Salesforce.com 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The commissions are deferred and amortized over the non-cancelable terms of the related customer contracts,

which are typically 12 to 24 months. The commission payments are paid in full the month after the customer’s

service commences. The deferred commission amounts are recoverable through the future revenue streams under

the non-cancelable customer contracts. The Company believes this is the preferable method of accounting as the

commission charges are so closely related to the revenue from the non-cancelable customer contracts that they

should be recorded as an asset and charged to expense over the same period that the subscription revenue is

recognized. Amortization of deferred commissions is included in marketing and sales expense in the

accompanying consolidated statements of operations.

Business Combinations

The Company recognizes separately from goodwill the fair value of assets acquired and the liabilities

assumed. Goodwill as of the acquisition date is measured as the excess of consideration transferred and the net of

the acquisition date fair values of the assets acquired and the liabilities assumed. While the Company uses its best

estimates and assumptions as a part of the purchase price allocation process to accurately value assets acquired

and liabilities assumed at the acquisition date, the Company’s estimates are inherently uncertain and subject to

refinement. As a result, during the measurement period, which may be up to one year from the acquisition date,

the Company may record adjustments to the fair value of assets acquired and liabilities assumed, with the

corresponding offset to goodwill. Upon the conclusion of the measurement period or final determination of the

fair value of assets acquired or liabilities assumed, whichever comes first, any subsequent adjustments are

recorded to the Company’s consolidated statements of operations.

In addition, uncertain tax positions and tax related valuation allowances assumed in connection with a

business combination are initially estimated as of the acquisition date. The Company reevaluates these items

quarterly and records any adjustments to the Company’s preliminary estimates to goodwill provided that the

Company is within the measurement period and the Company continues to collect information in order to

determine their estimated fair values as of the date of acquisition. Subsequent to the measurement period or the

Company’s final determination of the tax allowance’s or contingency’s estimated value, changes to these

uncertain tax positions and tax related valuation allowances will affect the Company’s provision for income taxes

in the Company’s consolidated statement of operations.

Accounting for Stock-Based Compensation

The Company recognizes share-based expenses on a straight-line over the requisite service period of the

awards, which is the vesting term of four years. Stock-based expenses are recognized net of estimated forfeiture

activity.

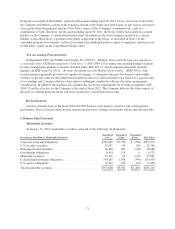

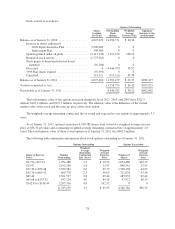

The fair value of each option grant was estimated on the date of grant using the Black-Scholes option

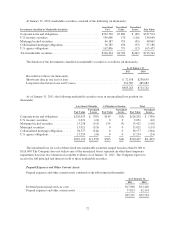

pricing model with the following assumptions and fair value per share:

2011 2010 2009

Volatility .................................. 45-50% 50-60% 47-60%

Estimated life .............................. 3.7-3.8years 3.8 - 4 years 4 years

Weighted-average risk-free interest rate .......... 0.98 - 2.1% 1.78 - 2.39% 1.47 - 3.08%

Dividend yield .............................. 0 0 0

Weighted-average fair value per share of grants . . . $48.83 $24.73 $15.39

Since November 2009, the weighted-average estimated life was based on an actual analysis of expected life.

Prior to November 2009, the weighted-average estimated life assumption of 4 years was based on the average of

the vesting term and the 5 year contractual lives of options awarded. The weighted average risk free interest rate

is based on the rate for a 4 year U.S. government security at the time of the option grant.

69