Sharp 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sharp Annual Report 2007 51

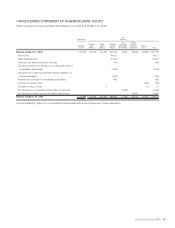

2007 in accordance with the Additional New Accounting

Standards. The accompanying consolidated statement of share-

holders’ equity for the year ended March 31, 2006, which was

voluntarily prepared for inclusion in the consolidated financial state-

ments, has not been adapted to the new presentation rules of 2007.

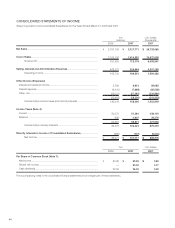

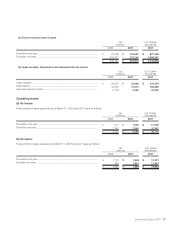

(4) Royalty and Technical Assistance Fees and Related Costs

Royalty and technical assistance fees and the corresponding costs

originally included in “Other, net” of Other Income (Expenses) were

reclassified into “Net sales” and “Cost of sales, ”respectively, effec-

tive for the year ended March 31, 2007. This change was made

to provide more appropriate presentation or classification of

income and cost, since the currently increased income arises from

main business activities carried out by the Company and its

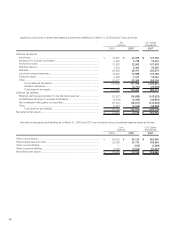

consolidated subsidiaries. With this change, for the year ended March

31, 2007, net sales are up by ¥15,614 million ($133,453 thousand),

cost of sales is up by ¥4,458 million ($38,103 thousand), and

operating income is up by ¥11,156 million ($95,350 thousand),

compared to the previous classification with no impact on income

before income taxes and minority interests for the year ended March

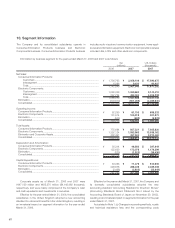

31, 2007. The effect of this change on segment information is stated

in Note 10. Segment Information.

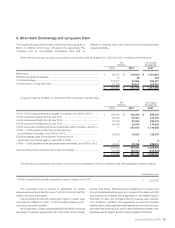

(5) Method of Amortization for Bond Issue Cost

Previously, bond issue cost was fully expensed as incurred.

Effective for the year ended March 31, 2007, however, bond issue

cost is capitalized as deferred assets and amortized under the straight

line method over the redemption period due to the following rea-

sons; This change was made to recognize the effect of financing

cost over the redemption period and realize appropriate periodic

accounting of profit and loss. One is because expansion in scale of

bond issue led to increase in bond issue cost. Other reasons include

the fact that effect of bond issue cost lasts over redemption period,

rather than only when incurred, and that amortized cost method is

adopted for bonds, under which the difference of ¥5,000 million

($42,735 thousand) between the issue price and face value will be

amortized over the redemption period. With this change, for the year

ended March 31, 2007, income before income taxes and minority

interests is up by ¥4,865 million ($41,581 thousand), compared to

the previous method.

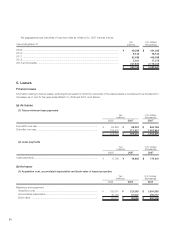

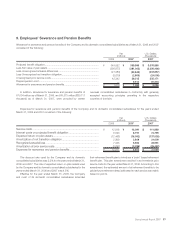

(p) Additional information

Previously, cost of software embedded in products was recognized

as manufacturing expense at the time of inspection due to practi-

cal convenience. Effective for the year ended March 31, 2007,

however, cost of software embedded in products is capitalized as

an asset when inspected and recognized as manufacturing

expense when the products with the embedded software are sold,

in accordance with “Accounting Standard for Research and

Development Costs.” This change was made due to the increase

in the amount of software embedded in products, as a result of

an increase of complicated and multifunctional products in this

fiscal year. With this change, for the year ended March 31, 2007,

operating income and income before income taxes and minority

interests are up by ¥10,455 million ($89,359 thousand), respectively,

compared to the previous method.

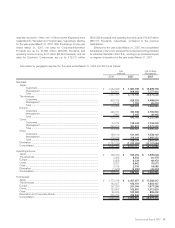

(q) Reclassifications

Certain prior year amounts have been reclassified to conform to 2007

presentation. These changes had no impact on previously

reported results of operations.