Salesforce.com 2011 Annual Report Download - page 78

Download and view the complete annual report

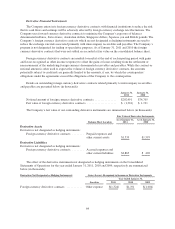

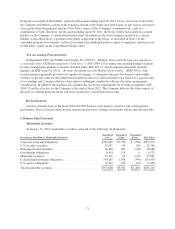

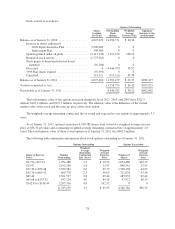

Please find page 78 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company estimated its future stock price volatility considering both its observed option-implied

volatilities and its historical volatility calculations. Management believes this is the best estimate of the expected

volatility over the weighted-average expected life of its option grants.

During fiscal 2011 and 2010, the Company capitalized $2.6 million and $2.4 million, respectively, of stock

based expenses related to capitalized internal-use software development and deferred professional services costs.

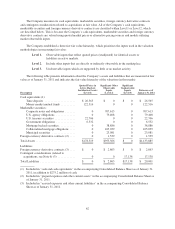

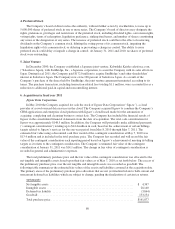

During fiscal 2011, the Company recognized stock-based expense of $120.4 million. As of January 31,

2011, the aggregate stock compensation remaining to be amortized to costs and expenses was $559.8 million.

The Company expects this stock compensation balance to be amortized as follows: $195.1 million during fiscal

2012; $157.9 million during fiscal 2013; $129.6 million during fiscal 2014; $76.8 million during fiscal 2015 and

$0.4 million during fiscal 2016. The expected amortization reflects only outstanding stock awards as of

January 31, 2011 and assumes no forfeiture activity. The Company expects to continue to issue share-based

awards to its employees in future periods.

Warranties and Indemnification

The Company’s enterprise cloud computing application service is typically warranted to perform in a

manner consistent with general industry standards that are reasonably applicable and materially in accordance

with the Company’s online help documentation under normal use and circumstances.

The Company’s arrangements generally include certain provisions for indemnifying customers against

liabilities if its products or services infringe a third-party’s intellectual property rights. To date, the Company has

not incurred any material costs as a result of such indemnifications and has not accrued any liabilities related to

such obligations in the accompanying consolidated financial statements.

The Company has also agreed to indemnify its directors and executive officers for costs associated with any

fees, expenses, judgments, fines and settlement amounts incurred by any of these persons in any action or

proceeding to which any of those persons is, or is threatened to be, made a party by reason of the person’s service

as a director or officer, including any action by the Company, arising out of that person’s services as the

Company’s director or officer or that person’s services provided to any other company or enterprise at the

Company’s request. The Company maintains director and officer insurance coverage that would generally enable

the Company to recover a portion of any future amounts paid. The Company may also be subject to

indemnification obligations by law with respect to the actions of its employees under certain circumstances and

in certain jurisdictions.

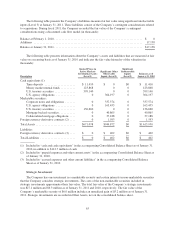

Advertising Expenses

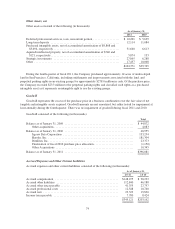

Advertising is expensed as incurred. Advertising expense was $61.4 million, $50.8 million and $43.7

million for fiscal 2011, 2010 and 2009, respectively.

Subsequent Events

The Company evaluated subsequent events through the date this Annual Report on Form 10-K was filed

with the SEC.

In February 2011, the Company acquired a privately-held company for approximately $11.3 million in cash.

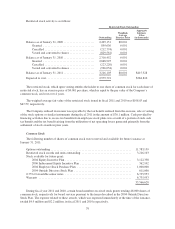

As of February 1, 2011 the Notes due 2015 are convertible at the option of the noteholder. For 20 trading

days during the 30 consecutive trading days ended January 31, 2011, the Company’s common stock traded at a

price exceeding 130% of the conversion price of $85.36 per share applicable to the Notes. Accordingly, the

70