Office Depot 2003 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Office Depot 2003 / Proxy Statement 90

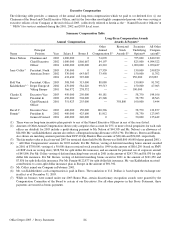

Compensation Committee Report

on 2003 Executive Compensation

The following report of the Compensation Committee and the

Performance Graph shall not be deemed to be incorporated

by reference by any general statement incorporating all or

any portion of this proxy statement into any filing under the

Securities Act of 1933 or under the Securities Exchange Act of

1934, except to the extent we specifically incorporate this

information by reference.

What is our Philosophy of Executive Compensation?

Our compensation philosophy is to design and implement

compensation practices that motivate employees to enhance

shareholder value. Our compensation practices are designed to

attract, motivate and retain key personnel by recognizing indi-

vidual contributions as well as the achievement of specific pre-

determined goals and objectives, primarily through the use of

“ at risk” compensation strategies. Our compensation program

for executive officers consists of five (5) main components:

(i) competitive base salaries,

(ii) annual cash incentives based on our overall

Company performance under our bonus plans;

(iii) stock option awards intended to encourage the

achievement of superior results over time and to

align executive officer and shareholder interests; and

(iv) for our most senior executive officers, including our

Chairman and Chief Executive Officer, our Division

Presidents and our Executive Vice Presidents, (a)

performance accelerated stock options and (b) per-

formance shares.

The second, third and fourth components constitute “ at risk”

or “ performance based” elements of each executive’s total

compensation.

Base Salary. Our Compensation Committee determines

base salaries for executive officers utilizing market survey

data which focuses on other high performance and specialty

retail companies. A number of the companies included in the

comparison base are included in the S&P Retail Stores

Composite and in the S&P 500. The Committee generally

considers the median level of the executive market for compa-

rably sized companies within these surveys in determining

executive base pay levels.

Salary Adjustments in 2003. The 2004 base salary for

Bruce Nelson, our Chairman and Chief Executive Officer, will

remain the same as his base salary in 2003. Salaries for Mr.

van Kaldekerken will increase to $630,000* and for Mr.

Brown to $525,000 in 2004. As a group, the base salaries of

our NEOs increased by 6.8% for 2004 over 2003 levels.

*Note that Mr. van Kaldekerken is paid in euros rather than

dollars. The noted salary for 2004 reflects a euro-denominated

salary of 500,000 euros, which translates to $630,000 at an

exchange rate of $1.26 as of December 31, 2003.

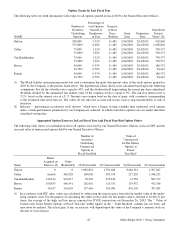

Annual Bonus.The bonus compensation of our executive

officers is generally determined pursuant to our bonus plans,

which provide for cash awards to eligible participants, based

upon objectives determined each year. The objectives of our

bonus plans are to enhance shareholder value by rewarding

employees for the attainment of financial objectives and for

the attainment of specific work unit and individual goals

linked to specified strategic elements of the business. Our

Company utilizes a bonus plan formula which our sharehold-

ers approved at the 2002 Annual Meeting. By extending

annual bonuses deep into the organization, we seek to moti-

vate all managerial employees to help achieve our profit

objectives and other key strategic initiatives. Awards under

our Bonus Plan are expressed as a percentage of base salary

earnings. Awards to executive officers are a function of the

participant’s level of responsibility and our Company’s overall

financial performance for a given year. Awards to other man-

agement employees under our Bonus Plan are also based on

achievement of individual performance objectives.

Under our Bonus Plan, performance is measured in connec-

tion with attainment of specific financial objectives (including

earnings per share) and may also be based on individual goals,

where appropriate, that are established by the participant and

his or her immediate supervisor. Our Chairman and Chief

Executive Officer, as well as our other Executives are meas-

ured in connection with attainment of specific objectives

based on one or more of the following measurements: EPS,

TSR, RONA, ROI, relative performance against a peer group

or other measure, or some other criterion established by the

Compensation Committee of our Board of Directors at or near

the beginning of each year* pre-tax earnings, net earnings,

earnings per share, return on net assets and return on equity.

The Bonus Plan allows our Compensation Committee to

adjust these measurements under certain circumstances. Our

Compensation Committee approves the goals set for and

awards to our Chairman and Chief Executive Officer, our

Group Presidents, and our Executive Officers under our Bonus

Plan. This emphasis on “ at risk” compensation is consistent

with our compensation philosophy and supports continued cre-

ation of shareholder value.

In order to ensure the eligibility for deduction of annual bonus

payments (where the recipient’s total income exceeds $1 mil-

lion), under Section 162(m) of the Code, it is necessary that

our shareholders periodically approve the overall bonus plan

of our Company. Our current Bonus Plan was approved by our

shareholders at the Annual Meeting in 2002.

*EPS=earnings per share; TSR=total shareholder return,

measured as the increase in stock price (plus any dividends

paid on the company’s shares) over a period of time,

whether or not compared to the increase in stock price (plus

dividends) of other comparable companies; RONA=total

return on net assets of our Company; and ROI=total return

on investment of our Company.

Performance Shares. Prior to December 31, 2001, we had in

place a compensation program for certain senior executives

which permitted certain of such executives to receive a match-

ing bonus payment, deferred until a specified future date, and