Salesforce.com 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

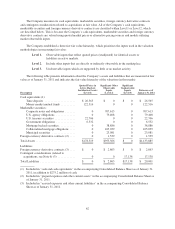

Notes are convertible at the holders’ option for the quarter ending April 30, 2011. Upon conversion of any Notes,

the Company will deliver cash up to the principal amount of the Notes and, with respect to any excess conversion

value greater than the principal amount of the Notes, shares of the Company’s common stock, cash, or a

combination of both. Therefore, for the quarter ending April 30, 2011, the Notes will be reclassified to a current

liability on the Company’s consolidated balance sheet. In addition to the Notes being reclassified to a current

liability as described above, a portion of the equity component of the Notes, as described in Note 2 of the

consolidated financial statements, will be reclassified from additional paid-in capital to temporary salesforce.com

stockholders’ equity on the consolidated balance sheet.

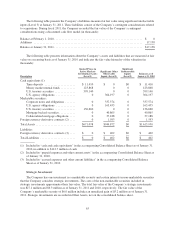

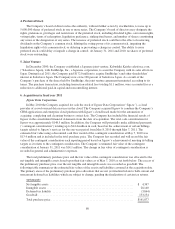

New Accounting Pronouncement

In September 2009, the FASB issued Update No. 2009-13, “Multiple-Deliverable Revenue Arrangements—

a consensus of the FASB Emerging Issues Task Force” (ASU 2009-13). It updates the existing multiple-element

revenue arrangements guidance currently included under ASC 605-25, which originated primarily from the

guidance in EITF Issue No. 00-21, “Revenue Arrangements with Multiple Deliverables” (EITF 00-21). The

revised guidance primarily provides two significant changes: 1) eliminates the need for objective and reliable

evidence of the fair value for the undelivered element in order for a delivered item to be treated as a separate unit

of accounting, and 2) requires the use of the relative selling price method to allocate the entire arrangement

consideration. In addition, the guidance also expands the disclosure requirements for revenue recognition. ASU

2009-13 will be effective for the Company at the start of fiscal 2012. The Company believes the future impact of

this new accounting pronouncement will not be material to consolidated net income.

Reclassifications

Certain reclassifications to the fiscal 2010 and 2009 balances were made to conform to the current period

presentation. These reclassifications include deferred income taxes, strategic investments and income taxes payable.

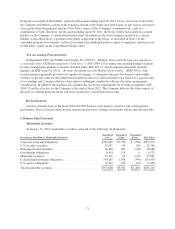

2. Balance Sheet Accounts

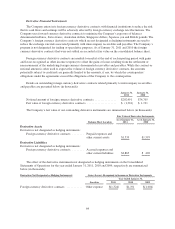

Marketable Securities

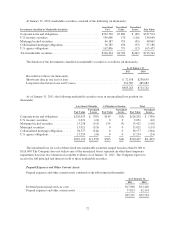

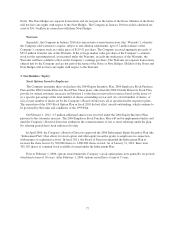

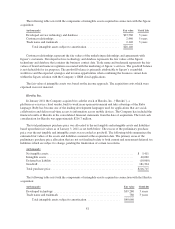

At January 31, 2011, marketable securities consisted of the following (in thousands):

Investments classified as Marketable Securities

Amortized

Cost

Unrealized

Gains

Unrealized

Losses Fair Value

Corporate notes and obligations ........................... $701,047 $7,356 $ (790) $707,613

U.S. treasury securities .................................. 22,631 85 (10) 22,706

Mortgage backed securities ............................... 38,348 656 (118) 38,886

Government obligations ................................. 6,414 118 0 6,532

Municipal securities .................................... 23,121 79 (119) 23,081

Collateralized mortgage obligations ........................ 104,285 1,098 (344) 105,039

U.S. agency obligations .................................. 79,242 190 (24) 79,408

Total marketable securities ............................... $975,088 $9,582 $(1,405) $983,265

71