Office Depot 2003 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87 Office Depot 2003 / Proxy Statement

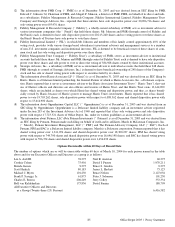

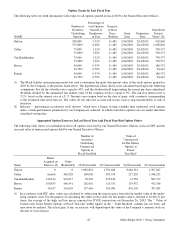

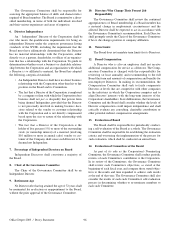

Option Grants In Last Fiscal Year

The following table sets forth information with respect to all options granted in fiscal 2003 to the Named Executive Officers.

Percentage of

Number of total Options Exercise

Securities Granted to or Base Grant Date

Underlying Employees Price Grant Expiration Present

NAME Options in Year ($/share) Date Date Value(1) ($)

Nelson 200,000 3.52% 11.485 2/14/2003 2/14/2013 902,860

375,000(2) 6.60% 11.485 2/14/2003 2/14/2010 1,692,863

Colley 75,000 1.32% 11.485 2/14/2003 2/14/2013 338,573

75,000(2) 1.32% 11.485 2/14/2003 2/14/2010 338,573

Van Kaldekerken 75,000 1.32% 11.485 2/14/2003 2/14/2013 338,573

75,000(2) 1.32% 11.485 2/14/2003 2/14/2010 338,573

Brown 40,000 0.33% 11.485 2/14/2003 2/14/2013 180,572

18,750(2) 0.70% 11.485 2/14/2003 2/14/2010 84,643

Fannin 40,000 0.33% 11.485 2/14/2003 2/14/2013 180,572

18,750(2) 0.70% 11.485 2/14/2003 2/14/2010 84,643

(1) The Black-Scholes option-pricing model was used to determine the grant date present value of the stock options granted in

2003 by the Company to the persons listed above. The hypothetical values shown were calculated based upon the following

assumptions: For all, the volatility rate is equal to 40%, and the dividend yield (representing the current per-share annualized

dividends divided by the annualized fair market value of the common stock) is equal to 0%. The risk-free interest rate is

3.2%, based on the interest rate of a U.S. Treasury zero-coupon bond on the date of grant, with a maturity corresponding

to the estimated time until exercise. The values do not take into account risk factors such as non-transferability or risk of

forfeiture.

(2) Indicates “ performance-accelerated stock options,” which have a longer vesting schedule than traditional stock options,

unless certain performance parameters by our Company are achieved, in which event these options can vest earlier than their

scheduled vesting date.

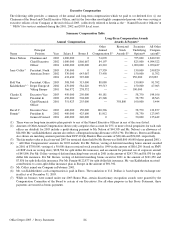

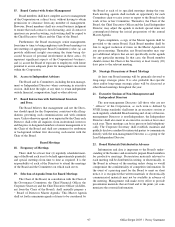

Aggregated Option Exercises In Last Fiscal Year And Fiscal Year-End Option Values

The following table shows you information about all options exercised by our Named Executive Officers in fiscal 2003 and the

year-end value of unexercised options held by our Named Executive Officers.

Number of Value of

Securities Unexercised

Underlying In-The-Money

Unexercised Options at

Options at Fiscal

Fiscal Year-End Year-End(1)

Shares

Acquired on Value

Name Exercise (#) Realized($) (#) Exercisable (#) Unexercisable ($) Exercisable ($) Unexercisable

Nelson 0 0 1,982,854 1,791,668 8,684,314 2,707,047

Colley 66,666 486,328 100,000 383,334 217,250 1,948,255

Van Kaldekerken 129,166 910,015 92,502 270,834 13,556 867,317

Brown 100,833 896,541 162,916 118,751 153,972 432,506

Fannin 34,617 361,659 137,466 102,084 476,105 387,005

(1) In accordance with SEC rules, values are calculated by subtracting the exercise price from the fair market value of the under-

lying common stock. For the purpose of calculating the values in this table, the fair market value is deemed to be $16.52 per

share, the average of the high and low prices reported for NYSE transactions on December 26, 2003. The “ Value of

Unexercised, In-the-Money Options at Fiscal Year-end,” unlike figures in the “ Value Realized” column, has not been, and

may never be realized. The actual gain, if any, on exercise, will depend upon the value of the Company’s common stock on

the date of such exercise.