Salesforce.com 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

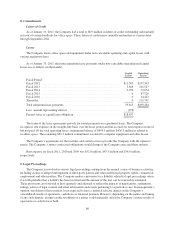

8. Commitments

Letters of Credit

As of January 31, 2011, the Company had a total of $8.9 million in letters of credit outstanding substantially

in favor of certain landlords for office space. These letters of credit renew annually and mature at various dates

through September 2021.

Leases

The Company leases office space and equipment under non-cancelable operating and capital leases with

various expiration dates.

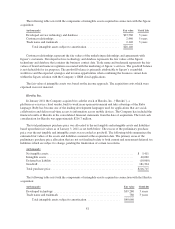

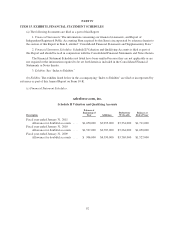

As of January 31, 2011, the future minimum lease payments under non-cancelable operating and capital

leases are as follows (in thousands):

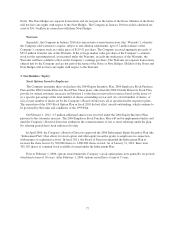

Capital

Leases

Operating

Leases

Fiscal Period:

Fiscal 2012 ..................................................... $11,503 $107,343

Fiscal 2013 ..................................................... 5,818 101,527

Fiscal 2014 ..................................................... 2,292 79,074

Fiscal 2015 ..................................................... 0 47,126

Fiscal 2016 ..................................................... 0 44,423

Thereafter ...................................................... 0 119,791

Total minimum lease payments ..................................... 19,613 $499,284

Less: amount representing interest ................................... (976)

Present value of capital lease obligation ............................... $18,637

The terms of the lease agreements provide for rental payments on a graduated basis. The Company

recognizes rent expense on the straight-line basis over the lease period and has accrued for rent expense incurred

but not paid. Of the total operating lease commitment balance of $499.3 million, $436.9 million is related to

facilities space. The remaining $62.3 million commitment is related to computer equipment and other leases.

The Company’s agreements for the facilities and certain services provide the Company with the option to

renew. The Company’s future contractual obligations would change if the Company exercised these options.

Rent expense for fiscal 2011, 2010 and 2009 was $52.8 million, $47.3 million and $36.0 million,

respectively.

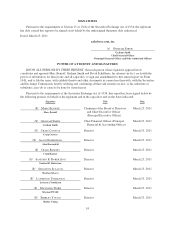

9. Legal Proceedings

The Company is involved in various legal proceedings arising from the normal course of business activities,

including claims of alleged infringement of third-party patents and other intellectual property rights, commercial,

employment and other matters. The Company makes a provision for a liability related to legal proceedings when

it is both probable that a liability has been incurred and the amount of the loss can be reasonably estimated.

These provisions are reviewed at least quarterly and adjusted to reflect the impacts of negotiations, settlements,

rulings, advice of legal counsel and other information and events pertaining to a particular case. In management’s

opinion, resolution of these matters is not expected to have a material adverse impact on the Company’s

consolidated results of operations, cash flows or financial position. However, depending on the nature and timing

of any such dispute, an unfavorable resolution of a matter could materially affect the Company’s future results of

operations or cash flows or both.

86