Porsche 2006 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190

|

|

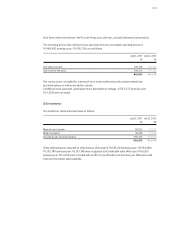

155

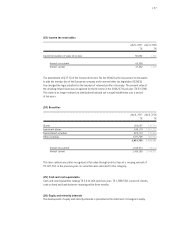

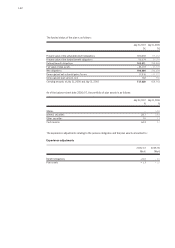

July31,2007 July31, 2006

T€ T€

Receivables from financial services 1,781,514 1,683,639

thereof non-current 1,321,635 1,248,750

thereof current 459,879 434,889

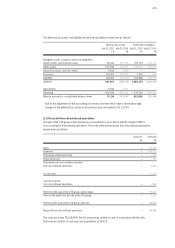

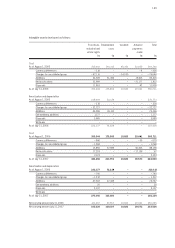

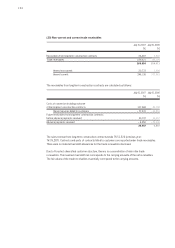

(21) Non-current and current receivables from financial services

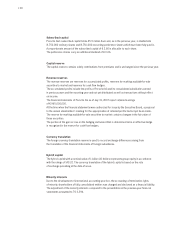

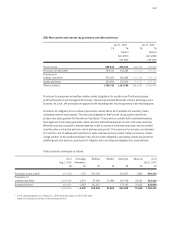

The receivables from financial services contain receivables from customer and dealer financing

including installments due for payment of T€ 504,244 (previous year: T€ 519,803) and receivables from

finance leases before valuation allowances of T€ 1,317,088 (previous year: T€ 1,202,852).

The accumulated allowances for outstanding minimum lease payments for finance leases that are subject

to risk amount to T€ 39,818 (previous year: T€ 39,016). There was no significant concentration of risk

in the receivables from financial services. The maximum bad debt risk corresponds to the carrying

amounts of the net receivables.

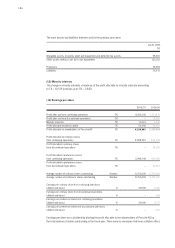

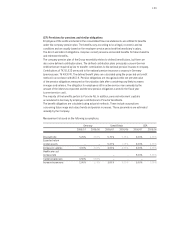

Receivables from finance leases are a result of vehicle financing and break down as follows:

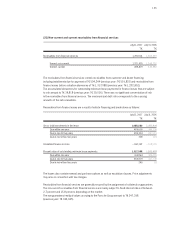

The leases also contain renewal and purchase options as well as escalation clauses. Price adjustments

may arise in connection with tax changes.

Receivables from financial services are generally secured by the assignment of collateral or guarantees.

The non-current receivables from financial services are mainly subject to fixed interest rates of between

2.7 percent and 15.8 percent, depending on the market.

The non-guaranteed residual values accruing to the Porsche Group amount to T€ 347,398

(previous year: T€ 334,345).

July31,2007 July31, 2006

T€ T€

Gross total investments in the lease 1,485,280 1,351,430

Due within one year 489,638 454,100

Due in one to five years 995,334 897,115

Due in more than five years 308 215

Unrealized finance income – 168,192 – 148,578

Present value of outstanding minimum lease payments 1,317,088 1,202,852

Due within one year 413,864 385,059

Due in one to five years 902,979 817,730

Due in more than five years 245 63