Office Depot 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Office Depot 2003 / Proxy Statement 92

Split Dollar Life Insurance. Effective April 1995, we pro-

vided certain of our executive officers the opportunity to pur-

chase whole life insurance policies, with the premiums paid

by us. If our assumptions regarding mortality, dividends and

other factors are realized, we will recover all of our payments

for premiums either from death benefits or from the executive,

if the policy is transferred to the executive. Messrs.

Nelson, Colley, Brown and Fannin have all been beneficiaries

of this program. Mr. van Kaldekerken participates in a different

insurance program in Europe. Effective January 1, 2004, our

Company discontinued the split dollar life insurance plan for

those executives in North America who were participants in

the plan. In consideration for surrendering these policies to

the Company, we paid the following amounts to our CEO and

other senior executives: Mr. Nelson—$480,000; Mr. Colley—

$80,000; Mr. Brown—$96,000; Mr. Fannin—$140,000.

These amounts were determined based upon the amount of

death benefit provided to the various executives and the esti-

mated time remaining to their normal retirement age. They

will be reflected in the Summary Compensation Table in our

2005 proxy statement. We also provided to each such execu-

tive a ‘gross-up’ payment to offset income taxes payable by

them in connection with the payments made to them in sur-

render of the split dollar life insurance policies. Henceforth,

the Company does not intend to maintain any program of split

dollar life insurance. It will maintain a program of group term

life insurance for all senior executives.

Executive Management Deferred Compensation Plan. We

have implemented the Executive Management Deferred

Compensation Plan (a non qualified retirement savings plan)

to provide our executive officers and other management and

sales executives the opportunity to defer retirement savings in

addition to those amounts which may be deferred under the

Office Depot Retirement Savings Plan (401(k) Plan). The

Executive Management Deferred Compensation Plan allows

us to supplement our matching contributions, which are lim-

ited under the Office Depot Retirement Savings Plan (401(k))

pursuant to provisions of the Internal Revenue Code.

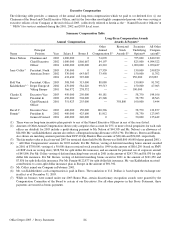

Philosophy of Compensation of our Chairman and Chief

Executive Officer. Our Employment Agreement with Mr.

Nelson, entered into effective December 29, 2001, the date of

his becoming our Chairman, as well as CEO, provides him

with a base salary at the maximum deductible amount (to the

Company) under Section 162(m) of the Code. Salary survey

work performed for us by a reputable outside consultant indi-

cates that Mr. Nelson’s base salary is competitive with the

salaries paid to similarly situated executives at other similarly

sized companies and is not excessive. In lieu of a larger base

salary payment (a portion of which would be non-deductible

by the Company for income tax purposes) to Mr. Nelson, the

Compensation Committee and Board of Directors have

elected to incentivize Mr. Nelson through substantial grants of

stock options, some of which are premium-priced or perform-

ance-accelerated, as described above, as well as his receipt of

performance shares. We believe that his overall compensation

package closely aligns his interests with those of our share-

holders. The Committee feels that Mr. Nelson’s compensa-

tion, including base salary, bonus payments and equity

incentives, is properly oriented towards risk-based, incentive

compensation and that the combination of base salary and

incentive compensation is competitive with similarly situated

chief executives. See the discussion above under the heading

“ CEO Compensation”for a more complete description of our

employment agreement with Mr. Nelson.

Section 162(m) and Deductibility Limits under the Internal

Revenue Code. Section 162(m) of the Internal Revenue

Code generally disallows a tax deduction to public companies

for compensation exceeding $1 million paid to our Named Exe-

cutiveOfficers. However, certain “ at risk” portions of our

executive officers’ compensation (those portions currently

being stock option grants, annual bonus, Performance-

Accelerated Stock Options and Performance Shares) may

qualify for deduction under Section 162(m). The Compen-

sation Committee intends to continue to take actions, including

seeking shareholder approval of bonus plans and other incen-

tives, to ensure that our executive compensation programs

meet the eligibility requirements under Section 162(m) of the

Code. In certain cases, where our Committee believes our

shareholder interests are best served by retaining flexibility of

approach, we do grant incentive compensation that does not

necessarily qualify for deduction under Section 162(m). In

some cases, it may not be possible to keep a given person’s

compensation under the Section 162(m) limit or to qualify all

compensation for deductibility under Section 162(m) in a par-

ticular year, but that remains always the goal of this

Committee. We strive to meet that goal, but the more important

goal is to ensure that our compensation systems are competitive

and enable us to attract and retain the most capable manage-

ment team possible in furtherance of the interests of our

shareholders.

Report of Compensation Committee

W. Scott Hedrick, Chairman

Neil R. Austrian, Member

Cynthia R. Cohen, Member

Bruce S. Gordon, Member