Office Depot 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in the prior year. These payments were partially offset by

proceeds received in 2001 from the issuance of $250 million

in senior subordinated notes as discussed above. We continually

review our financing options. Although we currently anticipate

that we will finance our 2004 operations, expansion and other

activities through cash on hand, funds generated from opera-

tions, equipment leases and funds available under our credit

facilities, we will continue to consider alternative financing as

appropriate for market conditions.

Office Depot 2003 / Form 10-K 24

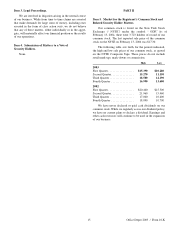

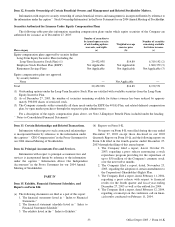

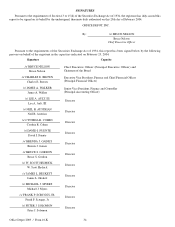

The following table summarizes the Company’s contractual cash obligations at December 27, 2003, and the effect such

obligations are expected to have on liquidity and cash flow in future periods:

Contractual Obligations Payments due by Period

(Dollars in thousands) Total Less than 1 Year 1–3 Years 4–5 Years After 5 Years

Long-term debt obligations (1) $1,126,449 $ 50,989 $200,460 $350,000 $ 525,000

Capital lease obligations (2) 120,495 16,766 23,760 15,856 64,113

Operating leases (3) 2,216,443 371,303 584,639 433,019 827,482

Purchase obligations (4) 90,283 45,386 37,647 4,350 2,900

Other long-term liabilities (5) — — — — —

Total contractual cash obligations $3,553,670 $484,444 $846,506 $803,225 $1,419,495

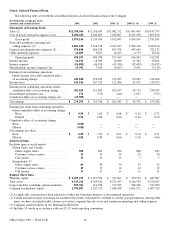

(1) Long-term debt obligations include our $400 million Senior Notes, our $250 million Senior Subordinated Notes and borrow-

ings under our revolving credit facility, excluding any related discount. Amounts include contractual interest payments (using

the interest rate as of December 27, 2003 for the revolving credit facility). Approximately yen 10,760,000, or $100.1 million

at December 27, 2003, due under our revolving credit facility has been classified according to its scheduled maturity on April

24, 2005; however, we may refinance this borrowing under a future credit facility.

(2) The present values of these obligations, are included on our Consolidated Balance Sheets. See Note G of the Notes to

Consolidated Financial Statements for additional information about our capital lease obligations.

(3) Our operating lease obligations are described in Note I of the Notes to Consolidated Financial Statements.

(4) Purchase obligations include agreements for goods and services that are enforceable and legally binding on the Company and

that specify all significant terms. As of December 27, 2003, such obligations include television advertising, a sports facility

naming right and other sports sponsorship commitments, telephone services, and software licenses and maintenance contracts

for information technology.

(5) Our Consolidated Balance Sheet as of December 27, 2003 includes $244.6 million classified as “ Deferred income taxes and

other long-term liabilities.”This caption consists primarily of our net long-term deferred income taxes, the unfunded portion

of the Guilbert pension plans, and liabilities under our deferred compensation plans. These liabilities have been excluded from

the above table as the timing and/or the amount of any cash payment is uncertain. See Note H of the Notes to Consolidated

Financial Statements for additional information regarding our deferred tax positions and Note J for a discussion of our employee

benefit plans, including the Guilbert pension plans and the deferred compensation plan.

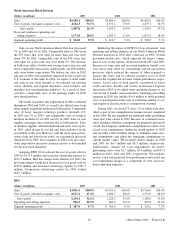

In addition to the above, we have letters of credit totaling

$81.5 million outstanding at the end of the year, and we have

recourse for private label credit card receivables transferred to

a third party. We record a fair value estimate for losses on

these receivables in our financial statements. The total out-

standing amount transferred to a third party at the end of the

year was approximately $263.4 million.

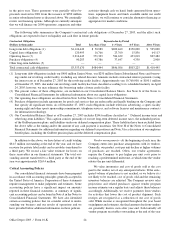

Critical Accounting Policies

Our consolidated financial statements have been prepared

in accordance with accounting principles generally accepted in

the United States of America. Preparation of these statements

requires management to make judgments and estimates. Some

accounting policies have a significant impact on amounts

reported in these financial statements. A summary of signifi-

cant accounting policies can be found in Note A in the Notes to

Consolidated Financial Statements. We have also identified

certain accounting policies that we consider critical to under-

standing our business and our results of operations and we

have provided below additional information on those policies.

Vendor arrangements—At the beginning of each year, the

Company enters into purchase arrangements with its vendors.

Generally, our product costs per unit decline as higher volumes

of purchases are reached. Often, our vendor agreements

require the Company to pay higher per unit costs prior to

reaching a predetermined milestone, at which time the vendor

rebates the per unit differential.

We value inventories and cost of goods sold at the cost

paid to the vendor, net of any anticipated rebates. If the antic-

ipated volume of purchases is not reached, or we believe it is

not likely to be reached, cost of goods sold and the remaining

inventory balances are adjusted. The Company reviews sales

projections and related purchases against vendor program

income estimates on a regular basis and adjusts these balances

accordingly. Additionally, we receive payments from vendors

for activities that lower the cost of product shipment. Such

receipts are recognized as a reduction of our cost of goods

sold. While income is recognized throughout the year based

on judgment and estimates, the final amounts due from vendors

are generally known soon after year-end. Substantially all

vendor program receivables outstanding at the end of the year