Salesforce.com 2011 Annual Report Download - page 76

Download and view the complete annual report

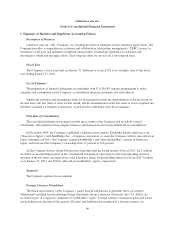

Please find page 76 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• The service has been provided to the customer;

• The collection of the fees is reasonably assured; and

• The amount of fees to be paid by the customer is fixed or determinable.

The Company’s arrangements do not contain general rights of return.

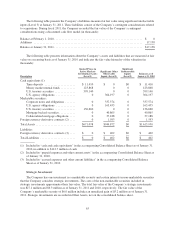

Subscription and support revenues are recognized ratably over the contract terms beginning on the

commencement date of each contract. Amounts that have been invoiced are recorded in accounts receivable and

in deferred revenue or revenue, depending on whether the revenue recognition criteria have been met.

Professional services and other revenues, when sold with subscription and support offerings, are accounted

for separately when these services have value to the customer on a standalone basis and there is objective and

reliable evidence of fair value of each deliverable. When accounted for separately, revenues are recognized as the

services are rendered for time and material contracts, and when the milestones are achieved and accepted by the

customer for fixed price contracts. The majority of the Company’s consulting contracts are on a time and

materials basis. Training revenues are recognized after the services are performed. For revenue arrangements

with multiple deliverables, such as an arrangement that includes subscription, premium support and consulting or

training services, the Company allocates the total amount the customer will pay to the separate units of

accounting based on their relative fair values, as determined by the price of the undelivered items when sold

separately.

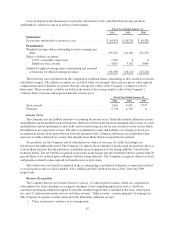

In determining whether the consulting services can be accounted for separately from subscription and

support revenues, the Company considers the following factors for each consulting agreement: availability of the

consulting services from other vendors, whether objective and reliable evidence for fair value exists for the

undelivered elements, the nature of the consulting services, the timing of when the consulting contract was

signed in comparison to the subscription service start date, and the contractual dependence of the subscription

service on the customer’s satisfaction with the consulting work. If a consulting arrangement does not qualify for

separate accounting, the Company recognizes the consulting revenue ratably over the remaining term of the

subscription contract. Additionally, in these situations, the Company defers only the direct costs of the consulting

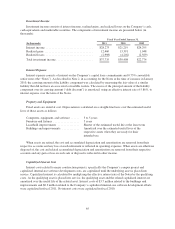

arrangement and amortizes those costs over the same time period as the consulting revenue is recognized. As of

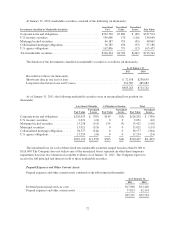

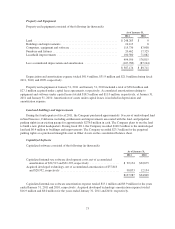

January 31, 2011 and 2010, the deferred cost on the accompanying consolidated balance sheet totaled $28.1

million and $19.1 million, respectively. These deferred costs are included in prepaid expenses and other current

assets and other assets.

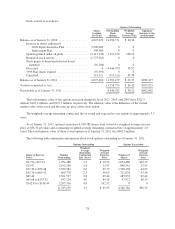

Deferred Revenue

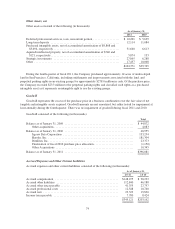

Deferred revenue primarily consists of billings or payments received in advance of revenue recognition

from the Company’s subscription service described above and is recognized as the revenue recognition criteria

are met. The Company generally invoices its customers in annual or quarterly installments. Accordingly, the

deferred revenue balance does not represent the total contract value of annual or multi-year, non-cancelable

subscription agreements. Deferred revenue also includes certain deferred professional services fees which are

recognized as revenue ratably over the subscription contract term. The Company defers the professional service

fees in situations where the professional services and subscription contracts are accounted for as a single unit of

accounting. Deferred revenue that will be recognized during the succeeding 12-month period is recorded as

current deferred revenue and the remaining portion is recorded as noncurrent. Approximately 6 percent of total

deferred revenue as of both January 31, 2011 and 2010, related to deferred professional services revenue.

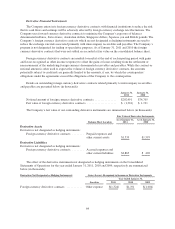

Deferred Commissions

Deferred commissions are the incremental costs that are directly associated with non-cancelable

subscription contracts with customers and consist of sales commissions paid to the Company’s direct sales force.

68