Salesforce.com 2011 Annual Report Download - page 60

Download and view the complete annual report

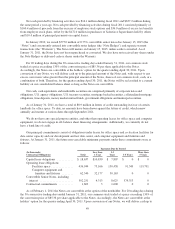

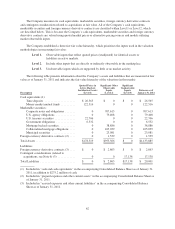

Please find page 60 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.amount of the Notes, shares of our common stock, cash, or a combination of both. Therefore, as of February 1,

2011, the Notes will be reclassified to a current liability on our consolidated balance sheet so long as the Notes

are convertible.

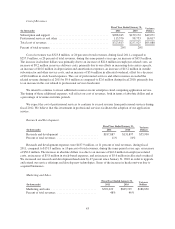

The Notes have a fixed annual interest rate of 0.75% and therefore, we do not have economic interest rate

exposure on the Notes. However, the value of the Notes are exposed to interest rate risk. Generally, the fair

market value of our fixed interest rate Notes will increase as interest rates fall and decrease as interest rates rise.

In addition, the fair value of our Notes is affected by our stock price. The carrying value of our Notes was $472.5

million as of January 31, 2011. This represents the liability component of the $575.0 million principal balance as

of January 31, 2011. The total estimated fair value of our Notes at January 31, 2011 was $946.1 million and the

fair value was determined based on the closing trading price per $100 of the Notes as of the last day of trading

for the fourth quarter of fiscal 2011, which was $164.55.

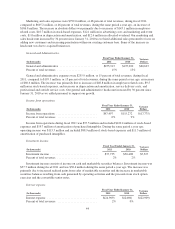

We have an investment portfolio that includes strategic investments in public and privately-held companies,

many of which are in the development stage. When our ownership interests are less than 20 percent and we do

not have the ability to exert significant influence, we account for the minority equity investments using the cost

method of accounting. Otherwise, we account for the investments using the equity method of accounting. At

January 31, 2011, the fair value of these investments was $27.1 million.

52