Office Depot 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Office Depot 2003 / Form 10-K 26

is not likely, we establish a valuation allowance. Generally,

changes in judgments that increase or decrease these valuation

allowances impact the effective tax rate, and therefore current

earnings. With the acquisition of Guilbert, our deferred tax

assets increased, primarily from their NOLs, though virtually

all have been offset by valuation allowances because of the

uncertainty of their realization. Should we be able to realize a

tax benefit from these deferred tax assets, the benefit would

reduce goodwill, rather than affect current earnings.

In addition to judgments associated with valuation

accounts, our current effective tax provision is based on

estimates of our mix of income between domestic and interna-

tional sources that may be taxed at different rates. Changes in

valuation reserves discussed above can impact the effective

tax rate, as well as resolution of tax matters at amounts other

than what we estimated. We regularly monitor our current and

deferred tax positions and reflect our best estimates of events

that have an uncertain outcome.

Significant Trends, Developments and Uncertainties

Over the years, we have seen continued development and

growth of competitors in all segments of our business. In par-

ticular, mass merchandisers and warehouse clubs have

increased their assortment of home office merchandise,

attracting additional back-to-school customers and year-round

casual shoppers. We also face competition from other office

supply superstores that compete directly with us in numerous

markets. This competition is likely to result in increased com-

petitive pressures on pricing, product selection and services

provided. Many of these retail competitors, including dis-

counters, warehouse clubs, and even drug stores and grocery

chains, carry at least limited numbers of basic office supply

products, including ink jet and toner cartridges, printer paper

and other basic supplies. Some of them have also begun to

feature technology products. Many of them price these offer-

ings lower than we do, but they have not shown an indication

of greatly expanding their somewhat limited product offerings

at this time. This trend towards a proliferation of retailers

offering a limited assortment of office products is a potentially

serious trend in our industry, and one that our management is

watching closely.

We have also seen growth in new and innovative competi-

tors that offer office products over the Internet, featuring special

purchase incentives and one-time deals (such as close-outs).

Through our own successful Internet and business-to-business

web sites, we believe that we have positioned ourselves com-

petitively in the e-commerce arena.

Another trend in our industry has been consolidation, as

two major competitors in the superstores channel and the

copy/print channel have been (or are in the process of being)

acquired and consolidated into larger, well-capitalized corpo-

rate conglomerates. This trend towards consolidation, coupled

with acquisitions by financially strong organizations, is poten-

tially a significant trend in our industry.

Market Sensitive Risks and Positions

We have market risk exposure related to interest rates and

foreign currency exchange rates. Market risk is measured as the

potential negative impact on earnings, cash flows or fair values

resulting from a hypothetical change in interest rates or foreign

currency exchange rates over the next year. We manage the

exposure to market risks at the corporate level. The portfolio of

interest-sensitive assets and liabilities is monitored and adjusted

to provide liquidity necessary to satisfy anticipated short-term

needs. The percentage of fixed and variable rate debt is man-

aged to fall within a desired range. Our risk management poli-

cies allow the use of specified financial instruments for hedging

purposes only; speculation on interest rates or foreign currency

rates is not permitted.

Interest Rate Risk

We are exposed to the impact of interest rate changes on

cash equivalents and debt obligations. The impact on cash and

short-term investments held at the end of 2003 from a hypo-

thetical 10% decrease in interest rates would be a decrease in

interest income of approximately $1.4 million in 2003.

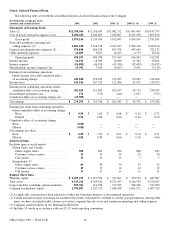

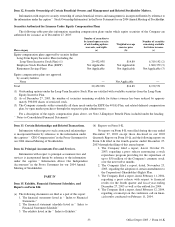

Market risk associated with our debt portfolio is summarized below:

2003 2002

Carrying Fair Risk Carrying Fair Risk

(Dollars in thousands) Value Value Sensitivity Value Value Sensitivity

$250 million Senior Subordinated Notes. . . . $259,440 $300,000 $ 5,760 $262,213 $279,625 $6,174

$400 million Senior Notes . . . . . . . . . . . . . . . $398,923 $420,320 $16,016 ———

Revolving Credit Facility (1) . . . . . . . . . . . . . $100,102 $100,102 $ 501 $ 81,415 $ 81,415 $ 407

(1) Including current maturities.

The risk sensitivity of fixed rate debt reflects the estimated

increase in fair value from a 50 basis point decrease in interest

rates, calculated on a discounted cash flow basis. The sensitiv-

ity of variable rate debt reflects the possible increase in interest

expense during the next period from a 50 basis point change

in interest rates prevailing at year-end.

In January 2004, we entered into an interest rate swap

agreement to receive fixed and pay floating rates, converting

the equivalent of $100 million of this portfolio to variable

rate debt through 2013.