Office Depot 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations.

Results of Operations

General

Office Depot, Inc., together with our subsidiaries, (“ Office

Depot”or the “ Company”) is a global supplier of office prod-

ucts and services. We sell to consumers and businesses of all

sizes through our three business segments: North American

Retail Division, Business Services Group, and International

Division. Our management views our overall business in

the context of the performances of these three principal busi-

ness segments.

These segments include multiple sales channels consisting

of office supply stores, a contract sales force, Internet sites,

and catalog and call centers, all supported by our crossdock,

warehouse and delivery operations. Each of these segments is

described in more detail in Item 1, Business Section, of this

Annual Report on Form 10-K. We operate on a 52- or

53-week fiscal year ending on the last Saturday in December.

All years in the discussion below contained 52 weeks.

In June 2003, we expanded our contract business in

Europe with our acquisition of Guilbert, a leading contract

stationer. Guilbert sells to small, medium and large companies

in France, the UK, Germany, Italy, Ireland, the Netherlands,

Spain, Belgium and Portugal through a direct sales force and

through e-commerce and other Internet solutions, under the

Guilbert威 and NiceDay娃brand names. The results of Guilbert

are included in our International Division since the date of

acquisition.

Forward-Looking Statements

This Management’s Discussion and Analysis of Financial

Condition and Results of Operations (“ MD&A”) is intended

to provide information to assist you in better understanding

our business. We recommend that you read this MD&A in

conjunction with our Consolidated Financial Statements and

the Notes to those statements. This MD&A contains signifi-

cant amounts of forward-looking information, and is qualified

by our Cautionary Statements regarding forward-looking

information. You will find Cautionary Statements throughout

this MD&A; however, most of them can be found in a separate

section immediately following this MD&A. Without limitation,

wherever in this Annual Report we use the words “ believe,”

“ estimate,”“ plan,”“ expect,”“ intend,”“ anticipate,”“ continue,”

“ project,”“ should,”and similar expressions, we are identifying

forward-looking statements, and our Cautionary Statements

apply to these terms and expressions and the text in which

such terms and expressions are used. The purposes of this

MD&A include providing to the reader the perspectives of

management as we view the business, and providing to you

insights that are not necessarily obvious or clear from reading

our financial statements (including footnotes) alone.

17 Office Depot 2003 / Form 10-K

Overall

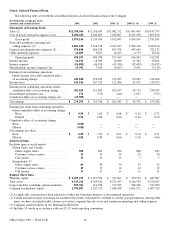

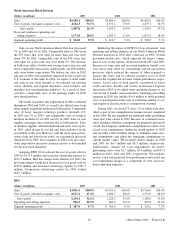

(Dollars in millions) 2003 2002 2001

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $12,358.6 100.0% $11,356.6 100.0% $11,082.1 100.0%

Cost of goods sold and occupancy costs. . . 8,484.5 68.7% 8,022.7 70.6% 7,940.1 71.6%

Gross profit . . . . . . . . . . . . . . . . . . . . . 3,874.1 31.3% 3,333.9 29.4% 3,142.0 28.4%

Store and warehouse operating and

selling expenses. . . . . . . . . . . . . . . . . . . . 2,802.2 22.7% 2,338.1 20.6% 2,331.0 21.1%

Segment operating profit. . . . . . . . . . . . . . . 1,071.9 8.6% 995.8 8.8% 811.0 7.3%

General and administrative expenses . . . . . 578.8 4.7% 486.3 4.3% 445.5 4.0%

Other operating expenses . . . . . . . . . . . . . . 22.8 0.1% 9.8 0.1% 12.1 0.1%

Operating profit . . . . . . . . . . . . . . . . . . . . . . $ 470.3 3.8% $ 499.7 4.4% $ 353.4 3.2%

Our overall sales increased 9% in 2003 after an increase

of 2% in 2002. The increase in sales in both periods is attribut-

able to increased sales from our International Division and our

Business Services Group, partially offset by declining sales in

our North American Retail Division. Positively impacting

sales in our International Division during 2003 was our acqui-

sition of Guilbert in June, which contributed additional sales of

$808.8 million, the impact of changes to foreign currency

rates, and the growth in our existing contract business. Our

management believes that the acquisition of Guilbert has

added significantly to our capability and future business

prospects in Europe. Our BSG segment experienced increased

sales as a result of expanding our contract business, partially

offset by weaker catalog sales. Worldwide e-commerce sales

have improved in all periods, increasing to $2.6 billion in

2003 from $2.1 billion in 2002.

Comparable sales measure the sales from operations or

stores that have been in existence or open for one year or more

and is used throughout the MD&A to understand the relative

trends in our business. From time to time we regroup product

categories to conform more closely to the way that we manage

the business. Accordingly, certain comparable sales product

amounts reported in prior periods have been adjusted to con-

form to current year classification. From a comparable sales

perspective, total Company sales declined 2% in 2003 and

were flat in 2002, primarily as a result of negative comparable

sales in our North American Retail Division of –4% and –2%,

respectively. The decline in comparable sales in the North

American Retail Division primarily reflects a decrease in

sales of our technology and furniture products.