Porsche 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

second fiscal year in which Porsche AG was the big-

gest single shareholder in the Wolfsburg-based auto-

motive group, the majority of financial analysts and

investors were clearly convinced of the benefits that

the collaboration brings for both companies. At the

Porsche Annual General Meeting in January 2007,

and subsequently the extraordinary shareholders’

meeting in June 2007, support for the strategy taken

was equally positive (see also page 11, in the ‘Holding

Company’ chapter). Porsche supported the opinion-

forming process on the capital markets by explaining

the industrial logic behind collaboration between the

two motor vehicle manufacturers and the positive in-

fluence it has on Porsche accounts. Moreover, from

the perspective of many investors, Porsche was dis-

tinguished from its competitors as it continued to

achieve a highly profitable growth rate by manufac-

turing premium sports vehicles.

Higher Stake in VW Fuels Porsche Stock Prices

The stock performance of Porsche shares between

August 2006 and March 2007 was characterized by

a continuing upward trend. When Porsche announced

at the end of March that it wanted to increase its share

of common stock in Volkswagen AG to just below 31

percent, thereby triggering a takeover bid under Ger-

man law, the price of stock once again increased sig-

nificantly. The price of Volkswagen stock subsequent-

ly rose as well, further strengthening the conviction

on the financial markets that the collaboration bet-

ween the two companies is mutually beneficial. Just

before the extraordinary shareholders’ meeting at the

end of June, which approved an amended company

structure and the new name Porsche Automobil Hol-

ding SE, the price of stock once again experienced

sharp growth. Only a few days later, on July 9, 2007,

Porsche shares reached an interim all-time high of

1,418 Euro.

The stock also benefited from Porsche’s close con-

tacts with participants on the financial markets. The

company’s development was, for example, explained

in detail to institutional investors and analysts at road

shows held at all the most important financial centers

both at home and abroad, as well as during intensive

discussions at Porsche’s headquarters in Zuffenhau-

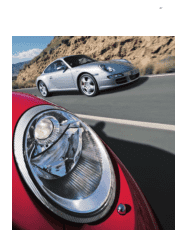

sen. Investors and analysts were not only impressed

by the sales successes of the 2006/07 fiscal year,

achieved in particular by the 911 series, but were also

increasingly convinced of the benefits of cooperation

with Volkswagen. Porsche worked at improving finan-

cial experts’ understanding of the strategy behind this

cooperation and of the associated complex company

results. Such activities repeatedly culminated in a

commitment to Porsche stock, with the overwhelm-

ing majority of financial experts recommending the

purchase of Porsche stock. Several investment banks

increased their target price forecasts for Porsche

shares to values from 1,100 Euro through to just

under 1,500 Euro. In the 2007/08 fiscal year, targets

were set even higher.

Outstanding Long-term Development

The long-term development of the stock illustrates the

excellent reputation Porsche enjoys. During the last

ten fiscal years, from August 1, 1997 to the last day

of the current review year on July 31, 2007, the price

of shares has risen from the equivalent of 142 Euro to

1,340 Euro, an increase of 844 percent, compared

with the Dax’s increase of only 72 percent.

The increase in value of a shareholding with Porsche

stock over the same ten-year period was equally posi-

tive. If a sum of 10,000 Euro had been invested in the

sports car manufacturers’ shares on August 1, 1997,

it would have increased to 97,000 Euro (including

dividends) by July 31, 2007.

37