, 2006.

Effective for the year ended March 31, 2006, the consolidated

subsidiaries in the United Kingdom adopted a new accounting

standard for retirement benefits in the United Kingdom.

As a result, retained earnings decreased by ¥4,765 million since

the net transition obligation and actuarial losses were charged directly

to retained earnings with an immaterial impact on the net income

for the year ended March 31, 2006.

Effective for the year ended March 31, 2007, the consolidated

subsidiaries in the U.S.A. adopted the revised accounting standard

for retirement benefits in the U.S.A..

As a result, retained earnings decreased by ¥2,826 million ($24,154

thousand) since prior service costs and actuarial losses that had not

been recognized were charged directly to retained earnings with an

immaterial impact on the net income for the year ended March 31, 2007.

The effects of these changes on segment information are stated

in Note 10. Segment Information.

Directors and statutory auditors customarily receive lump-sum

payments upon their termination, subject to shareholders’

approval. Such payments are charged to income when paid.

( l ) Research and development expenses and software costs

Research and development expenses are charged to income

as incurred. The research and development expenses charged to

income amounted to ¥154,362 million and ¥189,852 million

($1,622,667 thousand) for the years ended March 31, 2006 and 2007,

respectively.

Software costs are recorded principally in prepaid expenses and

other. Software used by the Company are amortized by the