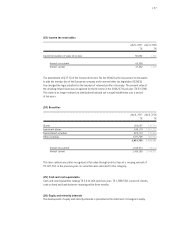

Porsche 2006 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156

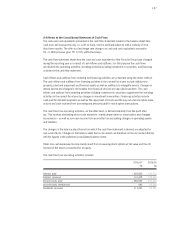

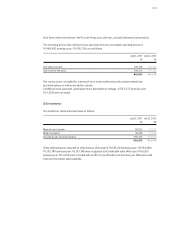

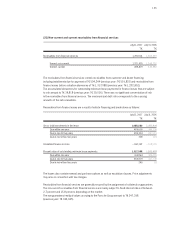

Depending on liquidity requirements and the market situation a certain volume of receivables from

financial services is sold to third parties. In such cases, the company examines whether the criteria for

derecognition of receivables legally transferred in factoring contracts are satisfied. If the criteria are

not satisfied, so-called recourse factoring, the receivables remain on the balance sheet.

Factoring in the course of asset-backed security transactions which do not satisfy the derecognition

criteria resulted in receivables from financial services at a carrying amount of T€ 1,160 (previous year:

T€ 1,079) as of the balance sheet date. The opportunities and risks associated with recourse factoring

are essentially comparable to those inherent in receivables that have not been sold. The liabilities

associated with the receivables that have been transferred and not derecognized amount to T€ 1,020

(previous year: T€ 990).

The item derivative financial instruments mainly includes forward exchange contracts,

currency options, stock options with cash compensation and compounders. A fractional amount of

T€ 268,600 is due in more than one year (previous year: T€ 157,542).

Other assets mainly contain other taxes and advance payments; of these an amount of T€ 14,892

(previous year: T€ 12,853) is due in more than one year.

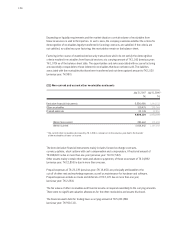

Prepaid expenses of T€ 23,139 (previous year: T€ 19,451) are principally attributable to the

cut-off of other rent and marketing expenses as well as maintenance for hardware and software.

Prepaid expenses include accruals and deferrals of T€ 2,170 due in more than one year

(previous year: T€ 2,264).

The fair values of other receivables and financial assets correspond essentially to the carrying amounts.

There were no significant valuation allowances for the other receivables and assets disclosed.

The financial assets held for trading have a carrying amount of T€ 5,091,886

(previous year: T€ 910,111).

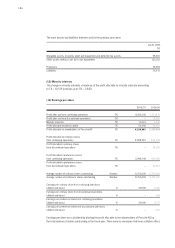

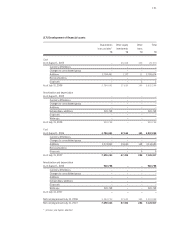

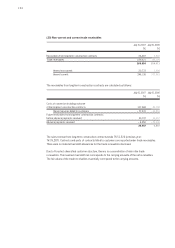

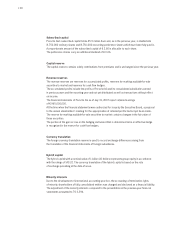

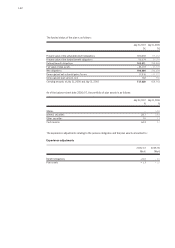

July31,2007 July31, 2006

T€ T€

Derivative financial instruments 5,556,490 1,294,132

Other receivables 310,475 259,064

Prepaid expenses 23,139 19,451

5,890,104 1,572,647

thereof non-current 285,662 172,659

thereof current 5,604,442 1,399,988

*the current other receivables decreased by T€ 1,306 in comparison to the previous year due to the transfer

of the receivables of taxes on income.

*

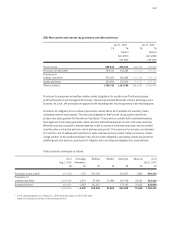

(22) Non-current and current other receivables and assets