Office Depot 2003 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Office Depot 2003 / Proxy Statement 88

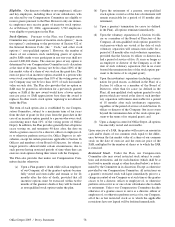

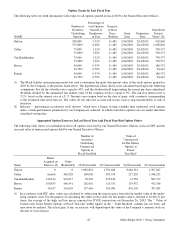

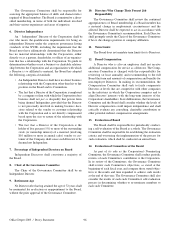

Long-Term Incentive Plans—Awards In Last Fiscal Year

Estimated Future Payouts

Under Plan (In Numbers of Shares)(1)

Performance or

Number of Other Period

Shares, Units or Until Maturation Threshold Target Maximum

Name Other Rights or Payout (# of Shares) ( # of Shares) ( # of Shares)

Nelson 35,000 3 years 17,500 35,000 52,500

Colley 18,000 3 Years 9,000 18,000 27,000

Van Kaldekerken 15,000 3 Years 7,500 15,000 22,500

Brown 15,000 3 Years 7,500 15,000 22,500

Fannin 12,000 3 Years 6,000 12,000 18,000

(1) All awards are pursuant to the Company’s Performance Shares Plan (the “ Plan”), approved by the Shareholders at the 2002

Annual Meeting. Pursuant to this Plan, select managers are awarded units in the Plan, which provides for an award of a spec-

ified number of shares of the Company’s stock provided that our Company meets or exceeds certain performance criteria

established by our Compensation Committee. If the Company fails to meet the specified criteria, participants may receive as

little as zero shares, or if it substantially exceeds those criteria, up to 150% of the base award amount. Each such Plan is a

closed plan, established at the beginning of a three-year performance cycle and ending at the end of such three-year per-

formance cycle. Each year, our Compensation Committee considers whether to establish such a Plan, the participants in the

Plan and the measurement criteria to be utilized to determine awards pursuant to the Plan. The Committee did establish such

a plan in 2003, and the performance shares awarded are indicated above.

Loans to Executive Officers of the Company

Prior to enactment of the Sarbanes-Oxley Act in July 2002,

the Company made a loan, in 1997, to its now-President

Europe, Rolf van Kaldekerken, in the amount of $322,114*.

The loan bears interest at the rate of 6% per annum (payable

interest only each year), is secured by a mortgage on Mr. van

Kaldekerken’s personal residence and is repayable either upon

Mr. van Kaldekerken’s departure from the Company, or sale

of his personal residence. There is no provision for earlier

repayment, other than a voluntary repayment by Mr. van

Kaldekerken. This loan will not be renewed or extended.

Office Depot, Inc. has ceased making any loans of any type to

executive officers for any purposes whatsoever and no longer

will extend or maintain credit to, or renew any extension of

credit, in the form of a personal loan, to or for the benefit of

any of its executive officers or directors.

*Calculated on the balance due on a loan now denominated

as 255,646 euros, translated to U.S. dollars at the year-end

conversion of $1.26 to the euro.

CEO Compensation

Employment Agreement. Effective December 29, 2001, we

entered into a new Employment Agreement with Bruce

Nelson (the “ Employment Agreement”) to serve as Chairman

of the Board and Chief Executive Officer. The Employment

Agreement amends, restates and supersedes certain prior

agreements with Mr. Nelson. Mr. Nelson first became CEO on

July 17, 2000. Under the terms of the Employment Agreement,

we have agreed to employ Mr. Nelson through at least

December 31, 2004. The Employment Agreement provides

for automatic renewal for a period of one year (and from year

to year thereafter) unless and until either Mr. Nelson or our

Company notifies the other, in writing, at least six months

prior to the end of the Employment Term (initially December

31, 2004), that he or it does not wish to renew the Employment

Agreement.

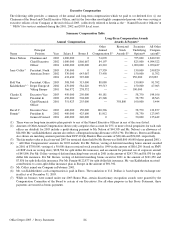

Salary and Bonus. As of December 29, 2001, the date of

the Employment Agreement, Mr. Nelson’s base salary was

$1,000,000 per year. There has been no increase in Mr.

Nelson’s base salary subsequent to that date. The Agreement

provides that Mr. Nelson’s salary will be reviewed annually

by our Compensation Committee and may be increased, but

not decreased. Under the Agreement, Mr. Nelson also will

participate in our Executive Officer Bonus Plan (“ Bonus

Plan”). Under this Plan, our Compensation Committee estab-

lishes annual performance targets for our CEO. We intend

these performance targets to qualify as incentive compensa-

tion under Section 162(m) of the Internal Revenue Code, inso-

far as that is possible. Mr. Nelson’s bonus, if any, is primarily

tied to earnings per share of the Company. For 2002 and sub-

sequent years under the Employment Agreement, Mr. Nelson

is eligible to achieve a bonus up to 200% of his base salary for

achieving the “ maximum” level of performance. His “ mini-

mum”bonus level (provided our Company’s performance in a

given year qualifies for any bonus payment) is 70% of base

salary, and his “ target” bonus is 100% of base salary. Mr.

Nelson did not receive a bonus for 2003.