Salesforce.com 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

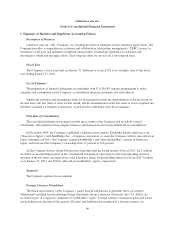

translated into U.S. dollars at the exchange rate on the balance sheet date. Revenues and expenses are translated

at the average exchange rate during the period. Equity transactions are translated using historical exchange rates.

Concentrations of Credit Risk and Significant Customers

The Company’s financial instruments that are exposed to concentrations of credit risk consist primarily of

cash and cash equivalents, marketable securities and trade accounts receivable. Although the Company deposits

its cash with multiple financial institutions, its deposits, at times, may exceed federally insured limits. Collateral

is not required for accounts receivable. The Company maintains an allowance for doubtful accounts receivable

balances. The allowance is based upon historical loss patterns, the number of days that billings are past due and

an evaluation of the potential risk of loss associated with delinquent accounts.

No customer accounted for more than 5 percent of accounts receivable at January 31, 2011 and 2010. No

single customer accounted for 5 percent or more of total revenue during fiscal 2011, 2010, and 2009.

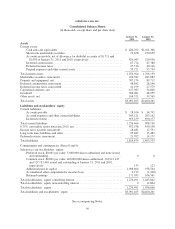

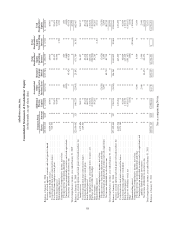

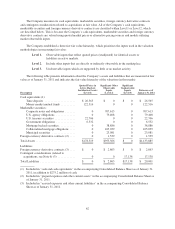

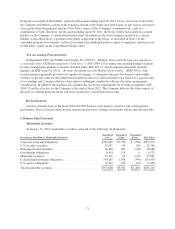

As of January 31, 2011 and 2010, assets located outside the Americas were 16 percent and 12 percent of

total assets, respectively. Revenues by geographical region are as follows (in thousands):

Fiscal Year Ended January 31,

2011 2010 2009

Revenues by geography:

Americas ....................................... $1,135,019 $ 923,823 $ 776,495

Europe ......................................... 291,784 232,367 190,685

Asia Pacific ..................................... 230,336 149,393 109,589

$1,657,139 $1,305,583 $1,076,769

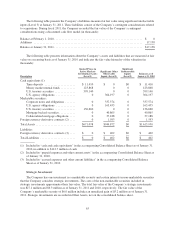

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months

or less to be cash equivalents. Cash and cash equivalents are stated at fair value.

Marketable Securities

Management determines the appropriate classification of marketable securities at the time of purchase and

reevaluates such determination at each balance sheet date. Securities are classified as available for sale and are

carried at fair value, with the unrealized gains and losses, net of tax, reported as a separate component of

stockholders’ equity. Fair value is determined based on quoted market rates when observable or utilizing data

points that are observable, such as quoted prices, interest rates and yield curves. Declines in fair value judged to

be other-than-temporary on securities available for sale are included as a component of investment income. In

order to determine whether a decline in value is other-than-temporary, we evaluate, among other factors: the

duration and extent to which the fair value has been less than the carrying value and our intent and ability to

retain the investment for a period of time sufficient to allow for any anticipated recovery in fair market value.

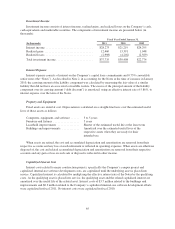

The cost of securities sold is based on the specific-identification method. Interest on securities classified as

available for sale is also included as a component of investment income.

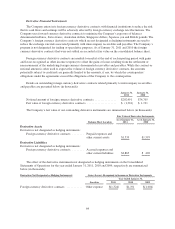

Fair Value Measurement

The Company reports its financial and non-financial assets and liabilities that are re-measured and reported

at fair value at each reporting period.

61